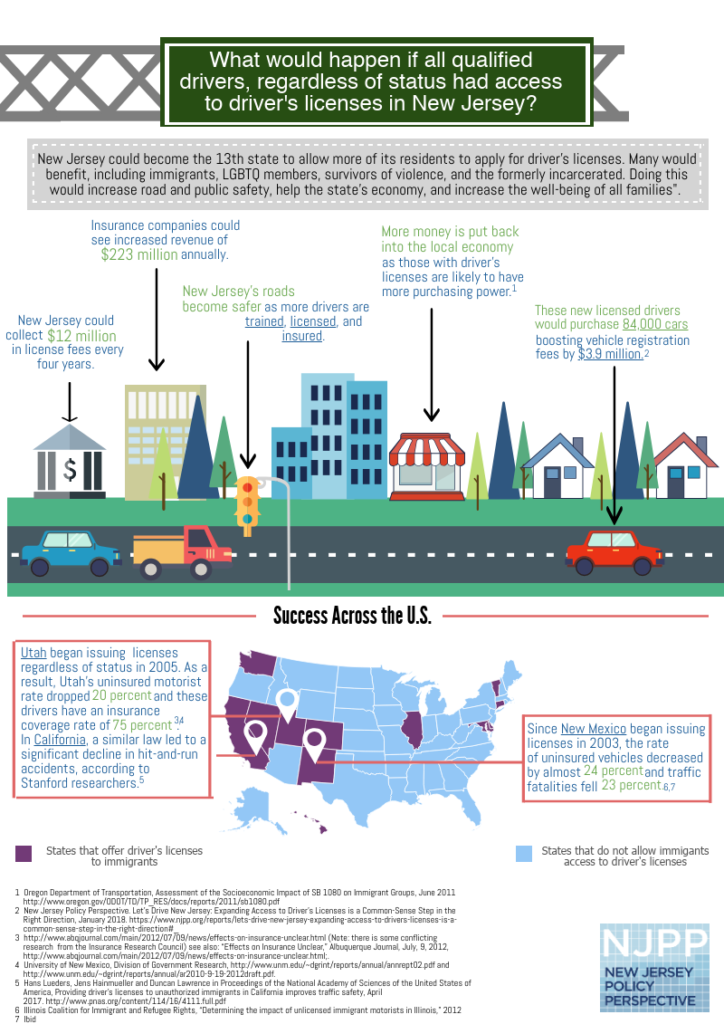

New Jersey is poised to become the 13th state in the nation to allow all residents, regardless of immigration status, to apply for a driver’s license. Doing so would increase public safety, bolster the state’s economy, and increase the well-being of all families, particularly the hundreds of thousands of New Jersey residents who would gain the right to legally drive.

How many New Jersey residents would benefit from expanded access to driver’s licenses?

There are approximately 466,000 undocumented immigrants in New Jersey who are of driving age and would be eligible for a license. Based on the experience of other states, NJPP estimates that half these eligible New Jerseyans – 233,000 – would receive a license within the first three years of implementation, a 3.8 percent increase in the total number of licensed drivers in the state. A higher number would likely apply for a license, but not everyone who applies passes the written and road tests.

Would allowing undocumented immigrants access to obtaining a driver’s license and insurance under their name increase premiums?

No. There is no evidence that undocumented immigrants obtaining a driver’s license raises premiums for the average driver. In fact, having more insured drivers who have been tested, trained, and licensed on the road would make everyone safer. Since auto insurance is compulsory in New Jersey, universal driver’s licenses would allow for thousands of drivers to obtain auto insurance coverage, thereby reducing the number of uninsured drivers, a cost that is currently borne by all insured motorists.In Utah, which has allowed undocumented immigrants to drive legally since 1999, the uninsured motorist rate dropped by 20 percent.

Do undocumented immigrants qualify for the Special Automobile Insurance Policy (SAIP), also known as the dollar-a-day auto insurance policy?

No. Undocumented immigrants do not qualify for the dollar-a-day (SAIP) auto insurance policy because they are not eligible for federal Medicaid benefits. Undocumented immigrants are barred from all social safety net programs (i.e. NJ Family Care, TANF, SNAP).

Do you need a social security number (SSN) to obtain auto insurance?

No. Insurance companies are not required by law to ask for a driver’s social security number (SSN). Insurers may ask for an SSN in their auto insurance application, but disclosing an SSN is not mandatory to obtain auto insurance.

Does auto insurance coverage or cost vary depending on the type of license you have? For example, some states have Real ID license; does it matter if you have a Real ID compliant license?

No. Having a certain kind of license does not bar individuals from certain types of insurance coverages. Also, under the current proposed expanded driver’s license legislation, insurance companies are barred from assigning anyone with the proposed provisional license to a rating plan.

Will drivers who obtain a license be vulnerable to violations of privacy if they get into an automobile accident?

Potentially. Ideally, restrictions to automobile accident reports would protect drivers from unsolicited legal notices that can mislead or scare people into thinking they need a lawyer simply because they were in an auto accident. People with provisional driver’s licenses should be confident that an auto accident does not jeopardize their privacy or subject them to unnecessary medical treatment and fraudulent activity.