New Jersey has a lot at stake as the Senate considers the American Health Care Act (AHCA), because the bill lawmakers are considering is still a disaster for New Jersey – made worse by the amendments added by the House.

The provisions in the original bill that most harm New Jerseyans – effectively eliminating the Medicaid expansion, permanently capping Medicaid, repealing health insurance subsidies for moderate-income New Jerseyans and eliminating the individual and employer mandate – essentially remained the same in the House-passed version. The repeal of the Medicaid expansion and subsidies in the marketplace alone would result in a $28 billion loss in federal funds over 10 years and cut about 54,000 jobs, causing irreparable harm to New Jersey’s health, budget and economy

These findings are consistent with the recent Congressional Budget Office (CBO) analysis[1] that found little difference between the original and the House-passed bill at the national level. For example, it concluded the House-passed bill would cause about the same number of Americans to become uninsured as in the original (23 million and 24 million, respectively).

One way or another, this bill would hurt most New Jerseyans: seniors, people with disabilities, children, working families, health providers and ordinary taxpayers. The only way to prevent such widespread pain is for the Senate to reject proposals that:

- Effectively end the Medicaid expansion by reducing the matching rate

- End the Medicaid program as an entitlement by permanently capping and reducing funding

- Replace subsidies for moderate-income Americans with tax credits that offer less or no assistance to those who need it most

- Reduce essential benefits and consumer protections

More Than Half a Million New Jerseyans Would Lose Coverage by 2026, Spiking the Uninsurance Rate by 50 Percent

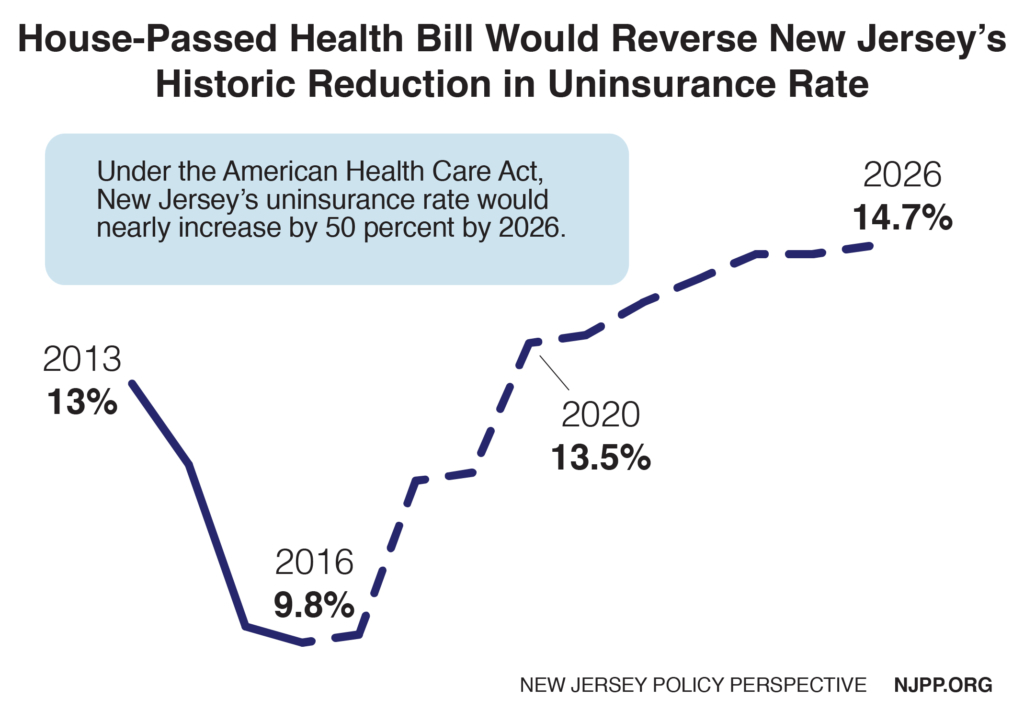

New Jersey’s remarkable progress in reducing the uninsured would be more than reversed under this bill. Under the Affordable Care Act (ACA), more than 800,000 residents gained coverage, decreasing the state’s uninsurance rate to 9.8 percent from 13 percent for people below age 65. Under the House-passed bill, an estimated 540,000 New Jerseyans would lose coverage, making that rate jump to 13.5 percent by 2020 before eventually reaching 14.7 percent by 2026.

In short, the uninsurance rate would increase by 50 percent and would actually be higher than it was before the ACA. There are a number of reasons for this, including that about 172,000 New Jerseyans were covered under NJ FamilyCare under pre-ACA federal waivers that have since expired.

