Housing affordability is one of the most pressing challenges facing New Jersey, but not all policies aimed at making the state affordable are equally effective, efficient, or equitable. When evaluating new proposals and changes to the tax code, it’s critical to consider who stands to benefit, by how much, and who is left behind. In other words, “Affordable for who?”

The newly proposed property tax cut for seniors, StayNJ, has a laudable goal of helping seniors who are struggling with high costs stay in their homes. However, by the program’s very design, StayNJ would accomplish the exact opposite by providing huge tax cuts to the wealthiest homeowners in the largest homes, while providing little-to-no benefit to the lowest income homeowners and renters.

With no income cap on eligibility, higher tax cuts for more expensive homes, and no credit for renters, the StayNJ proposal represents a massive transfer of wealth and state resources to those who already have the most. As currently written, the proposal diverts billions of dollars away from much-needed investments in schools, transit, health care, and infrastructure we all rely on just as federal pandemic aid expires and state revenue collections decline.

Despite its name, A1 is decidedly second-rate when it comes to helping make New Jersey affordable for all.

1. StayNJ is Robin Hood in Reverse: Wealthy Residents Would Benefit the Most

The proposed tax cuts from StayNJ would benefit the wealthiest New Jersey residents the most and the lowest-income residents the least. According to an NJPP analysis of modeling from the Institute on Taxation and Economic Policy (ITEP), the top 1 percent of New Jersey residents would receive the an average tax cut of $2,688, while the lowest-income 20 percent would receive a mere $103, largely due to the high percentage of low-income residents who rent.[1] Among those who would receive a tax cut from StayNJ, the average cut for those in the top 1 percent is roughly three times the average tax cut for those in the bottom 40 percent.

When looking at the total cost of the proposal — $2.2 billion, according to ITEP’s modeling — roughly 40 percent would go to the wealthiest 20 percent of residents, while only 5 percent would go to the lowest-income 20 percent of residents. The top 1 percent of residents alone would get a bigger share of the benefits than the entire lowest-income 20 percent.

Considering the structure of StayNJ, it’s not surprising that the proposal disproportionately benefits those with the highest incomes.

In order to get the maximum tax cut of $10,000, a homeowner must pay $20,000 in property taxes, a rare occurrence reserved for the highest-valued homes. For reference, the average property tax bill in New Jersey is less than half that amount.[2]

As a result, the average homeowner in Alpine (average home value of $2.8 million) would receive $10,000. Meanwhile, the average homeowner in Trenton (average home value of $62,863) would receive $1,700.[3]

It’s worth noting that this analysis does not account for the residents who already receive property tax credits through ANCHOR and the Senior Freeze — which each have income limits on eligibility — meaning fewer low- and middle-income seniors would receive benefits under StayNJ. As written, the StayNJ benefit is half off a senior’s property tax bill, or their Senior Freeze and ANCHOR benefits combined, whichever is more.[4]

Add it all up and the lion’s share of the StayNJ benefit would go to the wealthy, with bigger benefits the wealthier the taxpayer. This undermines the state’s progressive tax code and the principle that government benefits should flow towards those with the least, not those with the most.

2. StayNJ Fails to Accomplish Its Stated Goal by Leaving Renters and Low-Income Seniors Behind

Seniors on fixed incomes often have a difficult time keeping up with rising costs, and there is evidence that New Jersey’s low-income seniors need additional financial help. The poverty rate for seniors in New Jersey (9.2 percent) is actually higher than the poverty rate for other adults (9.1 percent).[5]

