Expanding access to driver’s licenses to all New Jersey residents, regardless of immigration status, would make the state’s roads safer and its economy stronger. The proposal would also pay for itself by bringing in tens of millions of dollars in recurring revenue for the state’s general fund, according to an NJPP analysis of new data from the New Jersey Office of Revenue and Economic Analysis. This is a win-win for drivers, working families, and the state’s finances.

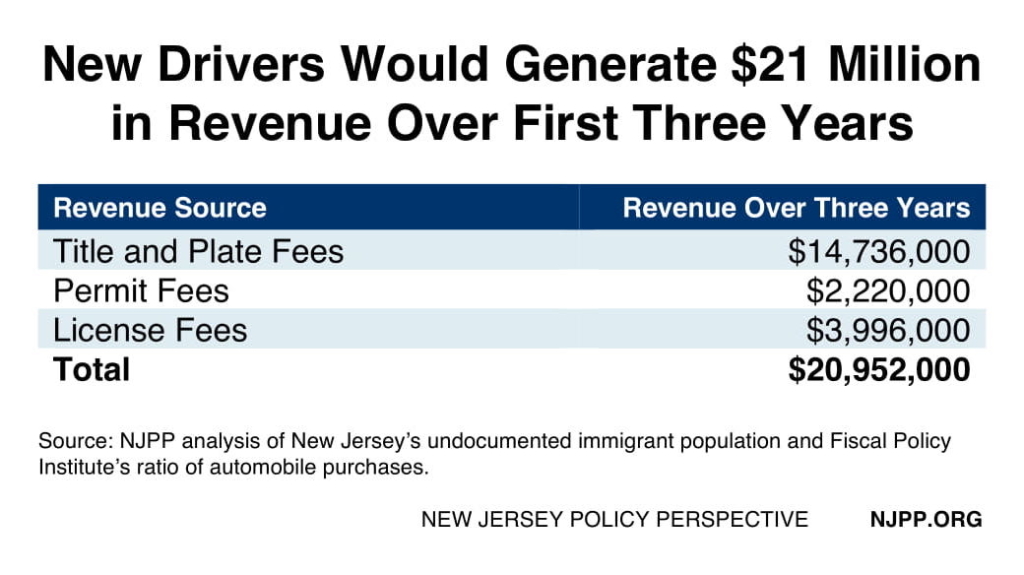

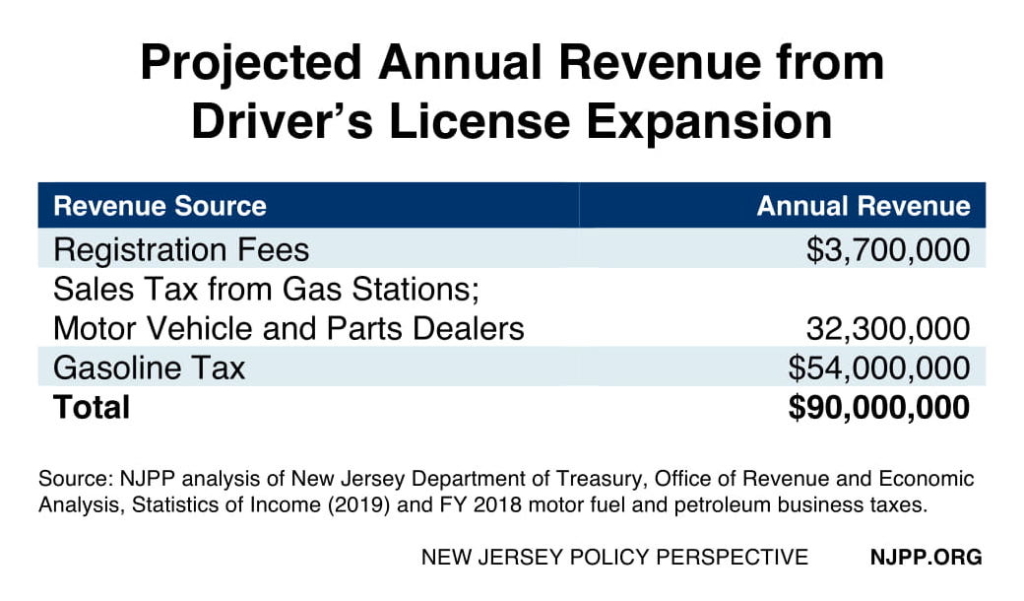

Over the first three years of implementation, driver’s license expansion is projected to generate $21 million in revenue from permit, title, and driver’s license fees. Once fully implemented, new drivers will generate $90 million annually from registration fees, the gas tax, and the sales tax on purchases made at gas stations and motor vehicle and auto parts retailers.[1]

New Jersey is one of the most diverse states in the nation and is home to approximately 484,000 undocumented residents, representing 5.4 percent of the state’s total population. Of the nearly half million undocumented residents, 91.5 percent are of driving age (16 and older). Based on the experiences of the twelve states that have already expanded access to driver’s licenses, NJPP estimates that 222,000 residents would obtain a drivers license during the first three years of implementation. This equates to a 3.5 percent increase in the total number of people in New Jersey with a driver’s license.[2]These new drivers would pay a collective $6 million in permit and license fees over the first three years of implementation.

