To read a PDF version of this report, click here.

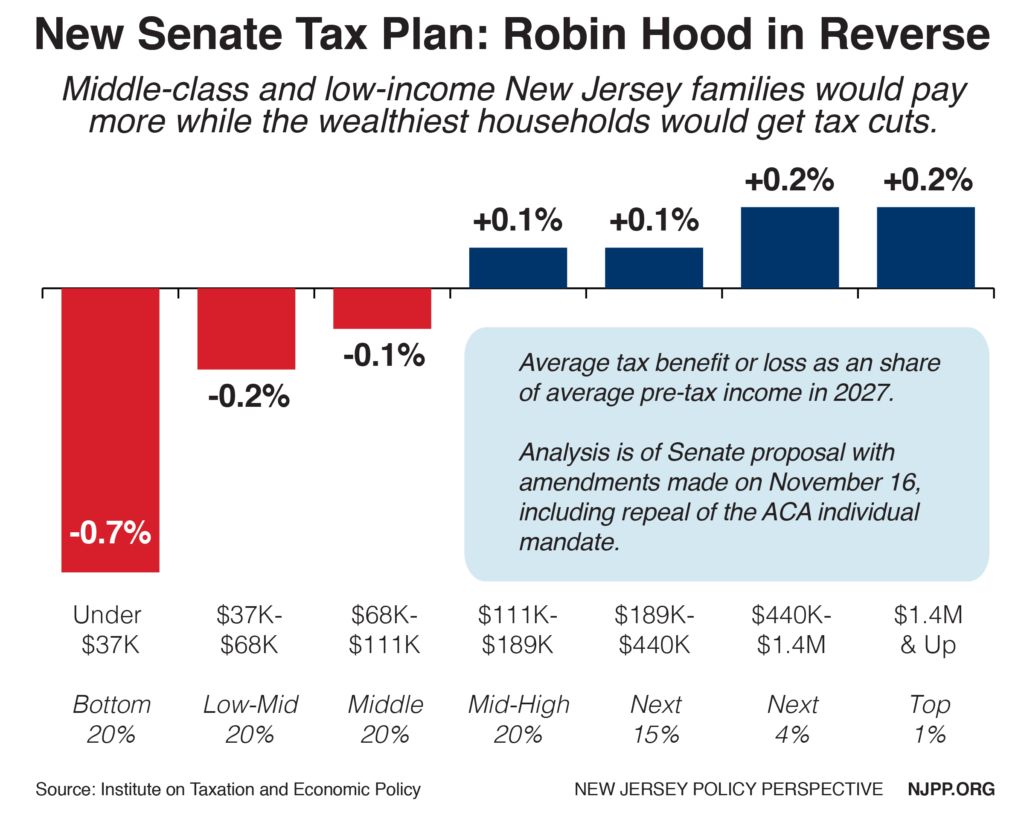

The latest Senate tax proposal, with the amendments added last Thursday, November 16, would raise taxes for the average middle-class and low-income New Jersey family while cutting taxes for wealthier families and for large corporations. Worse, it would increase the number of New Jerseyans without health insurance by 340,000 by 2027.[1] (Unless otherwise noted, all data in this Fast Facts is on the impact in the year 2027, once the plan is fully phased in.)

The proposal is noticeably worse than the original, both in its inequitable distribution – in other words, it brings more direct and immediate harm to the bottom 60 percent of families than the original bill – and in its overall impact on New Jersey: at least 29 percent of Garden State households would see a tax hike under the revised bill,[2] versus 22 percent in the original.[3]