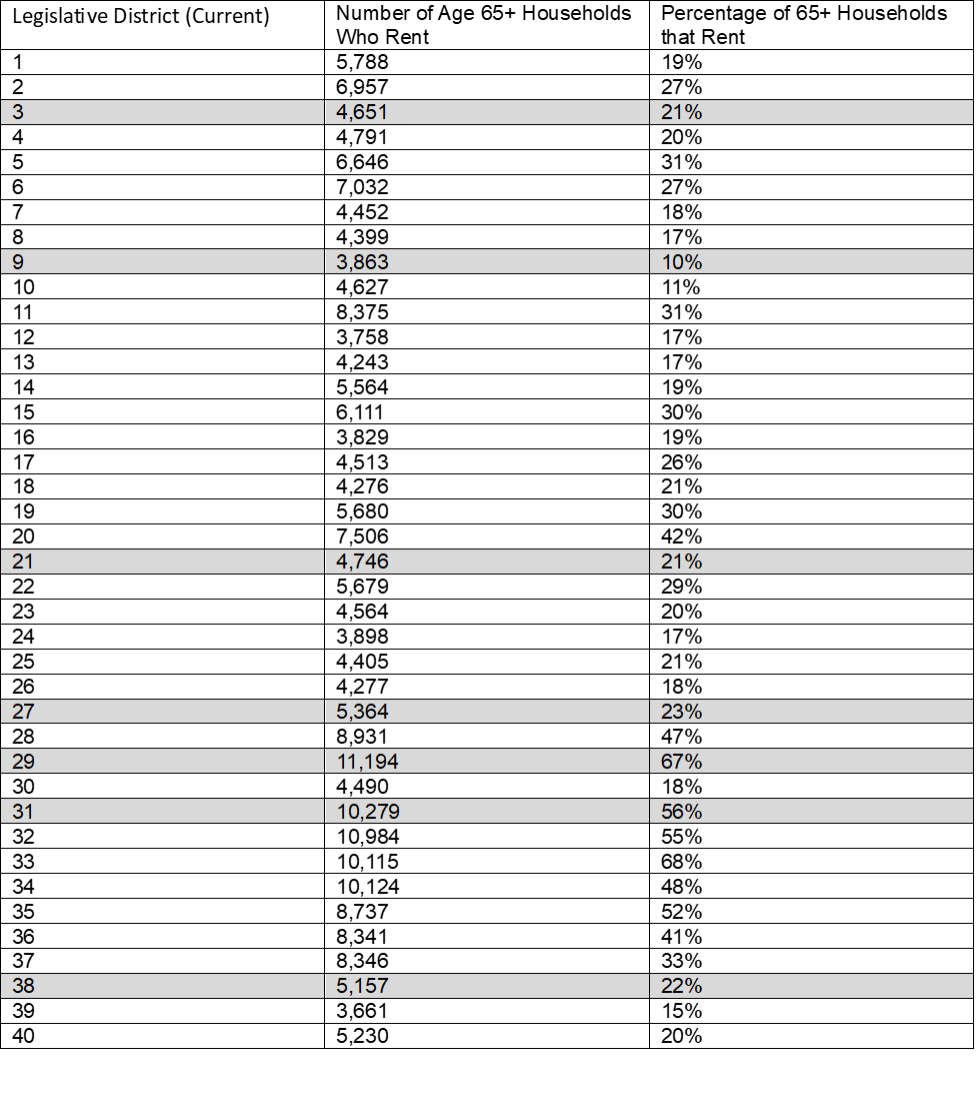

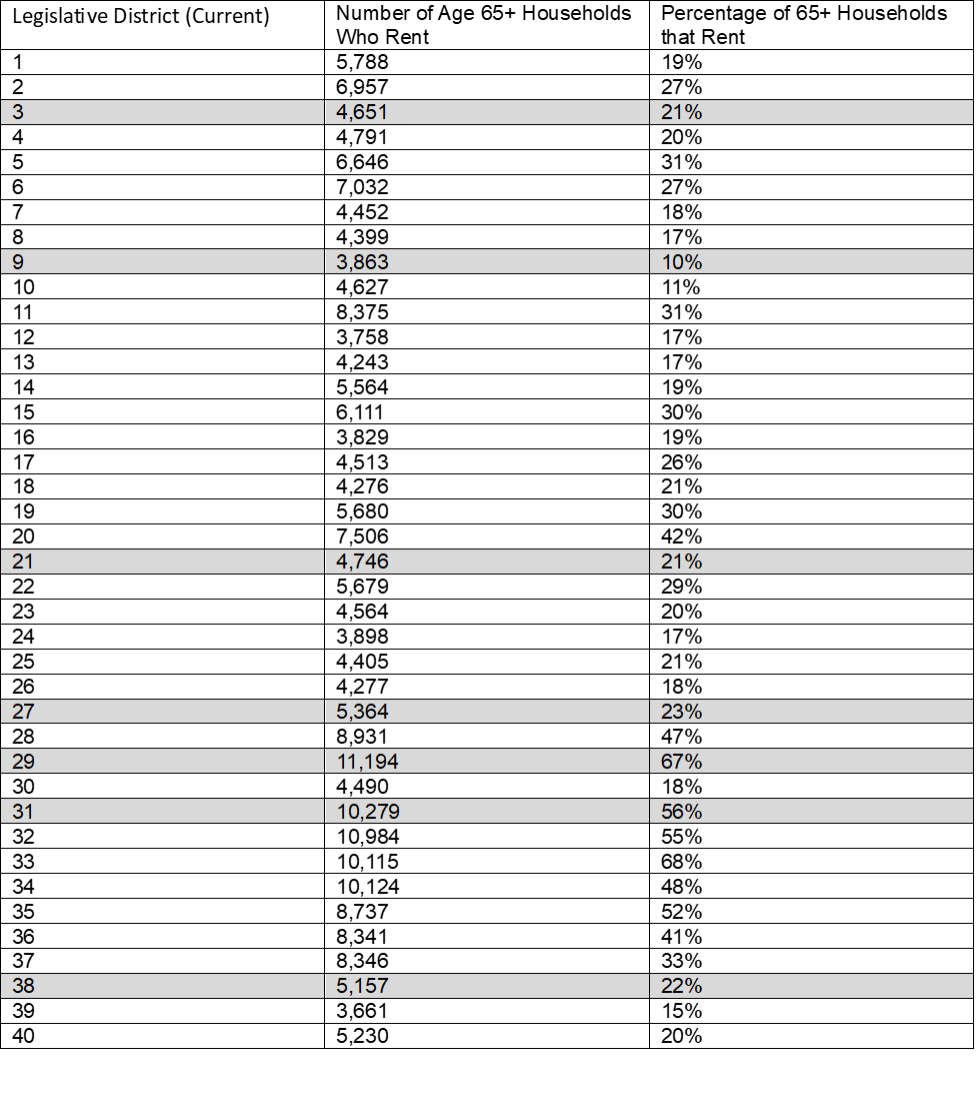

The StayNJ proposal leaves many of these low-income seniors behind, however, as the program excludes renters entirely. Renters have significantly less wealth and lower incomes than their home-owning peers. Renters also make up a substantial percentage of New Jersey’s senior population: Roughly one in five New Jersey seniors rent their homes, including more than half of Hispanic/Latinx and Black seniors.[6] Given the disparities in homeownership, this proposal will widen the racial wealth gap instead of helping close it. As noted in the appendix, senior renters number in the thousands in each legislative district.

With lower incomes, less wealth, and no equity in their home, seniors who rent are at high risk of being priced out and evicted.[7] This is illustrated by recent Census survey data showing that one in five New Jersey senior renters reported missing the last month’s rental payment.[8]

The concentration of homeownership in wealthier income brackets is clear when looking at how many people in each income range would qualify for StayNJ. Of those in the top one percent of earners in New Jersey, 40 percent would receive a tax cut from StayNJ, while a mere 5 percent of those in the lowest-income quintile would receive anything.

Beyond the exclusion of renters, this program may actually make senior housing affordability more challenging. Research shows property tax cuts for wealthy homeowners can stifle housing development and growth, stagnating the housing market and decreasing affordability, as Proposition 13 did in California.[9]