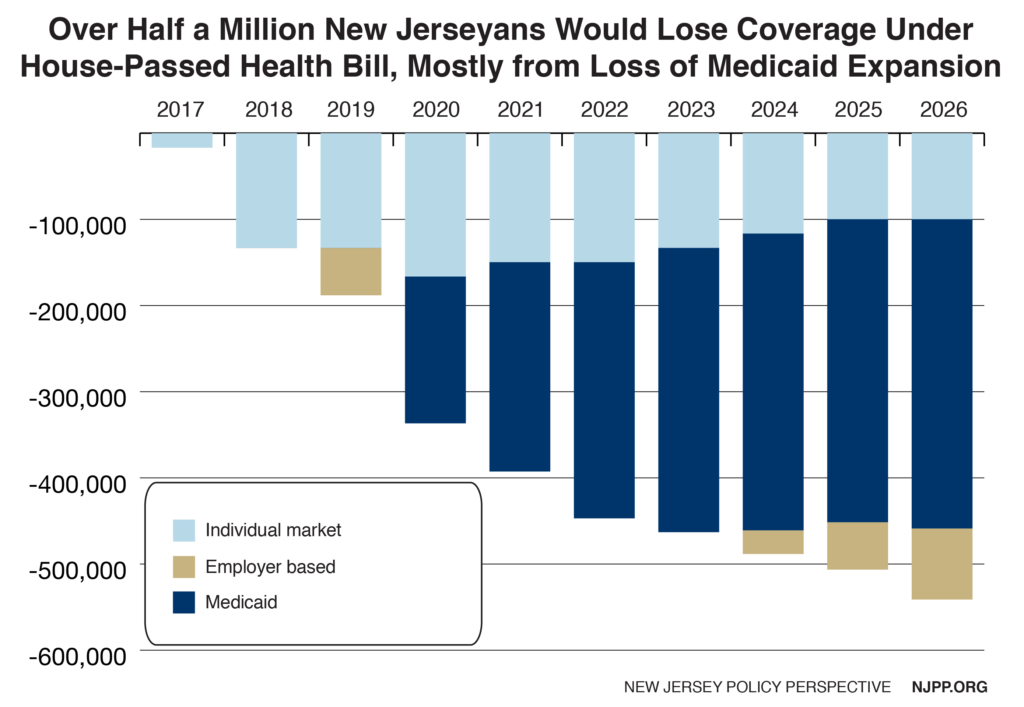

Americans would start to become uninsured as soon as the AHCA is enacted, according to the CBO, which assumes that that would take place in 2017. In New Jersey that means about 16,000 New Jerseyans would become uninsured this year, 337,000 New Jerseyans would lose coverage by 2020 and eventually 540,000 more Garden State residents would be uninsured by 2026.

New Jerseyans would lose coverage in several ways.

Most would become uninsured due to the phase-out of the Medicaid expansion, because very few of the recently covered could afford insurance in the new marketplace. For example, a typical 45-year-old at the federal poverty level currently pays nothing for Medicaid, but would have to pay $2,390 in net premium costs in the new marketplace, which is 19 percent of his or her entire income.[2] Given that most of the poor in New Jersey cannot even afford their very high housing costs, most have no disposable income for these additional costs.

Meanwhile, consumers in the individual market would lose coverage due to higher out-of-pocket costs for lower-income residents, the administrative complexity of applying for and administering the new tax credits and the repeal of the individual mandate. In addition, there would be a relatively small number of people currently in employer-based insurance who would lose coverage due to the repeal of the employer mandate.

The individual market coverage losses are largest early on, and then decrease slightly over time, but coverage losses in Medicaid only increase over time. Thus in 2020 the newly uninsured consist of an equal number of New Jerseyans in Medicaid and the Marketplace – but by 2026 about two-thirds are from Medicaid.

