To read a PDF version of the full report, click here.

A prosperous New Jersey depends on the livelihood of all our workers. In fact, the state economy benefits most when workers are able to earn fair pay for all the hours they work while balancing employment responsibilities with family obligations. However, millions of people across the nation, including hundreds of thousands in New Jersey, are not covered by overtime protections and risk being exploited for their time.[i] This is a direct result of federal overtime laws that have eroded over time—and the lack of a strong state overtime law—where far too many workers are exempt from the right to earn time-and-a-half when they work over 40 hours a week.

Currently, some salaried white-collar workers who earn more than $23,660 a year can be legally denied overtime pay. These exempted workers (1) are considered “highly compensated,” earning at least $455 per week ($23,660 per year), (2) have primary office or non-manual duties, and (3) pass the “duties test,” a complicated test of employees’ tasks and responsibilities that establish them as a bona fide executive, manager, or highly trained professional.[ii] The federal overtime salary threshold for these exempted workers will increase to $35,568 in 2020, but this still falls significantly short of historical standards.

When overtime protections were created in 1938, Congress authorized coverage for most workers. Still, specific groups of white-collar workers were exempted (as outlined above) under the presumption that “bona fide” executives, administrators, and skilled professionals possessed high enough salaries and enough individual bargaining power that they were not at significant risk of exploitation.[iii]

However, the federal salary threshold has severely eroded over the years from not being updated or indexed to inflation or wage growth. Over the past four decades, the percentage of full-time salaried white-collar workers who are guaranteed overtime pay has fallen significantly from 63 in 1975 to less than 7 in 2016.[iv]

The last time the federal salary threshold was meaningfully updated was in 1975, when it was 3 times the federal minimum wage.[v] From the 1940s through the late 1970s, the threshold remained above 2.5 times the minimum wage in all but two years (for those two years, the threshold only fell to 2.3 times the minimum wage).[vi] If this minimum threshold of 2.5 times the minimum wage held constant for New Jersey, it would be $52,000 per year for salaried white-collar workers at the current $10 minimum wage in 2019 and $78,600 in 2024 when the upcoming $15 minimum wage rate takes effect in New Jersey.

In 2016, the U.S. Department of Labor (DOL), under the Obama Administration, attempted to increase the overtime threshold to $47,476 per year for full-time, white-collar salaried workers and tie future automatic increases to the cost of living.[vii] However, a federal judge in Texas blocked the Labor Department from enforcing the higher threshold after it was challenged in court by a coalition of Republican-controlled states and business groups. In response, the U.S. DOL, under the Trump Administration, watered down the 2016 proposal to a $35,568 threshold starting in January 2020. The Trump Administration’s rule only covers one third of the workers that Obama Administration’s DOL rule would have covered, leaving behind 8.2 million workers across the country, including 280,000 in New Jersey.[viii] It also does not include automatic indexing which means the threshold will soon erode and cover far fewer workers.