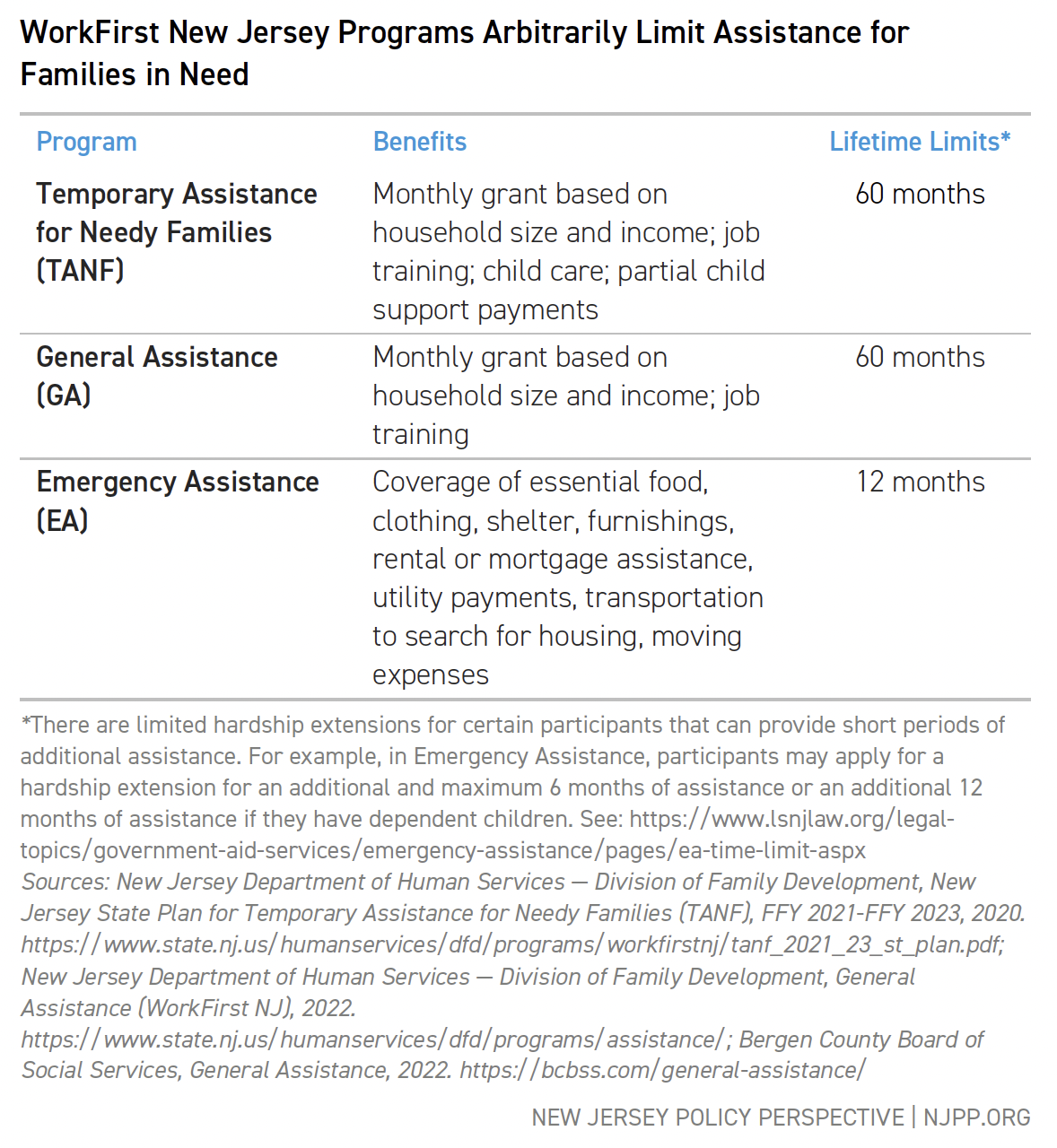

Instead of a tax cut targeted to wealthy homeowners, state lawmakers have other avenues to help reduce senior poverty: expanding outreach for enrollment in food assistance programs like SNAP, reducing health care and prescription drug costs, and increased funding for rent assistance,[10] foreclosure assistance, and housing counseling.

Using the tax code to assist seniors with high costs can only be successful if the changes are targeted to help those who need it most. StayNJ fails to do so.

3. StayNJ Threatens New Jersey’s Fiscal Health

During the Murphy administration, state lawmakers have made great progress towards fixing New Jersey’s financial health after years of mismanagement and not paying the bills. Thanks to a series of full pension payments, increased taxes for millionaires and the most profitable corporations, and strong investments in key factors that promote economic growth like public schools and infrastructure, the state finds itself on solid fiscal footing for the first time in decades.[11]

But StayNJ would jeopardize this progress by pouring billions of dollars into the hands of those who need it least, all without a revenue source to pay for it. To put the sheer size of StayNJ in perspective, its $1.2 billion sticker price is roughly equivalent to the entire budget for the state Department of Health.[12] The bill also lacks funding for administrative costs associated with the new program at the local or state level, which could balloon the cost even further. The $1.2 billion fiscal note for StayNJ may also be an undercount: The Murphy administration estimates that the annual cost is closer to $2 billion, and NJPP’s analysis indicates a cost of $2.2 billion for the state, though we were unable to model the impact of ANCHOR given the lack of public data on who has received tax credits through the new program thus far.

This expensive proposal takes place against a backdrop of reduced revenues and tax cuts for billion-dollar corporations. The Treasury forecast already anticipates $2 billion less in revenue collections over Fiscal Years 2023 and 2024.[13] And those forecasts do not include $1 billion in annual revenue that will be lost if lawmakers cut the corporate tax rate at the end of the calendar year, as they are poised to do.[14] Even a small economic downturn could wipe out the already-tenuous state surplus and make it difficult for lawmakers to balance future budgets without severe cuts to other programs and services.

