Letter from the President

Dear Friends and Partners,

Now is the time for bold action. New Jersey stands at a crossroads, facing unprecedented challenges. But in every challenge lies opportunity. The policy decisions we make today — on how we address poverty, confront stark racial and gender disparities, and invest in our people — will determine whether our state continues to allow inequities to fester or chooses a path toward equity, justice, and shared prosperity.

This third edition of NJPP’s Blueprint provides a clear and urgent roadmap to guide us through this pivotal moment. The policies outlined here are designed to tackle the root causes of inequality, close the racial wealth gap, and build a stronger, fairer New Jersey. These are not just ideas for the future — they are the solutions we need now to secure economic justice for all.

When we began drafting this Blueprint earlier this year, we envisioned a different political landscape. After the 2024 federal election results, we reexamined the Blueprint to see if these policies still made sense considering our current political moment. If anything, it is abundantly clear that implementing these policies is even more urgent. The challenges before us — growing income inequality, systemic racism, underinvestment in critical infrastructure, and an uncertain national climate — are daunting. But they also provide an opportunity to unite and advance transformative change.

The stakes are incredibly high. New Jersey cannot afford to continue ignoring the disparities that harm so many of its residents and hinder our collective potential. The time to act is now. With your partnership, we can seize this moment to ensure every resident, regardless of race, gender, income, ZIP Code, or immigration status, has a fair shot at success.

Let’s get to work.

In solidarity,

Nicole Rodriguez

President, New Jersey Policy Perspective

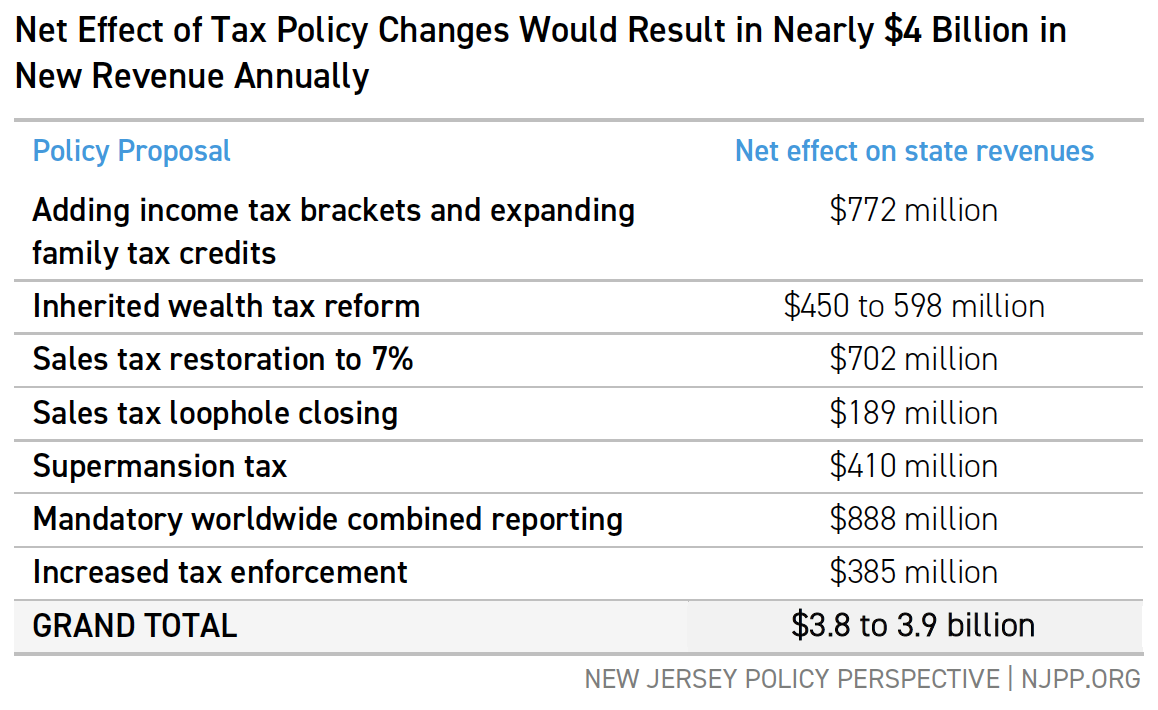

Progressive Tax Policy

The state budget is more than a financial document: It is a blueprint that reveals our collective values and priorities. As the main source of revenue, taxes directly shape the state’s ability to fund critical services like public schools and colleges, health care, mass transit, the social safety net, and public health infrastructure. For too long, New Jersey's tax system has prioritized short-term political convenience over long-term fiscal health, hampering our ability to address emergent challenges and preventing the state from making sustainable investments. To secure a more resilient future, lawmakers must focus on reforming the tax code to ensure that wealthy individuals and corporations contribute equitably. By making the tax system more progressive, we can generate the revenue needed to close structural deficits, address rising costs, and fund essential services without overburdening people and families living on low- and middle-incomes. The following priorities aim to create a fairer, more balanced tax structure to stabilize the budget, rein in racial wealth disparities, promote economic justice, and build shared prosperity across the state.

