For all New Jersey residents to recover from the COVID-19 pandemic and resulting economic crisis, more financial relief needs to flow to people excluded from most public programs and federal relief efforts.

New Jersey is strongest when all residents have the resources they need to thrive, regardless of where they were born. Yet, New Jersey is failing to provide support that matches the scale of challenges that deepen financial hardship across the state — particularly for undocumented immigrant families who help fund the same public programs they are excluded from through state and local taxes.[i] Even before the pandemic, immigrants faced barriers to many critical programs designed to support individuals’ well-being and economic security. Now they are being pushed farther behind.

As a state with one of the nation’s largest immigrant populations, supporting immigrant communities is critical to New Jersey’s recovery and future prosperity. Though the state has taken some steps to address serious inequities in economic well-being throughout the pandemic, more action is needed.

New Jersey’s Investment in Excluded Workers Falls Short of Need

Responding to advocacy and organizing led by immigrant community members and organizations, and in the absence of legislative action, Governor Murphy in May 2021 established the Excluded New Jerseyans Fund, which was to use $40 million in federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funds for one-time payments to New Jersey residents ineligible for unemployment insurance and federal stimulus payments.[ii] Eligibility is limited to households that suffered economic hardship due to COVID-19 and have annual income less than $55,000.[iii]

The state had until December 31, 2021 to distribute the $40 million in federal money before it expired. But with only $6 million in aid distributed by that deadline, the state reallocated $34 million to other expenses allowed under the CARES Act, including state government payroll and departmental costs. While it is unknown whether the state will add more federal funding to the program, the governor did add $10 million from a different pot of federal aid in December, and the Department of Human Services, who are administering the fund, promised that people already approved for funds would still receive benefits.[iv] The fund is set to end on January 31, 2022.

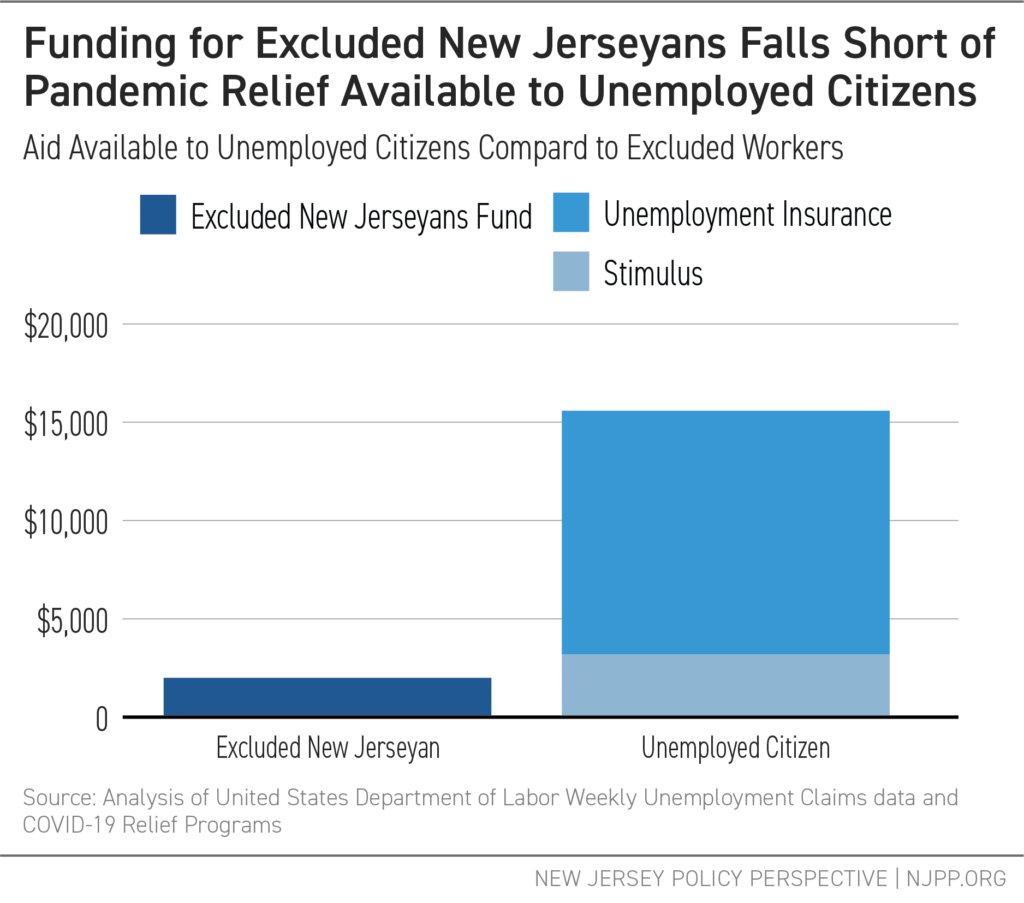

Even if the Excluded New Jerseyans Fund were kept at its original funding level, it does not match the aid provided to others facing financial hardship due to COVID-19. For perspective, if the state were to more equitably provide relief for excluded workers by matching the minimum amount of unemployment insurance received by other New Jersey residents who lost income since the onset of the pandemic, the Excluded New Jerseyans Fund would require $1.4 billion, plus additional funding for outreach and program administration. Further, matching the average amount of unemployment assistance received by New Jersey residents would require $2.7 billion.[v]