Number of Uninsured Would Swell in All Congressional Districts

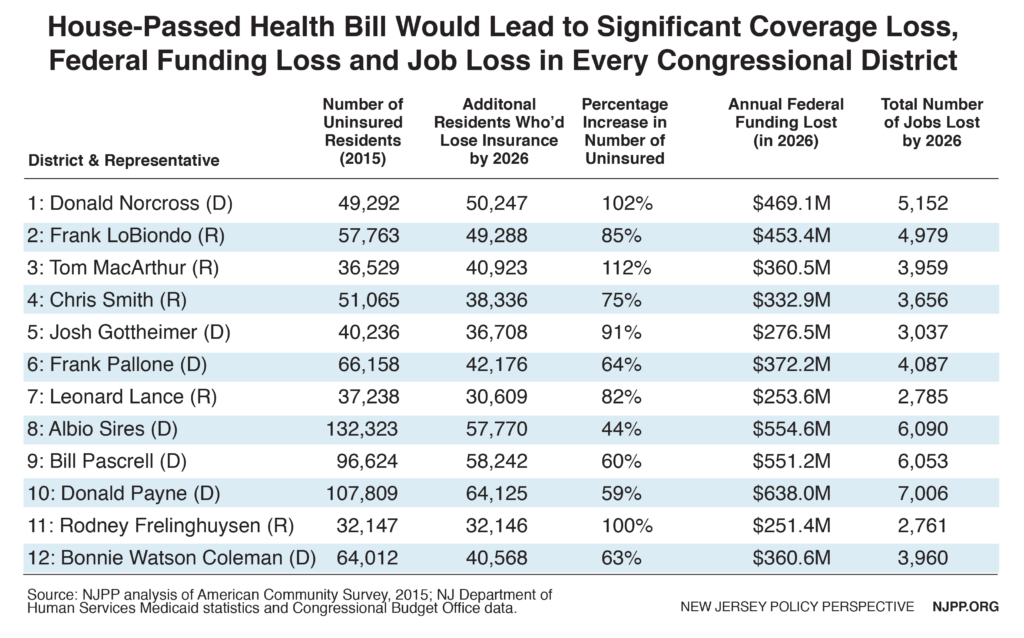

The House-passed health bill would hit all parts of New Jersey hard, with tens of thousands of residents losing coverage in every Congressional district. This is clearly not a partisan issue. In fact, on average, districts represented by Republican Congressmen would see a larger average percentage increase in the number of uninsured than districts represented by Democrats. Constituents represented by the only two members of New Jersey’s Congressional delegation who voted in favor of this bill – Congressmen Tom MacArthur and Rodney Frelinghuysen – would be particularly hard hit; these districts are two of three in the state with percentage increases in the uninsured above 100 percent.

One in 10 New Jersey Adults Would Lose Coverage Due to the Effective End of the Medicaid Expansion

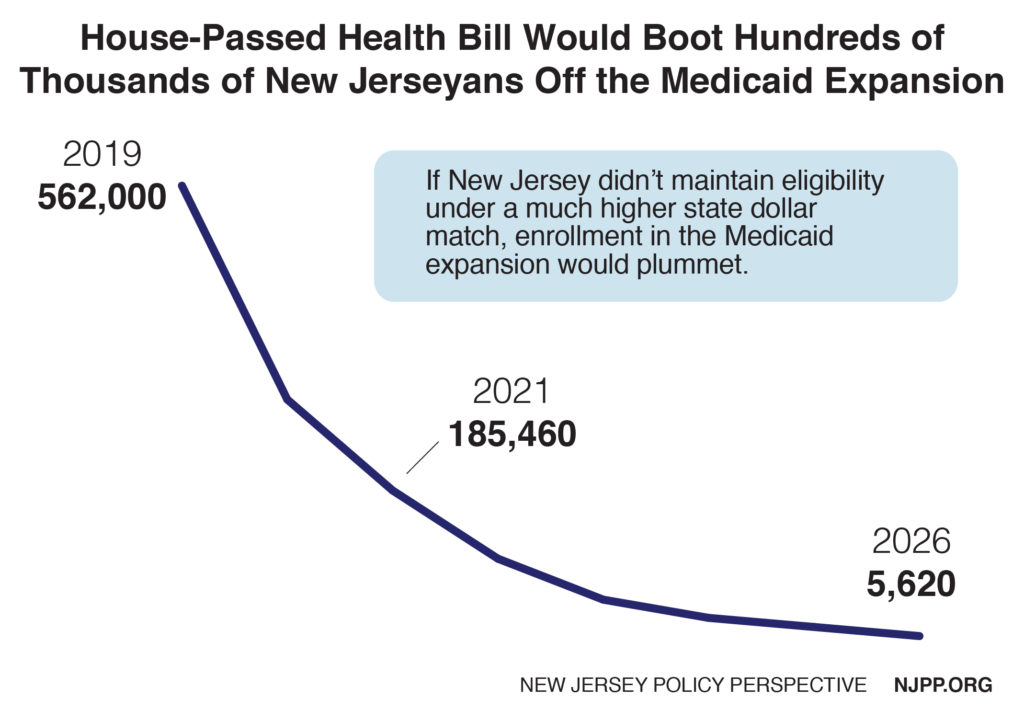

About 562,000 New Jersey adults are enrolled in the Medicaid expansion. Most of these beneficiaries are working in – or live with someone working in – a low-paid job. Many are parents trying to support their children. And the AHCA would quickly result in virtually all of these New Jerseyans losing their health coverage.