Raise Marginal Rates On Incomes Over $2 Million

In 2020, New Jersey passed a millionaires tax to improve the equality of the state's tax system by increasing taxes on over $1 million in income to 10.75 percent. In just a few short years, it has generated hundreds of millions in revenue to fund schools, essential programs, and municipal services throughout the state. Despite this major step forward, extreme wealth remains concentrated in a small number of households. To build on the success of the millionaires tax, New Jersey should introduce new tax brackets for the highest-income earners, with increased marginal rates for incomes over $2 million, $5 million, and $10 million. This change would generate $1.2 billion in revenue while affecting less than 1 percent of all households in the state.

Restore Sales Tax To 7 Percent

In 2016, as part of a deal to raise New Jersey’s gas tax to fund essential transportation projects, New Jersey implemented the first of two cuts to the state’s sales tax, ultimately lowering the rate from 7 percent to 6.625 percent. Since 2016, the change has cost the state billions of dollars in revenue while providing only minimal savings to state residents. Restoring the sales tax to 7 percent would cost most residents less than $100 a year — or $2 per week — and generate over $700 million in revenue annually.

Additionally, by removing sales tax loopholes that exempt car rentals, yacht purchases, and a range of services that cater to higher-income households and corporations, the state can generate an estimated $179 million. These reforms would generate nearly $900 million annually, which could be invested in higher education, health care, and other important services that encourage economic growth for all.

Restore The Estate Tax

As part of the same Christie-era package of cuts that rolled back the sales tax in 2016, the state eliminated its estate tax, which targeted the transfer of the overall value of the deceased person’s estate. By restoring this tax, and closing loopholes on the inheritance tax, New Jersey would help address wealth inequality by targeting transfers of wealth from already-wealthy individuals to their relatives and heirs while generating as much as $560 million in state revenue.

Force Corporations To Disclose Foreign Profits Through Combined Reporting

Corporations have dramatically increased their use of foreign tax havens like Switzerland or the Cayman Islands to avoid taxation at the state and federal levels. New Jersey needs to follow the lead of other states in adopting mandatory worldwide combined reporting, which would force corporate tax filers to disclose all of their profits — not just those generated in the United States. This simple policy change would treat profits stashed in foreign tax havens as part of the company’s overall tax base, generating an estimated $890 million for the state.

Increase The Fee On Sales Of Expensive Homes

Escalating housing costs are making life increasingly difficult for residents earning low- and middle-incomes. Even as the overall housing market has cooled, the sales of luxury homes over $1 million continues to grow across the state. Raising the realty transfer fee to 3 percent for homes over $1 million and 5 percent for homes over $2 million would generate $410 million in revenue for the state while affecting only the top 10 percent of home sales statewide.

Increase Tax Enforcement Spending

As wealthy individuals, families, and corporations find new and increasingly complex methods to avoid paying the taxes they owe, tax agencies need adequate staffing to effectively evaluate filings. Every additional auditor added to the workforce generates more than $2 million in state revenue. Unfortunately, New Jersey’s auditor workforce has shrunk by 30 percent since its peak in 2010. Restoring the capacity of a full workforce to the Garden State’s tax agency would return $340 million to the state’s budget.

For additional reading on all of these policies, refer to NJPP’s recent publication Fair and Square: Changing New Jersey’s Tax Code to Promote Equity and Fiscal Responsibility

Budget Transparency

Budgeting can and should be a democratic process, where residents have a meaningful say in how the legislature spends public money. For too long, New Jersey’s budget process has been exclusionary, with little opportunity to incorporate public feedback beyond cursory hearings, with much of the budget drafting happening behind closed doors before a rushed passage and signing. Moreover, New Jersey’s one-year budgeting process — driven heavily by executive-branch forecasts and immediate political expediency — limits the ability of the state to plan for the long term. New Jersey needs common-sense budgeting reforms to produce a budget with a reasonable opportunity for community input.

