This report was co-authored by Anthony Capote, Senior Policy Analyst at the Immigration Research Initiative, and David Dyssegaard Kallick, Director of the Immigration Research Initiative.

New Jersey’s fundamental strength lies in the rich tapestry of people who call the Garden State home, reflecting a diverse range of cultures and backgrounds. Nearly one in four residents (2.2 million) are immigrants,[i] who play a pivotal role in shaping the state’s identity.

Immigrants bring a wealth of skills and talents that enrich New Jersey’s arts, cuisine, and entertainment, add to the intellectual achievements across various fields, and play essential roles in the private and public sectors. Across the state, immigrants make significant contributions to their local communities and the broader economy through their labor, entrepreneurial endeavors, and tax contributions.

Despite the positive role immigrants play in New Jersey and around the country, there has been a rise in xenophobia and anti-immigrant policymaking in a number of states. It is imperative for New Jersey to uphold its values of inclusivity and support for immigrants. Championing “Fair and Welcoming” policies that lower barriers to essential public services and protect residents from discrimination and workplace abuses is not just a moral obligation but a strategic necessity for bolstering the state’s economy.

To measure the economic contributions of new immigrants, this research brief by New Jersey Policy Perspective and the Immigration Research Initiative models the long-term economic outcomes for newly arrived immigrants and projects that there will be significant wage earnings and tax contributions in their first year of arrival and even more over the long run.

Newly Arriving Immigrants Immediately Get to Work and Contribute to the Economy

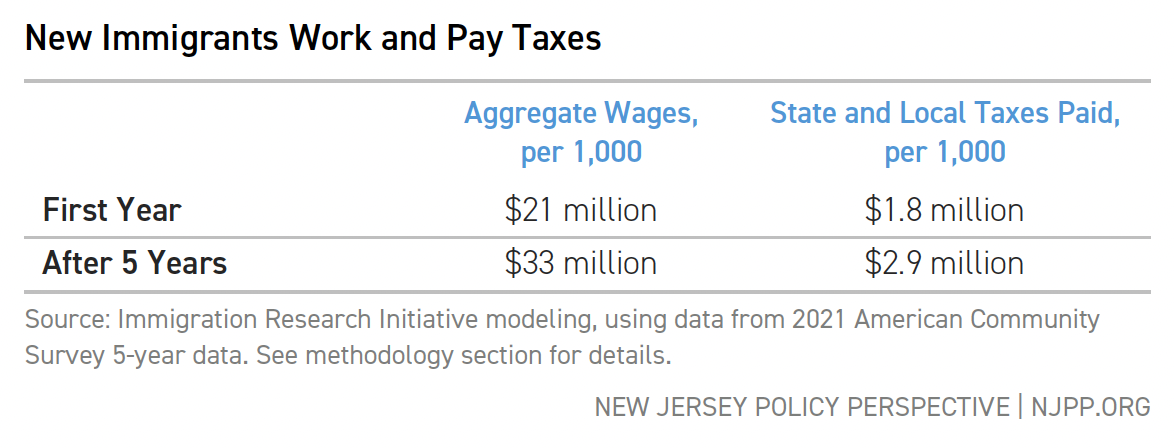

Newly arriving immigrants face multiple challenges as they navigate language barriers, adapt to unfamiliar cultures and systems, and adjust to a new way of life. Despite these challenges, many swiftly integrate into the workforce within their first year. As a result, each 1,000 new immigrants can be expected to earn a combined $21 million in annual wages, enhancing the economic vitality of their communities where they work and amplifying local spending power where they live. After five years, the same 1,000 immigrants can be expected to increase their wages by about 57 percent, totaling $33 million in aggregate wages.

As immigrants settle in and establish their roots in New Jersey, state and local tax revenues see an uptick. For every 1,000 workers, state and local tax revenues are poised to increase by $1.8 million. Over the span of approximately five years, each 1,000 newly arrived immigrants collectively add to state and local tax revenues a total of $2.9 million, a 61 percent increase from their initial year. Such increases in state and local tax revenues translate into broader benefits for all residents, providing additional funding for schools, libraries, transit infrastructure, and other public goods.

However, more work remains to be done at the federal level to reduce barriers to work authorization for newly arriving immigrants. Earnings and tax contributions are contingent upon pathways to work authorization, and for those unable to gain work authorization, the trajectory toward upward mobility is much more limited.

Supporting Immigrants Makes New Jersey Stronger and Fairer for All

New Jersey’s commitment to inclusivity and fairness is evident through past policies that extend vital resources such as driver’s licenses, health care for all kids, language services, and pandemic relief to all, regardless of their immigration status. As a state built on diversity and resilience, it is critical to reaffirm this commitment as a beacon of hope for those fleeing persecution and seeking refuge.

Lawmakers must translate these values into tangible action, aligning state policies with equity and hospitality by improving immigrants’ wages and lowering barriers to health care, legal services, quality education, affordable housing, and more. By doing so, New Jersey can be a stronger and fairer state where everyone is valued, protected, and given a chance to thrive.

End Notes

[i] 2022 American Community Survey data, https://www.census.gov/programs-surveys/acs/data.html.

Methodology

To model the likely outcomes for new arrivals, IRI looked at immigrants in New Jersey who had been in the country for less than two years, and who do not speak English very well.

To model the outcome for those who have been here for approximately five years, we expanded the analysis to include those who speak English “very well,” but did not include those who speak “only English” at home, reflecting the fact that most — though not all — immigrants learn to speak the language very well within five years. We did not include in the analysis people who speak “only English” at home. To get a robust sample size, IRI looked at two years for new arrivals and five to ten years for those who have been here longer.

The tax analysis is based on a simple use of the Institute on Taxation and Economic Policy report, “Who Pays: A Distributional Analysis of the Tax Systems in All 50 States.” According to the most recent, 7th Edition, the bottom 20 percent of tax filers in New Jersey pay 8.8 percent of their income in state and local taxes. We use this as the effective tax rate for newly arriving immigrants as well as for those who have been here for five years.

Many, but not all, of the workers would have work authorization. Many newly arriving immigrants are eligible to apply for Temporary Protected Status, humanitarian parole, asylum, or other designations that give them temporary or permanent work permits. The Institute on Taxation and Economic Policy’s related report, “Undocumented Immigrants’ State and Local Tax Contributions,” shows that immigrants without work authorization pay an effective tax rate of 7.7 percent in New Jersey, a little lower than those with work authorization. The overall tax estimate might be increased by some families with incomes on the higher range, and decreased some by the proportion of immigrants who are undocumented.

About the Authors

Marleina Ubel is a senior policy analyst at New Jersey Policy Perspective.

Anthony Capote is a senior policy analyst at the Immigration Research Initiative.

David Dyssegaard Kallick is director of the Immigration Research Initiative.