Friday Facts and Figures is a weekly newsletter with data points, analysis, and commentary on the biggest policy debates in New Jersey and beyond.

Sign up here.

Wasted

The latest state budget wasted a once in a generation opportunity to fix some of New Jersey’s crumbling infrastructure and chronically underfunded public services, writes Charles Stile in a new column that captures a lot of our feelings here at NJPP. Seemingly every budget deal involves some sort of backroom dealing and short-sighted decision-making, but this year was different. With record tax collections and federal pandemic aid, state lawmakers punted on fully funding NJ Transit, fixing the state’s unemployment insurance system, and investing in affordable housing as rents and housing costs skyrocket. “This year, with the extra billions on hand, could have been the time to look to the future,” writes Charles. “But instead, the budget finances the immediate future of the November elections.” [NorthJersey.com / Charles Stile]

$4 Million

Last Friday, Governor Murphy signed legislation to eliminate public defender fees for legal services rendered by the state’s Office of the Public Defender. Previously, New Jersey charged a minimum $150 fee for state-issued public defenders, with some clients charged more than $1,000 for legal services — an issue highlighted in an October 2022 report by NJPP’s Marleina Ubel. The new law also wipes out unpaid balances for public defenders, as well as any associated warrants, liens, or civil judgements. “This is a huge win for the people of New Jersey that will move the constitutional right to an attorney out from behind a paywall,” said Marleina Ubel. [Gothamist / David Giambusso]

380,000

New Jersey’s first offshore wind farm gained final approval from the federal government this week in a big win for the environment and good-paying jobs in the clean energy sector. Once completed in 2025, Ocean Wind 1 will add up to 98 wind turbines off the coasts of Cape May and Atlantic Counties — enough to power more than 380,000 homes. This project, combined with adjacent wind farms still in the approval process, will bring New Jersey closer to its clean energy goals and help transform the state into a leader in the clean energy economy. [NJ.com / Steven Rodas]

17

With no movement in Congress to expand tax credits for working families this year, 17 states have created or expanded their own state-level Earned Income Tax Credit or Child Tax Credit (CTC) — including New Jersey. In the latest state budget, New Jersey lawmakers doubled the CTC for kids under six, with a new maximum benefit of $1,000 per child. Colorado similarly increased its maximum CTC benefit to $1,200 for kids under six, while Minnesota created a new CTC of $1,750 for every child under 17 years old. Given the success of CTCs in improving health outcomes for children and families — and the reality that the costs of raising kids do not stop once they turn six — New Jersey lawmakers can and should expand the CTC next year so more kids are eligible. [Institute on Taxation and Economic Policy / Neva Butkus]

ICYMI

Last week, NJPP Peter Chen recommended three ways to fix New Jersey’s budget process, including a deadline for legislators to approve their budget proposal to prevent inside-dealing and the near constant threat of a state shutdown. In a new Friendly Fire column that ran this morning in The Star-Ledger, Julie Roginsky endorsed the idea, saying the current budget process “does not serve anyone well, including the vast majority of legislators who twiddle their thumbs in their caucus rooms while leadership negotiates behind closed doors.” [The Star-Ledger / Editorial Board]

Pets of NJPP

It’s been a while since we’ve featured Mau here, so here he is hanging out in the backyard on my new clover “lawn.” While I enjoy having my morning coffee outside with Mau, I think I’ve created a monster, because this indoor cat is looking to go outside all of the time now. Meow!

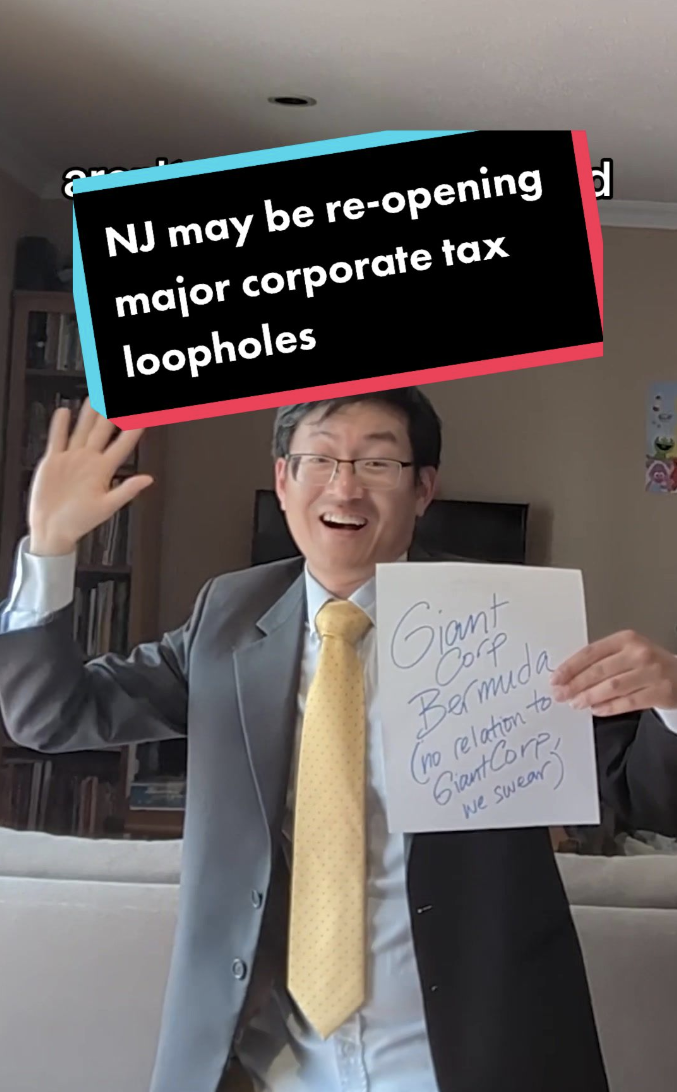

Check out our latest videos and follow us on TikTok.

Have a fact or figure for us? Tweet it to @NJPolicy.