Earlier Deadlines For Gubernatorial And Legislative Budgets

New Jersey’s state constitution mandates that lawmakers must pass the budget bill before midnight on June 30th to avoid a state shutdown. However, it does not dictate a timeline for the bill to be introduced or reviewed, which means that lawmakers often wait until the last minute to produce a budget. The legislative budget should have a June 1st deadline, allowing for a minimum of 14 days of meaningful public feedback before passage and signature. This change will likely require moving the gubernatorial budget deadline up from its current end-of-February timeline.

Further reading: Peter Chen (New Jersey Policy Perspective), It’s Groundhog Day For NJ Budget Process. But It Doesn’t Have To Be This Way.(2023).

Requirement For Public Hearings After Legislative Budget

Legislative budget hearings currently take place before the budget bill is introduced in late June. This leaves no time for a public hearing and severely minimizes — or simply eliminates — the opportunity for public testimony prior to passage. It also means that there is no time for amendment beyond technical corrections. The public deserves the chance to provide meaningful feedback on the actual budget to be passed, rather than just the governor’s preliminary budget.

Further reading: Peter Chen (New Jersey Policy Perspective), It’s Groundhog Day For NJ Budget Process. But It Doesn’t Have To Be This Way. (2023).

Post Budget Resolutions Before Hearing

Unlike with all other legislation, lawmakers are not required to disclose the changes to spending items they added to the budget bill prior to passage. Furthermore, the identity of sponsors only becomes known after the budget has passed, removing any opportunity for public accountability when the budget can still be changed. In fact, the only reason these changes ever become public is due to internal legislative rules, not a statute. Lawmakers can enhance transparency in the budget process by requiring all budget resolutions to be disclosed at the legislative budget deadline.

Further reading: Peter Chen (New Jersey Policy Perspective), It’s Groundhog Day For NJ Budget Process. But It Doesn’t Have To Be This Way. (2023).

Adopt Consensus Forecasting To Promote More Accurate Budgeting

New Jersey’s state budget is written every year based on revenue certifications by the executive branch. Because the state can only spend what revenue it has, an overly optimistic estimate from the governor’s office can hide potential budget deficits while a pessimistic one may force unnecessary cuts to service. New Jersey should join other states in adopting an open consensus forecasting process where legislative and executive branches jointly develop a forecast to guide budgeting. This will help reduce political gridlock, increase confidence in the revenue estimate’s value, and avoid situations where erroneous budget forecasts cause spending increases or cuts.

Further reading: New Jersey Policy Perspective, Tools for Building a Healthy Budget. (2021).

Adopt Multiyear Budget Forecasting To Avoid One-Year Gimmicks

New Jersey’s budget woes often stem from relying on one-year cash infusions or short-term gimmicks to patch deficits without a long-term plan to sustain revenues or manage growth in program costs. Looking instead to multiyear revenue and expenditure projections could help New Jersey identify potential funding cliffs or program growth that requires revenue adjustment in the current budget while reducing reliance on one-off revenue items.

Further reading: New Jersey Policy Perspective, Tools for Building a Healthy Budget. (2021).

Strengthen The State’s Surplus And Rainy Day Fund

Over the last seven years, New Jersey has clawed back from the brink of financial disaster, earning multiple credit rating upgrades and putting the state on stronger financial footing than it has been since the 1990s. However, current budgets are putting the state back on a path of structural deficits and threatening to undercut the state’s overall fiscal health. The surplus revenue fund, known colloquially as the “rainy day fund,” is composed of revenue from better-than-expected tax collections held in reserve to help protect the state budget against unexpected economic downturns. By strengthening requirements to invest in the surplus revenue fund, and considering constitutional protections for these critical reserves, New Jersey will be better positioned to weather future crises.

Further reading: New Jersey Policy Perspective, Tools for Building a Healthy Budget. (2021).

Affordability and Economic Security

New Jersey residents face significant barriers to making ends meet, such as skyrocketing childcare costs, food insecurity, and insufficient income from retirement savings. Even in one of the wealthiest states in the nation, income inequality is on the rise, and more than 1 in 8 children live in poverty. Women — predominantly Black, Hispanic/Latinx, and immigrant women — are more likely to be burdened by economic insecurity because of gender- and race-based pay gaps and unpaid caregiving responsibilities. The following are targeted state policies that can reverse these pervasive barriers to well-being, help families get out — and stay out — of poverty, and improve affordability for all residents by putting cash back in people’s pockets.