Under the AHCA, someone on the Medicaid expansion in December 2019 would be allowed to stay enrolled at a 90 percent federal match starting in 2020 until they became ineligible. But the problem is that the income of Medicaid beneficiaries often changes due to fluctuations in their wages and hours. If a person earned a little more and became ineligible for the Medicaid expansion, the federal government would no longer provide the higher 90 percent match if he or she returned. The end result: Within just a few years, nearly all Medicaid expansion recipients (99 percent, according to the CBO) would have left the expansion population and would therefore no longer be matched at the higher rate.

The AHCA Shifts Billions in Federal Costs to New Jersey

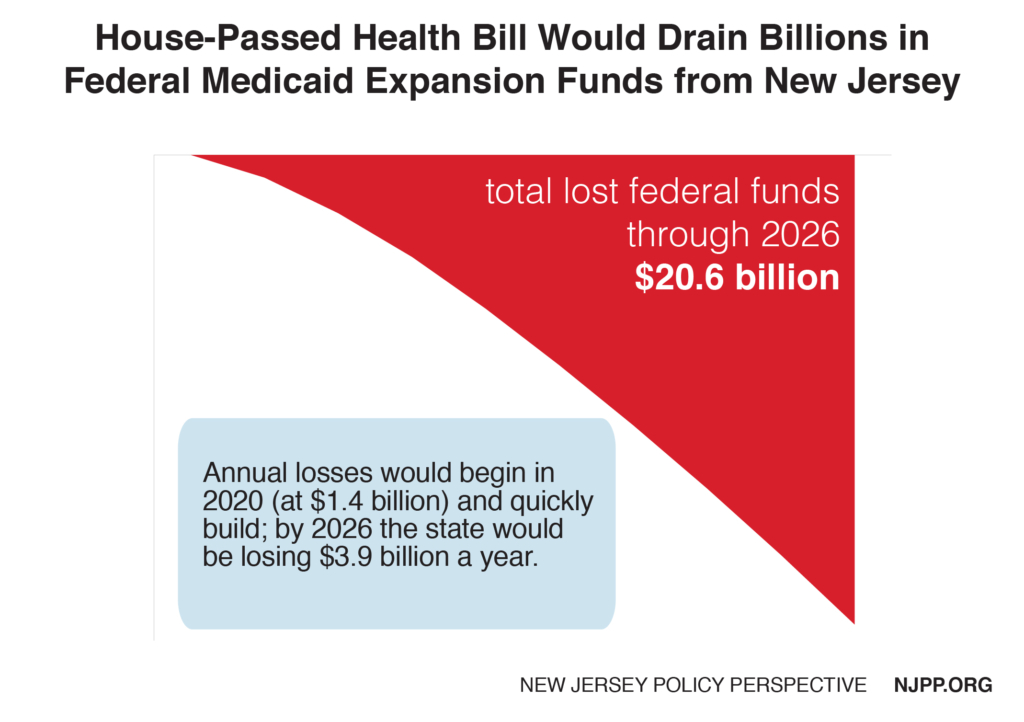

The proposal passed by the House would cause New Jersey to lose $21 billion in federal funds for the Medicaid expansion over seven years, creating a health crisis in New Jersey and making the state’s budget crisis even worse. This problem would take effect quickly because of the rapid turnover in Medicaid-eligible workers. In the first year alone the state would lose about $1.4 billion in federal funds, which would increase to almost $4 billion dollars a year by 2026.

Currently the state relies on about a half billion dollars in savings each year from the Medicaid expansion to help balance the state budget.[3] These savings include, for example, reduced state funding for charity care to hospitals and a lower state matching rate for adults who were previously covered under NJ FamilyCare. However the biggest problem would be caused by the likely loss of $21 billion in federal funds that the state uses to ensure about half a million residents have health care via the ACA’s Medicaid expansion.