These drivers are also estimated to purchase 80,000 cars over the same three year period, representing a three percent increase in the number of vehicles registered.[3] Title and plate fees associated with these new vehicles will generate almost $15 million in revenue.

According to NJPP’s analysis of new data from the New Jersey Treasury Department’s Office of Revenue and Economic Analysis, driver’s license expansion would also generate the state tens of millions of dollars in recurring revenue as new drivers register their vehicles and purchase gasoline as well as auto parts and associated retail goods at gas stations and auto part dealers. Using the Treasury’s data on sales taxes collected from gasoline stations and auto parts stores, combined with revenue figures from the petroleum gross receipts and motor fuels tax, NJPP projects that driver’s license expansion would generate $90 million annually in sales and gas tax revenue. Revenue from the gas tax would go directly to the Transportation Trust Fund, which currently collects 41.5 cents per gallon of gas sold. This will make the state’s gas tax collections less volatile and could lower the odds of a future gas tax increase.

In addition to making New Jersey’s roads safer and its economy stronger, expanding access to driver’s licenses would more than pay for itself, generating $90 million in tax revenue every year.

Methodology

Number of Undocumented Immigrants of Driving Age and the Number Who would obtain a driver’s license during the first three years of implementation

There are three estimates used to quantify the number of undocumented immigrants: 452,000 (Center for Migration Studies), 475,000 (Pew Hispanic Center), and 526,000 (Migration Policy Institute). The average of the three estimates is 484,000. There are two estimates for the percent of New Jersey’s undocumented immigrants who are 16 years or older: 90 percent (Center for Migration Studies) and 93 percent (Migration Policy Institute). NJPP took the average of the two numbers (91.5) and multiplied that by average number of undocumented immigrants to get the estimated number of undocumented residents who are of driving age: 444,000. We assume that New Jersey would have a high-end participation rate after three years, similar to Illinois’ rate of 47 percent. We project New Jersey’s rate will be slightly higher at 50 percent given driving is necessary to getting around the state’s sprawling suburbs. The Fiscal Policy Institute (FPI) similarly uses this take up rate in their projections for New York. Thus, we multiply the number of undocumented residents of driving age by the take up rate of 50 percent to project that approximately 222,000 undocumented immigrants who would obtain a driver’s license during the first three years of implementation.

Number of new cars on the road

To analyze new cars on the road after driver’s license expansion, NJPP projects similar automobile purchases and new licenses as FPI projected for New York. Multiplying FPI’s take-up ratio by the number of New Jersey residents that would get a driver’s license during the first three years of implementation projects 80,000 new cars. Note that new cars means new car purchases, not brand new automobiles. For more information, see: Expanding Access to Driver’s Licenses: Getting a License Without Regard to Immigration Status and Expanding Access to Driver’s Licenses: How Many Additional Cars Might Be Purchased? (http://fiscalpolicy.org/wp-content/uploads/2017/01/FPI-Additional-cars-report-2017.pdf)

Numbers for Annual Revenue

The annual revenue includes: registration fees, gas station and auto part sales tax revenue, and gas tax revenue. The projected 80,000 new cars after three years represents a 2.86 percent increase in registered cars in New Jersey. We multiplied the 2.86 percent increase to the latest figures on gas station and auto part retailer sales tax revenue and to annual gasoline purchases subject to the state gas tax (including petroleum gross receipts and motor fuels).

Revenue from the first three years of implementation

Regardless of a person’s age, first time drivers must pay a $10 dollar permit fee. NJPP multiplied this fee by 222,000, the number of estimated new drivers during the first three years of implementation. We also include revenue associated with title and license plates fees. We multiplied the one time fee of $46.50 times the number of estimated new cars, 80,000. Finally, we multiplied the number of people who would get a driver’s license during the first three years of implementation, 222,000 by $18 the price of a basic driver’s license according to Assembly bill A4743.

End Notes

[1] Does not include the revenue from sales tax of new car purchased.

[2] NJPP divided the estimated number of people who would get a license during the first three by the number of licenced drivers in NJ. Highway Statistics 2016. https://www.fhwa.dot.gov/policyinformation/statistics/2017/dl201.cfm

[3] See Methodology.