Expand The Child Tax Credit To $2,000 And Extend The Age Range To 6-11

In 2022, New Jersey became the seventh state to enact a refundable state-level Child Tax Credit (CTC) to help families meet the high costs of raising kids. Today, the state’s CTC directs millions of dollars to families living on low- and middle-incomes with a child under age 6 to help cover the high costs of raising children. By increasing the age range to include children ages 6-11 and boosting the benefit amount for children under the age of 6 from $500 to $1,000, this important program would reach hundreds of thousands more children and families and provide support for children later in life.

Further reading: New Jersey Policy Perspective, How an Expanded Child Tax Credit Would Help More Hard-Working New Jersey Families (2023).

Expand The Earned Income Tax Credit To 50 Percent Of The Federal Credit And Open Eligibility To All Tax Filers

The New Jersey Earned Income Tax Credit (EITC) helps individuals and families earning low- and middle-incomes across the state make ends meet, by boosting their income and helping them and their families better afford basic needs like rent, groceries, and school supplies. Increasing the credit from 40 to 50 percent of the federal credit would help those workers stretch their paychecks even further. Unfortunately, many workers, especially those without Social Security Numbers, are currently excluded from the program. The state should also include all income tax filers in the program including those with an Individual Tax Identification Number, and end the practice of excluding income tax filers who do not have a Social Security Number.

Further reading: New Jersey Policy Perspective, Building a More Immigrant Inclusive Tax Code: Expanding the EITC to ITIN Filers (2020).

Expand The WorkFirst New Jersey Grant Amount And Reduce Administrative Red Tape

A robust social safety net for New Jersey requires supporting the families earning the lowest incomes who have the hardest time paying the state’s high cost of living. The WorkFirst New Jersey/TANF grant amount hasn't kept up with inflation, and falls short of covering the cost of raising a family, at a mere $559 a month for a family of 3. The state must raise its benefit amount to at least 50 percent of the federal poverty level, while also lowering administrative barriers to application and documentation, smoothing program off-ramps, and getting more money to children by improving eligibility levels.

Further reading: New Jersey Policy Perspective, Outdated and Ineffective: Why New Jersey Needs to Update Its Top Anti-Poverty Program (2024).

Develop Feasibility Study On Reparations Programs And Payments

New Jersey’s severe racial wealth gap rests on a legacy of slavery. Centuries of discriminatory policies across labor, housing, and education have hobbled families’ ability to build generational wealth and stability. In 2019, members of the Legislative Black Caucus proposed a bill to create a task force on reparations for Black residents, which has stalled in the legislature. In response, the New Jersey Institute for Social Justice convened the New Jersey Reparations Council, a first-of-its-kind commission bringing together experts from an array of disciplines to confront the legacy of racism and slavery in the Garden State. New Jersey should adopt the recommendations of the New Jersey Reparations Council when they are released in 2025.

Further reading: New Jersey Reparations Council One-Page Factsheet (2023).

Improve SNAP Administration Funding And Increase Minimum Benefits

Residents trying to access nutritional benefits often report obstacles, including difficulties with phone systems, slow online portals, and language barriers. The state should increase administrative funding for the Supplemental Nutrition Assistance Program (SNAP) to reduce these challenges and ensure adequate support for applicants at county offices. Additionally, the state should increase its minimum SNAP benefit, which currently stands at $95, to more accurately reflect food costs.

Further reading: Hunger Free New Jersey, Boosting NJ SNAP: Eliminating Barriers to Participation (2021).

Implement Universal School Meals Statewide

The state has expanded free school meal access to more than 500,000 students, but nearly 1 million children are still missing out on free meals, with families going into debt simply to cover meal costs. Universal school meals help kids get the nutrition they need to learn, assist families in reducing grocery and food spending, and reduce the administrative burden on schools and families. New Jersey should join the 8 states that already cover the cost of school meals for all children.

Further reading: Food Research and Action Center, The Case for Healthy School Meals for All (2021).; NJ Spotlight News, NJ Schools Prepare to Feed 60,000 More Students Starting in September (2024).

Create A Baby Bonds Program To Close The Wealth Gap

Young people from wealthier households have a leg up when paying for higher education, buying a first home, or starting a business. A baby bonds program could be a powerful tool to help offset disadvantages caused by a lack of generational wealth. Investing in special savings accounts for children born into families eligible for New Jersey FamilyCare (the state’s Medicaid and Children’s Health Insurance Program) could help build wealth for these families once the child turns 18. By creating these special accounts and regularly investing additional funds into them, New Jersey can help correct for the lack of generational wealth in households with low incomes.