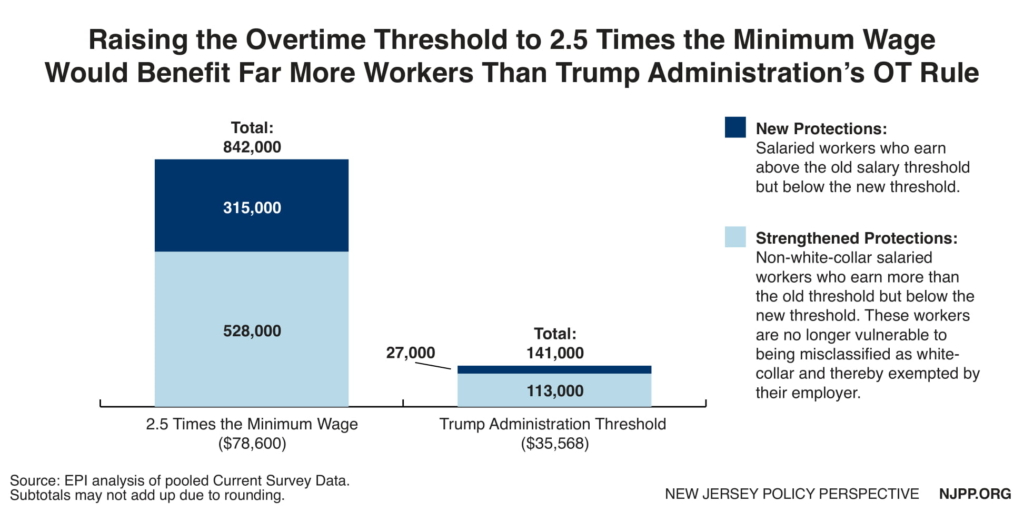

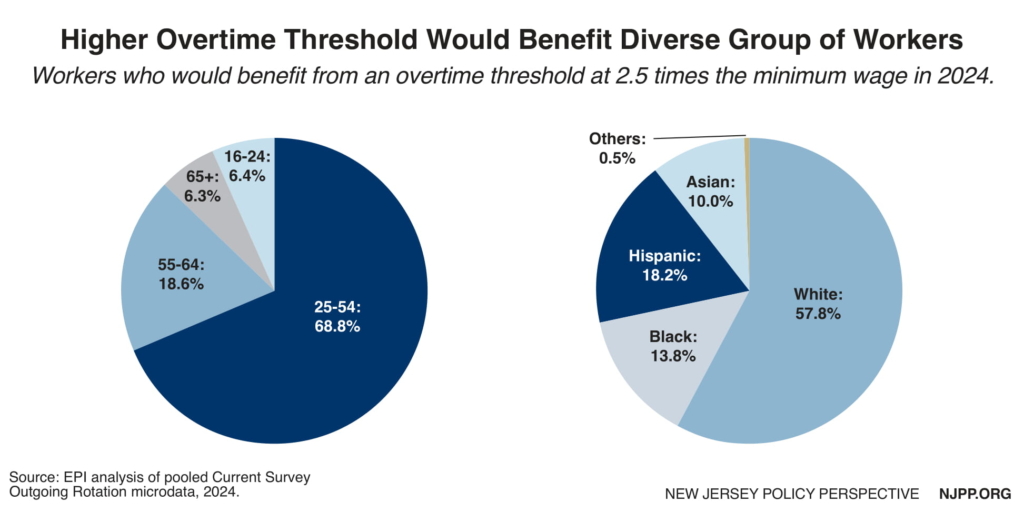

If New Jersey adopts its own overtime threshold at 2.5 times the minimum wage—$78,000 by 2024—it would restore the standard from the 1940s through the late 1970s. By 2024, when the state minimum wage reaches $15 an hour, 842,000 salaried white-collar workers would gain coverage, representing 38 percent of total salaried workers. Specifically, 315,000 would gain overtime protections for the first time and 528,000 would have strengthened protections, as they would be less likely misclassified as exempt, white-collar workers. Under this threshold, 287,000 more workers would gain new overtime protections than under the Trump administration’s new overtime threshold.

Of these covered 842,000 salaried workers, more than half are women and nearly one third are parents. In addition, nearly half of the workers are Black, Latinx, and Asian and 69 percent are prime working age adults (25–54 years old).

Under the 2.5 times the minimum wage salary threshold, New Jersey workers, their families, and the broader state economy would benefit. For workers, this means that those who were previously required to work extra hours without extra pay would receive the wages they earned, boosting their take home pay. If they choose not to work overtime, workers would have more invaluable time to spend with their families.

For the economy, raising the overtime threshold can stimulate job growth. An employer may find it advantageous to hire more workers instead of paying overtime premiums for extra hours by existing staff.[ix] Also, expanding overtime protections will benefit the state economy as it will increase worker productivity and improve profitability for businesses. Research indicates that being overworked is associated with lower rates of output, and reductions in working hours within some industries has increased productivity.[x] Further, raising the overtime threshold will likely increase pay and therefore strengthen consumer power, which is a proven way to grow an economy from the bottom up. When people have more money in their pockets, they are likely to spend a portion of those increases locally, thereby supporting local businesses and boosting their local economy.

New Jerseyans who work extra hours deserve the right to overtime pay. Regrettably, federal policymakers have not prioritized these workers as overtime protections have drastically eroded. It’s up to state lawmakers to step in to protect New Jersey’s working families from unfair and exploitive labor practices.

End Notes

[i] Economic Policy Institute. Overtime research overview.

[ii] Lexis Nexis. 2011. New Jersey Adopts The Federal Regulations Concerning Exemptions From Overtime Pay Laws; Economic Policy Institute. 2019. Modernizing Massachusetts overtime law is critical to strengthening pay and protecting work-life balance for hundreds of thousands of Massachusetts workers.

[iii] Economic Policy Institute. 2019. EPI comments on proposed changes to Washington state’s overtime rules.

[iv] Economic Policy Institute. 2017. What’s at stake in the states if the 2016 federal raise to the overtime pay threshold is not preserved—and what states can do about it.

[v] Economic Policy Institute. 2019. EPI comments on proposed changes to Washington state’s overtime rules.

[vi] Economic Policy Institute. 2019. EPI comments on proposed changes to Washington state’s overtime rules.

[vii] Economic Policy Institute. 2019. More than eight million workers will be left behind by the Trump overtime proposal.

[viii] Economic Policy Institute analysis of pooled Current Survey Outgoing Rotation microdata, 2024

[ix] Economic Policy Institute. 2019. EPI comments on proposed changes to Washington state’s overtime rules.

[x] Washington Center for Equitable Growth. 2019. Overworked America: The economic causes and consequences of long work hours. Page 22.