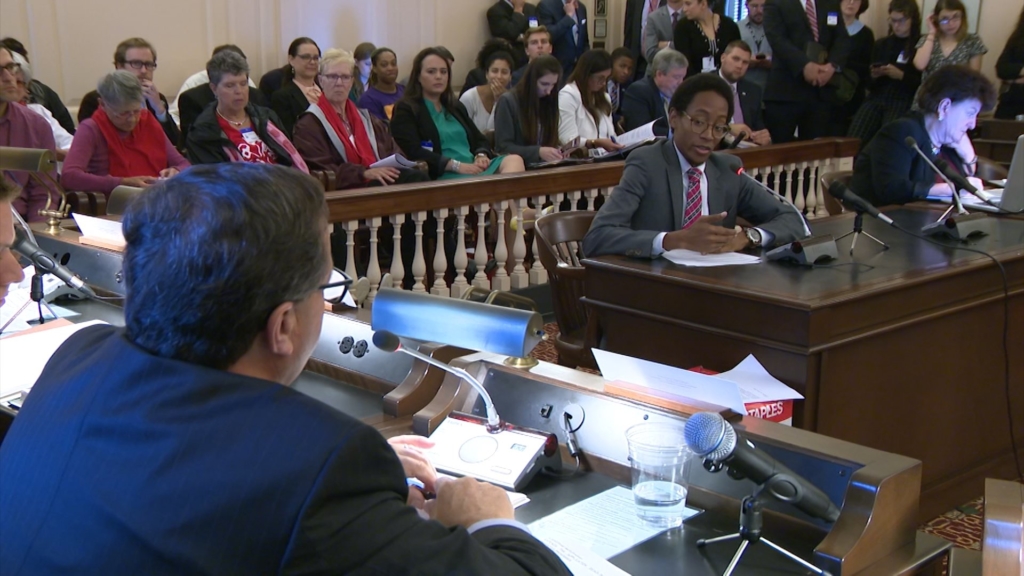

This testimony on A4730 and A5343, proposals to extend New Jersey’s corporate subsidy programs, was delivered to the Assembly Commerce and Economic Development Committee on Thursday, June 13, 2019.

Good morning Chairman Johnson and members of the committee. My name is Brandon McKoy and I am the President of New Jersey Policy Perspective. I appreciate this opportunity to testify on this very important issue.

New Jersey Policy Perspective has researched and analyzed the state’s economic development programs for over twenty years. We closely monitor the tax credits awarded by the state Economic Development Authority, how many jobs created and maintained the state gets in return, and we regularly compare New Jersey’s corporate subsidy programs — and the laws that guide them — against those in other states across the nation.

These decades of research and analysis bring us to a simple conclusion: New Jersey’s economic development programs have been improperly designed, poorly measured, and insufficiently examined since the implementation of the 2013 Economic Opportunity Act, which I will heretofore refer to as the 2013 EOA. While the Economic Development Authority in and of itself is not a problematic entity, the legislation guiding its operations leaves much to be desired.

Since the passage of the 2013 EOA, New Jersey’s corporate tax subsidies have risen to unprecedented levels, with an enormous financial reward to very few corporations and an enormous cost to Garden State taxpayers. New Jersey is now a national outlier for how much it spends on corporate subsidies and how little it receives as a return on investment. But it doesn’t have to be this way. As the current laws guiding the state’s corporate subsidy programs are set to expire on June 30, this legislative body has an incredible opportunity to revamp the state’s approach to economic development so it benefits businesses, their workers, and taxpayers alike.

The purported goals of the legislation being considered today may have good intentions, but they lack the critical reforms necessary to get New Jersey’s economic development strategy back on track. It is NJPP’s position that the extensive flaws in the 2013 EOA must be addressed before any consideration of extending these programs.

While bill A4730 would slightly improve eligibility requirements for the Grow New Jersey Assistance Program, it lacks key reforms that would reel in an out-of-control corporate tax subsidy initiative. It contains no annual spending caps, no mandated reporting to verify outcomes, no recurring evaluation process, no annual forecasting or multi-year cost projections, and no labor protections. In fact, this legislation rewards corporations that hire contract workers.

Meanwhile, A5343 would simply extend the existing program to January 31, 2020. For a program with well-documented flaws that is projected to rob the state budget over $1 billion in revenue annually for the foreseeable future, this makes little sense. Rational and attainable fixes have been suggested time and time again to this legislature, both by NJPP and national experts, and yet they remain conspicuously absent from both of these proposals.

Before considering extensions, we must recognize that these programs have not produced results as intended. The cost to the state remains too great, and the means to verify impact remain insufficient.

Before 2013, New Jersey’s corporate subsidy spending was in line with the national average, at about $16,000 per job created or maintained. Since the passage of the 2013 EOA, the state has awarded enormous corporate subsidies that are more than five times the national average. In return, the state has received little verifiable performance or uptick in jobs, development, and economic growth. Simply put, rather than being another tool in the toolbox of economic development, corporate tax subsidies became theeconomic development strategy of New Jersey.

For years, NJPP has raised the alarm about the enormous cost of these programs to our state, at a time when New Jersey can least afford to gamble away future tax revenue. These bills proposed today do not sufficiently assuage the concerns we have documented.

And you don’t have to just take my word for it. Other than the findings of multiple reviews and analyses by other independent actors, the Fiscal Impact Statement that accompanied the final version of the 2013 EOA clearly states that the loss of revenue to the state’s Treasury, due to credit redemptions, would be enormous. It also says that the levels of Corporate Business Tax uncertainty and losses, even with implied increased local spending and jobs development, could be substantial and result in a decade of direct business tax revenue reductions and losses. While some would like to deny the reality, those warnings have come to fruition.

Without implementing annual spending caps for awards, shorter term lengths for awards, penalties for bad actors and known tax dodgers, wage protections for workers, and nationally recognized best practices for assessment and review, New Jersey Policy Perspective cannot support these bills as currently constructed.

I understand that this body and the legislature are on a short time line with regard to the sunset of the 2013 EOA, but NJPP and others have been commenting on these issues to lawmakers for years. None of this should come as a surprise to anyone.

Given the scope and cost of New Jersey’s corporate subsidies, the laws guiding the Economic Development Authority will be among the most consequential pieces of legislation passed this session. Passage of any extension without the inclusion of critically necessary reforms leaves the state extremely vulnerable to uncertain and insufficient economic outcomes.

This presents you an incredible opportunity to fix the problems with New Jersey’s existing corporate subsidy programs and ensure future economic development benefits all New Jerseyans — business owners, their workers, local communities, and taxpayers alike.

Thank you again for this opportunity to testify. I look forward to working with you all as New Jersey revamps its approach to economic development.