Further reading: New Jersey Institute for Social Justice, Funding New Jersey’s Future with Baby Bonds (2023).

Equity in Education and Child Care

Strong public schools and affordable child care are essential to New Jersey's communities, helping children thrive during their formative years. Thanks to decades of substantial investments in education, the state boasts the highest-ranked public school system, and, as a result, a well-educated workforce. Despite this, New Jersey’s public schools face deep segregation and a legacy of leaving many students from families earning low incomes and students of color behind. Rising child care costs further strain families, widening the opportunity gap and making it harder for working parents to get ahead. To ensure every child, regardless of ZIP code or district, has access to quality education and care, New Jersey must better support students and families, building a stronger, more equitable economy for all. The focused investments that follow will uplift children and strengthen the state's future prosperity.

Revamp School Funding Formula To Reflect Real Cost Of Educating Children

State funding for schools in New Jersey relies on a formula set nearly two decades ago. The formula has remained static, despite more rigorous educational standards and a better understanding of the real cost of educating children — particularly those with special needs, who are English Language Learners, or whose families live on low wages. New Jersey must revisit its school funding formula to continue its successful direction of critical state funding to the districts that need it most while aligning the formula with the real cost of providing an education that meets the state’s educational standards.

Further reading: New Jersey Policy Perspective, Unlocking Academic Success: Revitalizing New Jersey’s School Funding Formula for Student Achievement (2023).

Expand State Funding And Resident Eligibility For The Child Care Assistance Program

New Jersey families face enormous challenges finding affordable, high-quality child care, even as child care workers continue to grapple with low wages. Increasing reimbursement rates for child care providers and expanding eligibility for the child care assistance program would help better meet the true cost of child care, ease the burden on working families, and enable providers to compensate workers fairly. It’s beyond time for substantial state investment in this vital piece of children’s educational lives and in keeping families in the workforce.

Further reading: Center for American Progress, How to Expand Access to Affordable, High-Quality Child Care and Preschool (2023).

Continue Preschool Expansion To All Children In Households With Low Incomes

New Jersey’s gold-standard full-day preschool program has expanded and now reaches nearly 80,000 children statewide. High-quality preschool lays the foundation for a lifetime of educational success, but many students from households earning low incomes still have no access to the free pre-K through their school district. To help ensure that all children have equal access to quality early childhood education, New Jersey should continue its expansion with a focus on children in families living on low incomes who would most benefit from pre-K access.

Further reading: National Institute for Early Education Research, State of Preschool Yearbook 2023: New Jersey State Profile (2024).; New Jersey Department of Education, School Performance Reports: Statewide Report 2022-2023 (2024).

Labor and Workplace Protections

New Jersey thrives when all workers receive fair pay, work in safe environments, and can access essential benefits like paid family and sick leave. While the state is known for strong labor policies, it must do more to extend these protections to workers earning low-wages, who are disproportionately Black and Hispanic/Latinx. These workers often face unsafe jobs and low wages due to systemic racism, including discriminatory hiring practices and wage gaps. As wages stagnate while productivity rises, many families still struggle to meet basic needs. The following policies would strengthen state labor protections, ensure better workplace safety, and guarantee fairer pay.

Raise The Minimum Wage To $20 And Eliminate Exemptions

In 2024, New Jersey reached a historic milestone as the state’s minimum wage officially increased to $15 for most workers and will continue to grow year on year with inflation. This is a huge step in improving the quality of life for hundreds of thousands of workers, boosting their pay to support themselves and their families. Yet the minimum wage’s purchasing power still lags because $15 in April 2018 would be worth nearly $19 today. Unfortunately, not all workers are covered by the minimum wage. The statute has carve outs for tipped workers, farmworkers, seasonal workers, and minors. These are the same workers earning some of the lowest wages and who are disproportionately people of color. Increasing the minimum wage and ending these exemptions would reduce income inequality and improve the quality of life for New Jersey’s families.

Further reading: New Jersey Policy Perspective, Raising the Minimum Wage to $15 is Critical to Growing New Jersey's Economy, (2018).

Enhance Paid Leave Insurance And Job Protections

Ensuring that all of New Jersey’s workers can take leave from work when facing illness, injury, or the demands of family caretaking is critical to employees’ ability to stay in the workforce. No worker in New Jersey should fear the loss of their job or wages for taking time to bond with their child or care for their loved one. Although New Jersey’s expanded paid family leave program was one of the nation’s first, other states have since passed versions that protect more workers and provide more generous benefits. New Jersey should also ensure that employers cannot fire workers for taking leave by expanding job protections to all eligible workers regardless of the size of their employer or the length of time they have been employed.