Maintaining Medicaid Expansion Would Cost New Jersey Billions

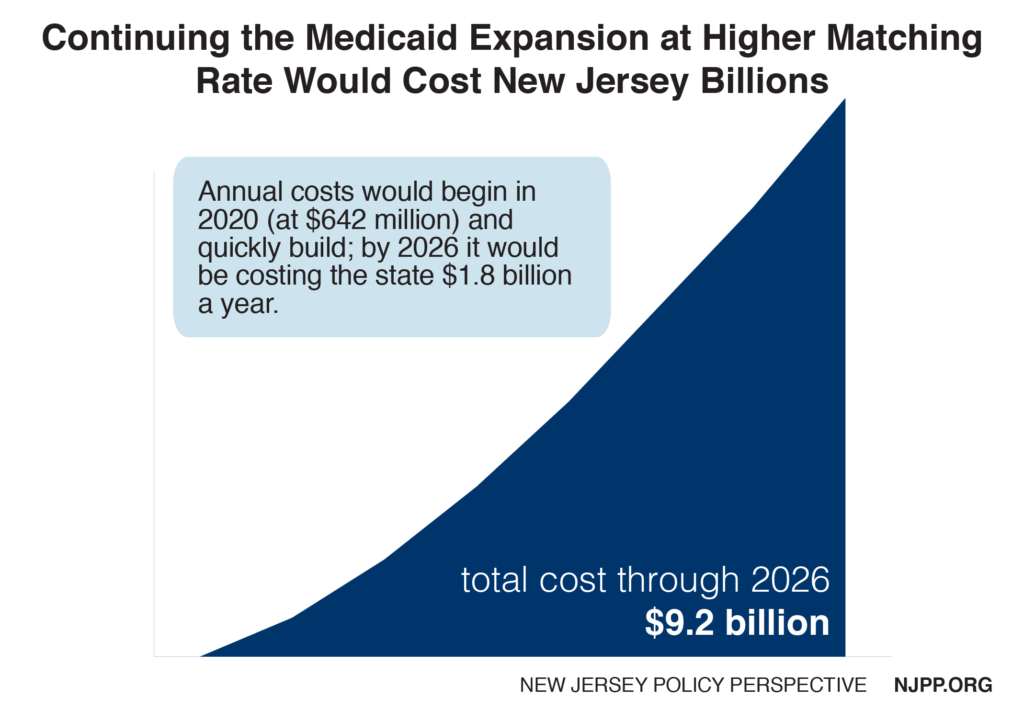

The AHCA does not prohibit states to continue offering an expanded Medicaid, but it shifts a prohibitively large burden of the cost back to states. New Jersey would have to pony up 50 percent of the cost of new Medicaid expansion applicants starting in 2020, rather than the 10 percent it has to provide under the ACA.

This would cost the state $600 million in the first year; by 2026 New Jersey would be on the hook for $1.8 billion a year – a total of $9 billion over seven years starting in 2020 when the phase-out starts under the AHCA.

Continuing the Medicaid expansion would be more difficult for New Jersey than most other states. For one, it has one of the largest enrollments in the Medicaid expansion and the federal matching rate that would be available to New Jersey under the bill would be only 50 percent, the 42nd lowest rate in the nation.[4] And New Jersey is already in a state of near bankruptcy, with many other urgent and significant funding needs. Lastly, the state’s economy is expected to continue to lag behind the rest of the nation through 2025.[5] For these reasons, this analysis assumes the state would be in no financial condition to continue the Medicaid expansion.

A Permanent Cap on Medicaid Would Threaten the Health of 1.6 Million New Jerseyans

New Jersey would also lose additional federal funding under the proposed Medicaid per capita cap. The bill would establish a dollar-amount cap on each person enrolled in Medicaid. The cap would be different for different types of enrollees (aged, disabled, children, adults, and adults in the Medicaid expansion) and it would be adjusted annually by the federal index for health services prices (CPI-Medical) for adults and children, and the same index plus one percentage point for seniors and people with disabilities. Given that the CBO projects that the index for health costs will increase on average by 3.7 percent annually from 2017 to 2026, compared to a 4.4 percent increase for Medicaid costs – it would guarantee savings to the federal government (and lost federal funds to the state) – which is the purpose of the cap.

Such a cap would affect everyone on Medicaid, especially seniors and people with disabilities because they represent about three quarters of Medicaid funding. Under a per capita cap model there is a disincentive to reduce eligibility because the federal funding follows the individual.