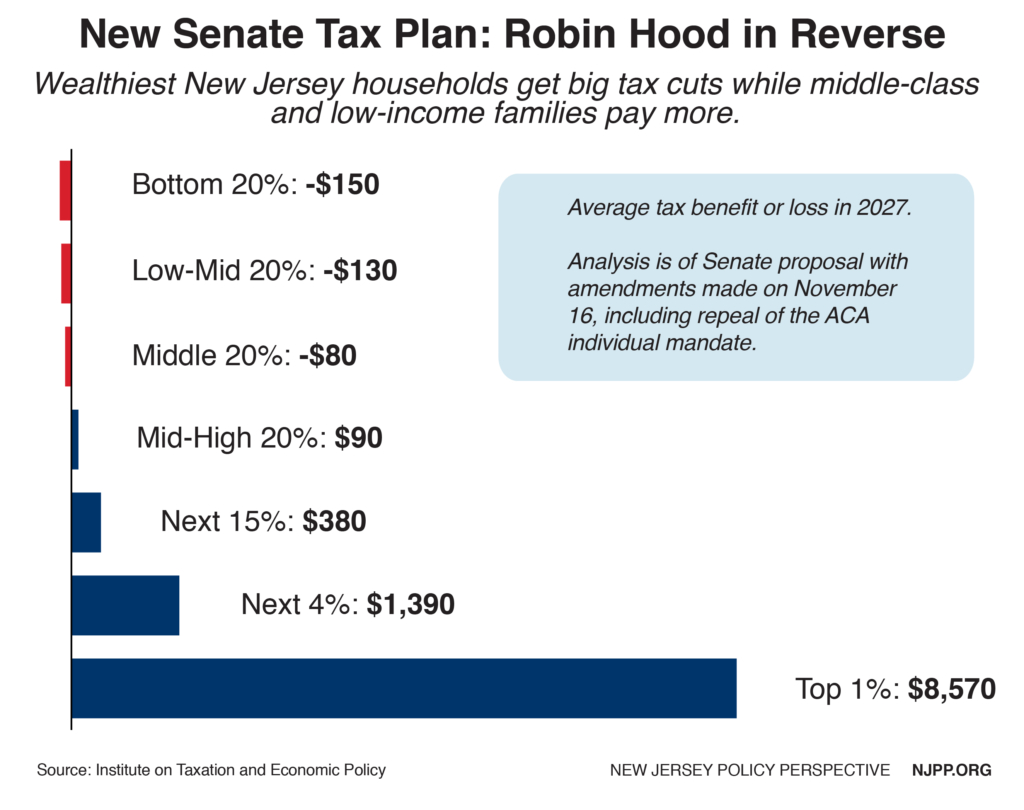

Once this plan is fully phased in, New Jersey households with incomes over $1.4 million (the top 1 percent) would receive an average $8,570 tax cut while the bulk of Garden State families (the bottom 60 percent, or those with incomes under $111,000) would see a tax hike averaging $120.

The plan is a clear example of Robin Hood in Reverse, as it gives the largest average tax hikes to New Jersey’s poorest families while showering the state’s very wealthiest families with the biggest tax cuts.[4] While just 1.6 percent of the state’s wealthiest 5 percent of families would see a tax hike, 1 in 3 families in the bottom 60 percent would.

The latest Senate proposal:

- Permanently repeals the Affordable Care Act’s individual mandate – the requirement that people get health insurance or pay a penalty – which would leave 13 million more Americans (and 340,000 New Jerseyans) uninsured, raise premiums for millions more, and create uncertainty across the health insurance market[5]

- Pairs permanent tax cuts for corporations and permanent tax hikes for many low- and moderate-income families with temporary tax cuts for most working and middle-class families[6]

- Increases the federal deficit by $1.5 trillion over a decade

- The growing deficit will be used as the excuse for major cuts in services and programs that working New Jerseyans count on

- By eliminating state and local tax deductions used by about 4 in 10 New Jersey families, it will make it harder for states to invest in schools, infrastructure, health care and more[7]

Endnotes

[1] NJPP analysis based on Congressional Budget Office estimates (see Endnote 5) using weighted average for employer-based, marketplace, and Medicaid expansion coverage.

[2] This estimate is the likely low, because it does not include the impact of the repeal of the ACA mandate.

[3] New Jersey Policy Perspective, Fast Facts: New Jersey Second Hardest Hit State Under Senate Tax Proposal, November 2017. https://www.njpp.org/budget/fast-facts-new-jersey-second-hardest-hit-state-under-senate-tax-proposal

[4] Institute on Taxation and Economic Policy Microsimulation Tax Model, November 2017. Full dataset available at https://itep.org/senatetaxplan/

[5] Congressional Budget Office, Repealing the Individual Health Insurance Mandate: An Updated Estimate, November 2017. https://www.cbo.gov/system/files/115th-congress-2017-2018/reports/53300-individualmandate.pdf

[6] Center on Budget and Policy Priorities, Senate Tax Bill Revisions Make Its Fundamental Tradeoffs – Big Tax Cuts for the Top, Little Gain for Low- and Moderate-Income Families – Even Harsher, November 2017. https://www.cbpp.org/federal-tax/commentary-senate-tax-bill-revisions-make-its-fundamental-tradeoffs-big-tax-cuts-for-the

[7] New Jersey Policy Perspective, Fast Facts: Millions of New Jerseyans Deduct Billions in State & Local Taxes Each Year, November 2017. https://www.njpp.org/budget/fast-facts-millions-of-new-jerseyans-deduct-billions-in-state-local-taxes-each-year