Further reading: Rutgers Center for Women and Work, An Update on Job Protection Gaps Under the New Jersey Family Leave Act. (2024).

Increase Enforcement For Labor And Employment Law

Strong labor laws are only as effective as their enforcement. New Jersey’s capacity to enforce labor laws has not kept pace with the increasing size of the workforce, hampering the state’s ability to protect its workers from wage theft and safety hazards. Since 2005, the number of residents and workers in the Garden State has grown substantially, but the number of staff dedicated to addressing workplace standards has decreased. New Jersey should expand the workforce for the Department of Labor and Workforce Development and the Attorney General to enable them to investigate employers, respond to thousands of workplace complaints promptly, and ensure that workers know their rights and feel safe reporting violations.

Further reading: Economic Policy Institute, Worker Protection Agencies Need More Funding To Enforce Labor Laws And Protect Workers. (2021).

Expand Workplace Safety Protections, Especially Heat

People who face unsafe work conditions often have little recourse and are forced to choose between their well-being and their income. Worker safety laws need updating to meet the contemporary needs of New Jersey’s workforce. As the climate warms, workers need special protections from heat-related illness including clear heat standards for employers. The rapid expansion of New Jersey’s warehousing sector requires additional regulation on quotas and work speed requirements. New Jersey must enhance workplace safety standards to protect all workers.

Further reading: New Jersey Monitor, Amid Heat Wave, Labor Groups Urge N.J. To Enact Protections For Outdoor Workers. (2024).

Health

All Garden State residents deserve to live fulfilling lives free from the constant worry of whether they can afford medical care. Yet, the high cost of health care creates significant financial stress for many New Jerseyans. From primary care visits to prescriptions to hospital stays, gaps in coverage and high out-of-pocket costs prevent people from seeking the care they need. Historical and ongoing racism, along with xenophobia, have disproportionately limited access to affordable insurance for Black, Hispanic/Latinx, and Indigenous populations, further compounding health inequities.Without affordable and comprehensive coverage, many must choose between paying for medical care or other necessities like rent and groceries. The following proposals would ensure that all residents have access to care by expanding affordable coverage options, limiting cost-sharing for essential care, and improving data transparency in the health care system.

Expand Medicaid Coverage To All Residents, Regardless Of Immigration Status

New Jersey’s life-changing Cover All Kids program, which increased outreach efforts and opened New Jersey FamilyCare (the state’s Medicaid and Children’s Health Insurance Program) to all kids regardless of immigration status, has helped tens of thousands of previously uninsured children access affordable coverage. Having coverage means better access to care and improved health outcomes. Expanding this program so that all income-eligible adults, regardless of immigration status, also have access to affordable, quality coverage through NJ FamilyCare would improve consistency of coverage and care options for families and reduce health inequities across the Garden State.

Further reading: NJ Spotlight News, Big Enrollment Of Undocumented Kids In NJ Health Insurance Program. (2023).; New Jersey Department of Human Services, Cover All Kids. (accessed 2024).

Create A Public Coverage Option Open To All Residents, Regardless Of Immigration Status

A variety of obstacles stand between many New Jersey residents and affordable health care coverage. Some residents do not have access to affordable options due to immigration status. Others who do have access to existing options like their employers or the state health insurance marketplace, GetCoveredNJ, still face high financial barriers in the form of cost-sharing. Historically, government-backed programs like Medicare have shown much greater success in controlling those costs than plans in the commercial market. Creating a government-backed health insurance option would help provide more options for residents, and allow the state to open the option for a wider range of residents.

Further reading: The State of New Jersey, Health Care Cost Growth Benchmark Report: Pre-Benchmark Year (2018–2019). (2024).; The State of New Jersey, Health Care Spending Trends for New Jersey Residents with Commercial Insurance, 2016–2021. (2024).; The Commonwealth Fund, State Public Option Plans Are Making Progress on Reducing Consumer Costs. (2023).

Establish an All-Payer Claims Database

Transparent data collection and analysis are critical in understanding trends in affordability and utilization of health care services so policymakers can make informed decisions. New Jersey lags behind several other states that have taken steps to improve access to health care data and regularly examine trends with statewide All-Payer Claims Databases (APCD). Establishing an APCD with more transparent, publicly available data is necessary for robust analysis of health inequities and improved policy recommendations to contain costs and expand coverage.