Therefore the most likely scenario is that there would be a major decrease in the reimbursement rate for most services, making them inaccessible to thousands of New Jerseyans – and reimbursement for some services could be eliminated entirely. This would dramatically affect thousands of Medicaid providers who would see a sharp decrease in revenue, especially New Jersey’s hospitals, which already have had their state and federal charity care funds cut by over half. This is another area where New Jersey would fare worse than most other states because its current reimbursement rates are already so low. For example, New Jersey’s rate to physicians for all services is less than half what Medicare pays, ranking the state 49th lowest nationally.[6]

This report does not include an estimate for the federal funding loss that would result from a per capita cap because it would likely underestimate the impact. That is because once a cap is established in Medicaid, it would be very easy for Congress to reduce it at any point, which is the point. In fact, the President has already proposed reducing the caps in his budget even though the Medicaid per capita cap legislation hasn’t been enacted yet. Other federal entitlement programs that have had their funding capped have never recovered. Given that Medicaid is a $15 billion program that represents about 25 percent of New Jersey’s budget, even a slight decrease in the $10 billion in federal funding the state currently receives could have catastrophic implications for Medicaid and other state priorities.

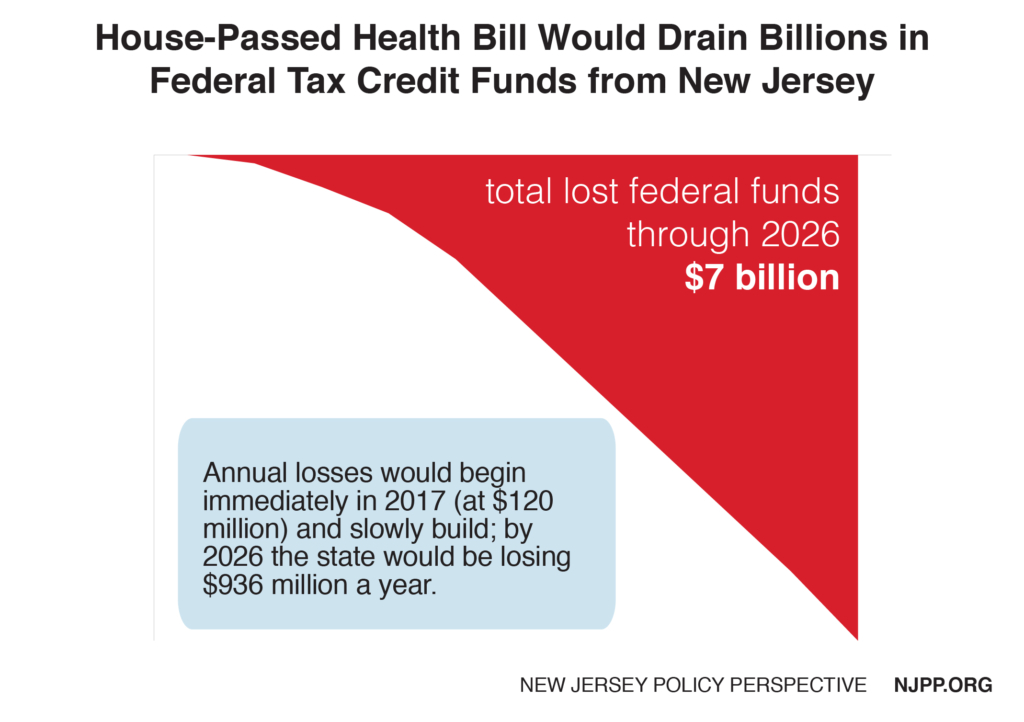

Premium Tax Credits Would be Reduced by $7 Billion Over 10 Years

In addition to the loss of $21 billion in Medicaid over seven years, New Jerseyans purchasing insurance in the marketplace would lose about $16 billion in current premium tax credits over 10 years. That loss would be partially offset by a $9 billion increase in new tax credits starting in 2020, for a net decrease of $7 billion in premium tax credits. The main reason for the overall loss is the current tax credits – which are calculated to ensure that no one pays more than a certain share of their income on insurance – would be replaced with lower, flat credits based on age.

The AHCA’s credits are $2,000 for the youngest consumers and $4,000 for the oldest, and are gradually phased out starting at $75,000 annually for a single person and $150,000 for joint tax filers. That will mean that higher-income New Jerseyans would receive a premium credit for the first time but lower-income New Jerseyans who need assistance the most would see a major drop in their tax credits. On average, a person buying insurance in the marketplace would pay $3,600 more in out-of-pocket expenses under the bill.[7] What’s more, a consumer now is usually protected from any increases in insurance premiums as long as they select the marketplace’s standard (silver) plan, but under the AHCA the consumer pays for the full increase.