The benefit amount for the Excluded New Jerseyans Fund, set at a maximum of $2,000 per individual and $4,000 per household, is insufficient to meet the needs of most households for even one month, let alone the duration of the pandemic. The monthly cost of living in Mercer County, for example, is $3,300 for a single adult, $5,500 for a household with one adult and one child, and $7,900 for a household with two adults and two children, according to the Economic Policy Institute’s Family Budget Calculator.[vi] And, while the cost of living varies substantially according to household size, the Excluded New Jerseyans Fund does not account for household size — both the benefit amount and the income cap are the same for any household with two or more people.

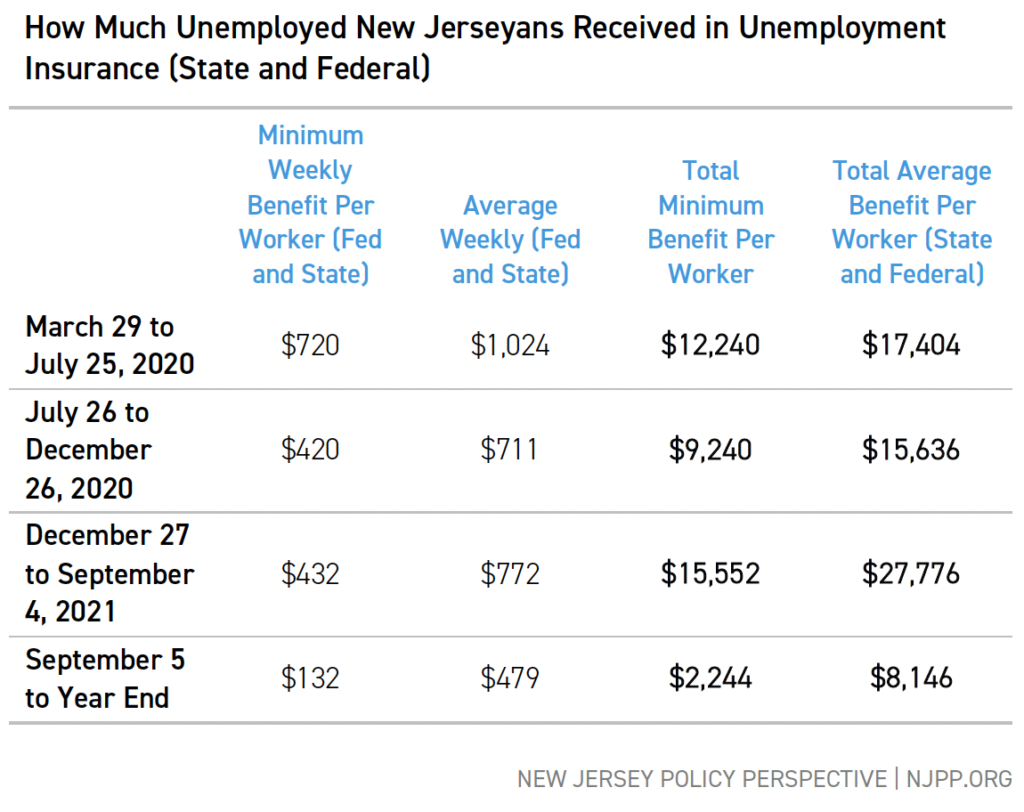

Assistance offered through the Excluded New Jerseyans Fund pales in comparison to the relief available to unemployed citizens. The average state unemployment benefit for New Jersey residents ranged from $395 to $485 per week during the past two years.[vii] In addition to state unemployment insurance, a federal supplement of $300 to $600 through the Federal Unemployment Compensation Program (FPUC) was given to unemployment insurance recipients during certain periods.[viii] Beyond unemployment insurance, New Jersey residents with a Social Security number were also eligible to receive up to $3,200 per adult and $2,500 per child in direct stimulus payments if they met the income thresholds established under the federal CARES Act and American Rescue Plan (ARP).

An unemployed New Jersey resident who is eligible for unemployment insurance and is unemployed for the average (mean) duration of unemployment (currently 29 weeks) would be eligible for a minimum of $12,380 and average of $21,738 in unemployment insurance.[ix]

Not only do payments from the Excluded New Jerseyans Fund fall far short of the cost of living in New Jersey, but the size of the fund is also too small to reach all excluded workers. New Jersey is home to nearly half a million undocumented residents, over 300,000 of whom are in the labor force.[x] Under the $50 million promised in December, however, only 25,000 individuals or 12,500 households could benefit. Now that a majority of the fund was reallocated to other expenses, exponentially fewer workers will have access to relief.