Further reading: APCD Council, State Efforts. (accessed 2024).; New Jersey Department of Banking and Insurance, New Jersey Affordability Standards Report. (2024).

Eliminate Financial Barriers To Reproductive Care, Including Abortion

Attacks on reproductive care, and particularly abortion, have threatened access to life-saving health care for people across the United States. While New Jersey has taken steps to protect this care, more can be done to improve affordability and accessibility for residents of the Garden State. Financial barriers due to lack of coverage and underinsurance (high cost-sharing) make it difficult for those seeking care to afford it, limiting their ability to access vital services. Removing these financial barriers by eliminating cost-sharing for services and ensuring parity across state coverage programs, regardless of immigration status, would help reduce major obstacles and guarantee the continued protection of rights to care.

Further reading: New Jersey Policy Perspective, What The Dobbs Decision Means for Abortion Rights in New Jersey and Beyond. (2022).

Empower The Prescription Drug Affordability Council And Office Of Health Care Affordability And Transparency To Address Rising Health Care Costs

The crisis of rising costs in health care has left all New Jerseyans with greater financial uncertainty and instability — especially families struggling to make ends meet, those facing accidents or chronic conditions, and those historically left out of the health system due to racism and xenophobia. Two recently established institutions, the state Prescription Drug Affordability Council (PDAC) and the Office of Health Care Affordability and Transparency (OHCAT), are tasked with better understanding these rising costs and exploring policy recommendations to address them. Ensuring they have adequate funding, codifying OHCAT, and equipping the PDAC to make recommendations that align with other prescription drug boards such as price caps, would help cement New Jersey’s legacy of progress.

Further reading: New Jersey Department of Banking and Insurance, New Jersey Affordability Standards Report. (2024).; The State of New Jersey, The Health Care Landscape in New Jersey: Select Indicators of Quality, Access, and Affordability. (2024).; New Jersey Policy Perspective, The Best Medicine: How the Drug Affordability Council Can Advance Future Drug Pricing Reforms in New Jersey. (2023).

Environment

New Jersey’s families deserve clean air, clean water, and access to green spaces, but stronger storms, rising air pollution, and dangerous flooding increasingly threaten our communities. As a coastal state, New Jersey is on the front lines of the climate crisis, and the harmful effects of environmental policy failures disproportionately impact communities which earn low incomes and communities of color, a phenomenon known as environmental racism. These communities are often burdened with higher pollution levels and greater exposure to environmental hazards due to discriminatory policies and practices. The following policies address these injustices, reduce fossil fuel use, and prioritize climate mitigation and resilience efforts to protect residents, especially those most vulnerable.

Codify 100 Percent Clean Energy Standard And Begin The Rulemaking Process

New Jersey’s overreliance on fossil fuels and the resulting pollution has led to widespread public health and environmental problems, especially in overburdened communities. Transitioning the state’s energy consumption to 100 percent clean energy will reduce air and water pollution, increase demand for green jobs, and create safer and healthier communities for all New Jerseyans. Ensuring that a significant portion of that energy is generated in-state through solar and wind power will also help boost local communities' economic well-being, and make New Jersey a leader in the new, green economy.

Further reading: NorthJersey.com, It’s High Time For New Jersey To Lead And Adopt A 100% Clean Energy Standard. (2024).

End Or Reverse Highway Expansion Projects

Despite New Jersey’s existing mandates to reduce greenhouse gas emissions, lawmakers continue to propose highway expansions, many of which are near overburdened communities that already suffer disproportionately from air pollution. Induced demand will inevitably increase both traffic congestion and greenhouse gas emissions — even with the projected transition to electric vehicles. Instead of spending money to expand highways, New Jersey needs to expand transit and greener transportation alternatives.

Further reading: Corey Hannigan (Tri-State Transportation Campaign), Stop Phil Murphy’s Brazen Turnpike Widening Trap. (2024).

Create Dedicated Funding For Climate Resilience And Begin The Rulemaking Process

As a densely populated coastal state, New Jersey faces unique challenges from the climate crisis. Yet it remains one of the only states on the eastern seaboard without dedicated funding for climate initiatives such as managed retreat plans for moving people and infrastructure away from flood zones, flood mitigation, and coastal resilience. New Jersey should create a fund similar to New York’s to dedicate funding to climate resilience, equipping the state with the necessary tools to face future challenges.