Eventually premiums would go down slightly, but only because more costs would be shifted to the consumer in out-of-pocket expenses. This would be especially true for older people because the bill allows insurers to charge them five times the amount for premiums than young people. A typical 60-year-old would pay $8,000 more for insurance; even taking into account tax credits they would be hit with an unaffordable 800 percent increase[8]

In addition, as a result of amendments that were adopted and sponsored by New Jersey’s own Congressman Tom MacArthur, states would be allowed to greatly increase premiums based on pre-existing conditions and to eliminate many essential benefits like hospitalization, maternity care and mental health or substance abuse treatment. This would shift even more out-of-pocket costs to the consumers Additional funding was added to Patient and State Stability Fund in the bill to help address these problems but it would not be nearly sufficient to offset the cost to consumers.[9]

To be conservative, this analysis assumes that New Jersey would not request these waivers. However, that would still be a distinct possibility. For one, prior to the ACA New Jersey allowed insurers to issue bare-bones health plans and deny treatment for pre-existing conditions for 12 months after enrolling. In addition there would be pressure on the state to apply for waivers if premiums increase to unacceptable levels. Furthermore, if New Jersey does not submit these waivers but other states do it could still affect New Jerseyans, because employers are free to base their benefits on what another state requires as long as the business has a site in that state.

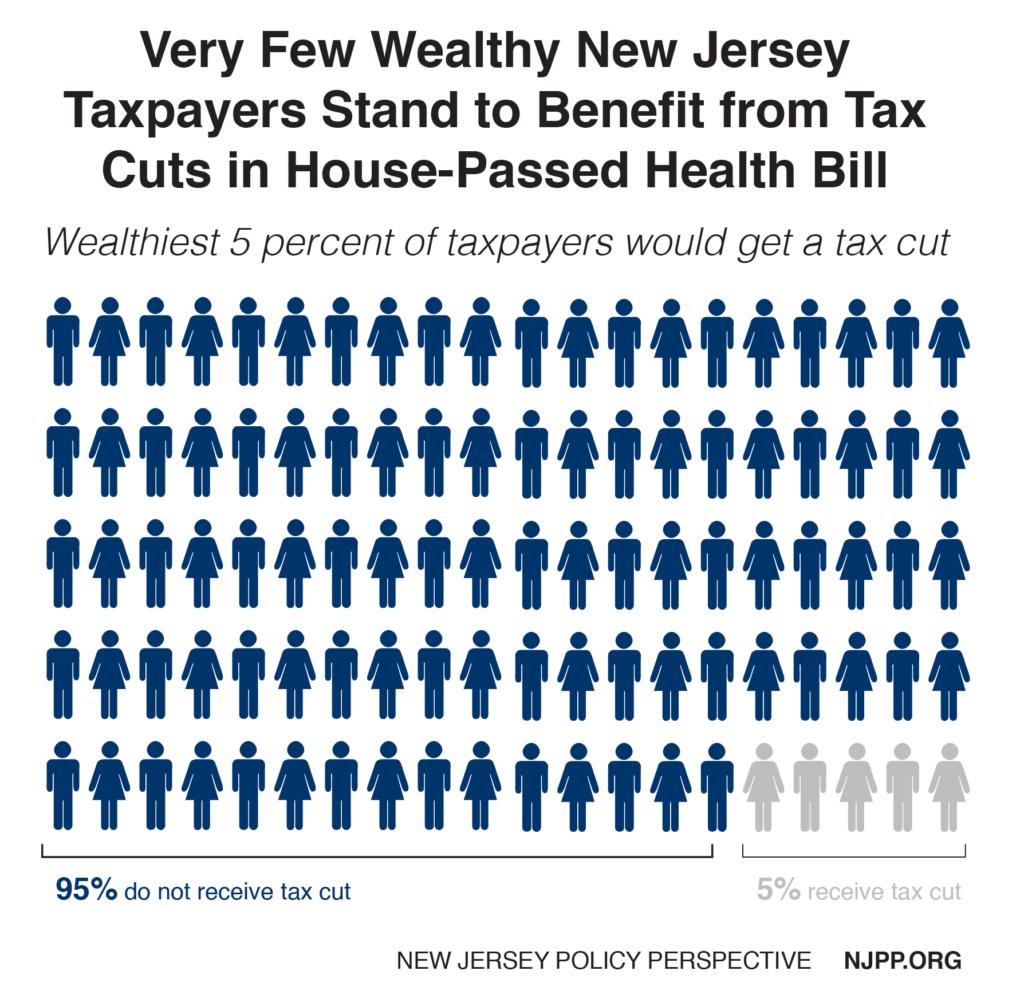

Health Care Cuts Being Used to Free Up Money for Big Tax Cuts for Wealthy Americans