There are More Efficient and Effective Ways to Help Seniors Stay in New Jersey

When designing policies to make the state more affordable for seniors, lawmakers should target support to the residents who need the most help. Instead, StayNJ would do the opposite by targeting benefits to New Jersey’s wealthiest households while leaving many low-income seniors behind entirely. The program’s poor design, coupled with its billion-dollar price tag and lack of a funding source, should have lawmakers looking for other ways to help seniors stay in New Jersey.

Appendix: Senior Renters by Legislative District

Source: U.S. Census Bureau, 2020 Demographic and Housing Characteristics Table H13

Source: U.S. Census Bureau, 2020 Demographic and Housing Characteristics Table H13

End Notes

[1] NJPP analysis of Institute on Taxation and Economic Policy modeling. Data on file with author.

[2] NJ Dep’t of Community Affairs, 2022 Property Tax Information (2023), https://www.nj.gov/dca/divisions/dlgs/resources/property_docs/22_data/22taxes.xls

[3] NJ Dep’t of Community Affairs, 2022 Property Tax Information (2023), https://www.nj.gov/dca/divisions/dlgs/resources/property_docs/22_data/22taxes.xls

[4] Derek Hall, N.J. senior tax relief bill fueling sudden drama and talk of state shutdown. Here’s what’s in it., NJ.com, May 28, 2023, https://www.nj.com/politics/2023/05/nj-senior-tax-relief-bill-fueling-sudden-drama-and-talk-of-state-shutdown-heres-whats-in-it.html

[5] Kaiser Family Foundation, Poverty Rate by Age, 2021, https://www.kff.org/other/state-indicator/poverty-rate-by-age/?currentTimeframe=0&sortModel=%7B%22colId%22:%2265%2B%22,%22sort%22:%22desc%22%7D.

[6] U.S. Census Bureau, 2020 Demographic and Housing Characteristics: H13B (Black), H13D (Asian), H13H (White Non-Hispanic), H13I (Hispanic/Latino).

[7] Annie Nova, He’s 75 and facing eviction. Many other older renters are, too. CNBC.com, June 22, 2021, https://www.cnbc.com/2021/06/22/millions-of-renters-may-soon-be-evicted-heres-one-familys-story-.html

[8] U.S. Census Bureau, Household Pulse Survey Week 57 (April 26 – May 8, 2023), Housing Table 1b, https://www2.census.gov/programs-surveys/demo/tables/hhp/2023/wk57/housing1b_week57.xlsx

[9] İmrohoroğlu, Ayşe, Kyle Matoba, and Şelale Tüzel. 2018. “Proposition 13: An Equilibrium Analysis.” American Economic Journal: Macroeconomics, 10 (2): 24-51. https://www.aeaweb.org/articles?id=10.1257/mac.20160327

[10] Will Fischer, Douglas Rice & Alicia Mazzara, Center on Budget and Policy Priorities, Research Shows Rental Assistance Reduces Hardship and Provides Platform to Expand Opportunity for Low-Income Families, Dec. 5, 2019, https://www.cbpp.org/research/housing/research-shows-rental-assistance-reduces-hardship-and-provides-platform-to-expand.

[11] Christian Wade, New Jersey receives ratings upgrade over ‘solid’ recovery, The Center Square, Apr. 7, 2023, https://www.thecentersquare.com/new_jersey/article_8f8ef360-d550-11ed-b2e5-4b80b8a6a8b7.html

[12] State of New Jersey, Budget in Brief: Summary of Budget Recommendations, Fiscal Year 2024, https://www.state.nj.us/treasury/omb/publications/24bib/BIB.pdf at p. 70.

[13] Derek Hall, N.J. tax revenues plummet billions below Murphy budget estimate. Are the good times over?, NJ.com, May. 18, 2023, https://www.nj.com/politics/2023/05/nj-tax-revenues-plummet-billions-below-murphy-budget-estimate-are-the-good-times-over.html

[14] State of New Jersey, Budget in Brief: Summary of Budget Recommendations, Fiscal Year 2024, https://www.state.nj.us/treasury/omb/publications/24bib/BIB.pdf at p. 65.

Source: U.S. Census Bureau, 2020 Demographic and Housing Characteristics Table H13

Source: U.S. Census Bureau, 2020 Demographic and Housing Characteristics Table H13