Further, many other New Jersey residents will lose access to pandemic relief without a more robust Excluded New Jerseyans Fund, including people recently released from incarceration as well as those working in the cash economy who face barriers to accessing benefits like unemployment insurance due to work history documentation requirements. A larger investment in excluded workers would not only improve the economic security of those excluded from economic opportunity and public programs, but also help workers better afford necessities crucial to their families’ and communities’ health and well-being.

How State Lawmakers Can Support Excluded Workers and Families

Several states have made greater use of federal fiscal recovery funds to support workers left behind by existing supports. For example, Washington allocated over $300 million for financial support to immigrants whose economic security was threatened by the pandemic.[xi] This aligns with guidance from the United States Department of the Treasury, which has encouraged states to use federal relief funds to aid unemployed workers and families and those facing financial insecurity.[xii]

Many states have also used state dollars to invest in workers and families excluded from federal programs. New York, for example, created a $2.3 billion fund to support immigrants excluded from relief.[xiii] New Jersey lawmaker can learn from these states’ initiatives and do a better job of making public investments to support recovery for all New Jersey residents.

End Notes

[i] Kapahi, Vineeta. “Unemployment Insurance Taxes Paid by Undocumented Workers Tops $1 Billion.” New Jersey Policy Perspective. https://www.njpp.org/publications/report/unemployment-insurance-taxes-paid-by-undocumented-workers-top-1-billion/

[ii] State of New Jersey, Governor Phil Murphy. May 2021. “Governor Murphy Announces $275 Million in Relief for Small Businesses and Individuals Impacted by COVID-19 Public Health Crisis.” https://www.nj.gov/governor/news/news/562021/20210507a.shtml

[iii] New Jersey Department of Human Services. October 2021. Excluded New Jerseyans Fund – Eligibility Criteria. https://www.nj.gov/humanservices/excludednjfund/apply/eligibility/

[iv] Nieto-Munoz, Sophie. December 17, 2021. “Another 10m added to N.J. excluded worker fund, extending deadline into 2022.” New Jersey Monitor. https://newjerseymonitor.com/2021/12/17/another-10m-added-to-n-j-excluded-worker-fund-extending-deadline-into-2022/; Yi, Karen. January 19, 2022. “Outrage After NJ Diverts $34M From Immigrant Worker Fund.” Gothamist. https://gothamist.com/news/outrage-after-nj-diverts-34m-immigrant-worker-fund

[v] NJPP analysis based on U.S. Department of Labor Weekly Unemployment Claims Data and Center for Migration Studies Population Estimates. This estimate assumes a benefit amount and duration that matches the average for New Jersey residents who lost employment and were eligible for unemployment insurance. The methodology for these estimates is adapted from the Fiscal Policy Institute’s brief, “Unemployment Compensation for Excluded Workers: $3.5 Billion Needed for 2020 and 2021,” available here: https://fiscalpolicy.org/wp-content/uploads/2021/03/FPI-Excluded-Workers-March-FINAL.pdf

[vi] Economic Policy Institute. “Family Budget Calculator.” https://www.epi.org/resources/budget/

[vii] United States Department of Labor, Employment and Training Administration. Monthly Program and Financial Data: Summary Data for State Programs. https://oui.doleta.gov/unemploy/claimssum.asp

[viii] New Jersey Department of Labor. “Federal and State Extended Benefits.” https://www.myunemployment.nj.gov/apply/extensions/

[ix] United States Bureau of Labor Statistics. “Table A-12. Unemployment persons by duration of employment.” https://www.bls.gov/news.release/empsit.t12.htm

[x] Center for Migration Studies. “State-Level Unauthorized Population and Eligible-to-Naturalize Estimates.” http://data.cmsny.org/state.html

[xi] Lazere, Ed. “How States Can Best Use Federal Fiscal Recovery Funds: Lessons From State Choices So Far.” Center on Budget and Policy Priorities. https://www.cbpp.org/research/state-budget-and-tax/how-states-can-best-use-federal-fiscal-recovery-funds-lessons-from

[xii] United States Department of Treasury. “FACT SHEET: The Coronavirus State and Local Fiscal Recovery Funds Will Deliver $350 Billion for State, Local, Territorial, and Tribal Governments to Respond to the COVID-19 Emergency and Bring Back Jobs.” https://home.treasury.gov/system/files/136/SLFRP-Fact-Sheet-FINAL1-508A.pdf

[xiii] New York State Senate. “Excluded Workers Fund to Pass Bringing $2.1B in Relief for Those Left Out of Federal Stimulus and Unemployment Insurance.”