The Republican leadership in Congress has made it clear that federal savings from these cuts to health care would pay for big tax cuts for wealthy Americans. In New Jersey, the wealthiest 5 percent of households will receive a total of $13 billion in tax cuts over 10 years. The tax cuts are most concentrated at the very top, with the wealthiest 1 percent of New Jersey taxpayers receiving 73 percent of the tax cut. These taxpayers, with an average annual income of $2.9 million, would receive an average tax cut of $23,000 a year.[10]

Proposal Would Disrupt New Jersey’s Economy and Cause the Loss of Thousands of Jobs

As might be expected, the loss of $28 billion in federal funds would seriously hurt the state’s economy. The $4.8 billion or so in federal funds New Jersey would be losing each year by 2026 would lead to a decrease of $6.6 billion in economic activity and the loss of 54,000 jobs.[11] That’s because federal funds, which come from outside the state, have what economists call a “multiplier effect.” As the funds make their way through the economy, they increase economic activity. For example, a nurse is hired, and he or she now has the income to buy a house or something else, which also generates additional economic activity and jobs.

Methodology

Increase in the uninsured

It was estimated that about two-thirds of everyone losing Medicaid due to the phase-out of the Medicaid expansion would not be able to secure alternative health insurance and therefore would become uninsured. This estimate was adjusted for each year based on the CBO estimate nationally. It was conservatively assumed that enrollment in the Medicaid expansion would not increase over the period studied consistent with recent enrollment rates.

To determine the number of the uninsured as result of changes in the marketplace, it was estimated that half of everyone in the marketplace with a subsidy would become permanently uninsured leaving about 100,000 New Jerseyans uninsured by 2026. To determine the number of uninsured in each prior year, the CBO national rates were used.

To calculate the number of uninsured due to changes in employment based insurance, New Jersey’s share of the US population was applied towards the CBO national estimates for the uninsured due to the loss of this insurance.

To determine the number of persons who would have been uninsured under the ACA, New Jersey’s number of uninsured for 2015 based on the 2015 American Community Survey was adjusted in subsequent years according to CBO national projections. To calculate New Jersey’s total population, the American Community Survey data for 2015 was adjusted based on its historical increase in the state’s population. The final uninsurance rate due to AHCA was calculated by dividing the total new uninsured each year by the state’s projected population under age 65 each year.

Lost federal funding

2017 New Jersey federal Medicaid funds were adjusted each year based on the state’s historical increases in per capita costs in the Medicaid expansion to determine the projected federal funds under the ACA (baseline) in New Jersey. These amounts were reduced based on the CBO attrition estimates nationally. The baseline was subtracted from the projected federal funds under AHCA to calculate the loss in federal funds each year. Unlike the CBO national estimate, it was assumed that the federal funding loss would not start until 2020 since there is no cost sharing in Medicaid in New Jersey and there is no incentive for enrollees to leave earlier. To calculate lost federal funds in the marketplace, New Jersey’s share of the national marketplace enrollees was applied to the CBO national estimates for the federal premium tax credit savings.

Congressional district impact

Each Congressional District’s share of Medicaid expansion enrollees as estimated by the NJ Division of Medical Assistance and Hospitals and share of marketplace enrollees as estimated in the 2015 American Community Survey for New Jersey was applied to the statewide estimates above.

Endnotes

[1] Congressional Budget Office, H.R. 1628, American Health Care Act of 2017 As passed by the House of Representatives on May 4, 2017, May 2017.

[2] Center on Budget and Policy Priorities, People Losing Medicaid Under House Republican Bill Would Face High Barriers to Coverage, June 2017.

[3] NJ Department of Human Services, Responses to OLS Questions on Governor’s FY2018 Budget, 2017.

[4] Kaiser Family Foundation, Federal Medical Assistance Percentage (FMAP) for Medicaid and Multiplier.

[5] Rutgers University, R/ECON: NJ’s Economy Will Continue to Lag the Nation’s Through 2025 While Undergoing Structural Changes, 2017.

[6] Kaiser Family Foundation, Medicaid-to-Medicare Fee Index, 2014.

[7] Center on Budget and Policy Priorities, House-Passed Health Bill Cannot Be Fixed, May 2017.

[8] Ibid 7

[9] New Jersey Policy Perspective, New Jerseyans with Pre-Existing Conditions Remain at Risk, May 2017.

[10] Institute on Taxation and Economic Policy, Affordable Care Act Repeal Includes a $31 Billion Tax Cut for a Handful of the Wealthiest Taxpayers: 50-State Breakdown, March 2017.

[11] NJPP analysis of economic model in Families USA, New Jersey’s Economy Will Benefit from Expanding Medicaid, February 2013.