Further reading: New York State, Clean Water, Clean Air and Green Jobs Environmental Bond Act. (accessed 2024).

Approve Utility Incentives For Medium And Heavy Duty (MHDV) Charging Infrastructure

Electrifying truck fleets is critical to improving public health, particularly in communities near major corridors and port areas where trucks are the heaviest polluters. The New Jersey Board of Public Utilities (BPU) can speed up the timeline for electrification by starting the utility filing process and approving incentives to help utilities recover the cost of installing charging stations for medium and heavy-duty vehicles. While BPU has taken significant steps in past years, it has not yet approved any incentives, delaying New Jersey’s transition to electric.

Further reading: Environmental Defense Fund, After A Worrisome Delay, New Jersey Regulators Are Making Real Progress On Electric Truck Charging Infrastructure. (2023).

Transportation

The transportation sector is the number one contributor to greenhouse gas emissions and air pollution in New Jersey. Additionally, New Jersey ranks as one of the most dangerous places to be a pedestrian. By prioritizing highways and cars, lawmakers exacerbate both of these problems, increasing traffic deaths and worsening air quality. The state took a huge step forward in creating the Corporate Transit Fee, finally giving NJ Transit dedicated funding for the first time in history. However, that funding is set to sunset by FY 2029, and there is no guarantee the legislature will not raid the funds for other purposes. The state should focus on providing accessible and affordable transportation alternatives to promote a safer and healthier future for all.

Pilot A Fair Fares Program For Riders With Low Incomes

Public transit is an essential service that millions of New Jerseyans rely on to get to school, to work, and to live their lives. Higher fares can put public transit out of reach for many residents. Transit riders tend to make lower wages than their car-owning counterparts, and are far more likely to be Black, Hispanic/Latinx, and Asian-American. Piloting a Fair Fares program to offer reduced fares for New Jerseyans with lower incomes will make public transit more affordable and accessible for those who need it the most.

Further reading: Community Service Society, When You Can’t Afford the Fare: How Expanding Fair Fares Can Help Working New Yorkers as Transit Hardships Persist. (2024).; New Jersey Policy Perspective, Getting Back on Track: Fully Fund NJ Transit by Taxing Big Corporations. (2023).

Set Statewide Goal To Reduce Per Capita Vehicle Miles Traveled (VMT) 10 Percent By 2035 And 20 Percent By 2050

Driving less reduces air pollution and greenhouse gas emissions and improves public health and safety. New Jersey should set a goal to reduce how much people drive while also gathering VMT data from Motor Vehicle Commission odometer readings. It’s important to know where and why people drive so the state can work towards infrastructure that supports alternative transportation such as walking, biking, and mass transit. Setting the goal to reduce VMT is the first step towards a safer and healthier New Jersey.

Further reading: New Jersey Future, We Need a Better Way of Measuring How Much People Drive—And Why. (2022).

Provide Steady Funding For NJ Transit Bus Electrification

Diesel buses pose serious health risks to communities, especially in environmental justice communities where families are suffering under years of harmful pollution. New Jersey mandates that all new bus purchases be zero-emission by 2032. However, it does not have a sustainable source of funding, relying instead on one-off appropriations and federal funding. Dedicating the Clean Energy Fund raids for electrification purposes would be a major first step, however the agency needs steady and adequate funding to meet the mandate on electric bus purchases.

Further reading: New Jersey Policy Perspective, Roadmap to Electrifying New Jersey’s Public Bus Fleet. (2021).; New Jersey Policy Perspective, Stop the Raids: The Clean Energy Fund Should Fund Clean Energy. (2023).

Set A Statewide Vision Zero Goal

New Jersey has an epidemic of traffic fatalities — all of which are entirely preventable. In 2012, Congress passed a law requiring states to set a safety performance target for people who are killed or seriously injured while biking or walking. While most states chose to set goals aimed at reducing the number of individuals harmed, New Jersey was one of the only states to increase the number of allowable deaths, setting a 2024 target higher than the number of people killed or injured in 2022. Vision Zero is a multidisciplinary approach that brings together local traffic planners, policymakers, and public health professionals to create a strategy to eliminate traffic fatalities and make roads safer for all users. Adopting a statewide Vision Zero goal to reduce traffic deaths is the first step to calming traffic and prioritizing the safety of everyone on the road.

Further reading: Smart Growth America. Dangerous By Design. (2024).

Public Safety

An equitable legal system should ensure safety without fear or violence. Over-policing and mass incarceration have long harmed the social and emotional well-being of communities, especially those of color. Building a more equitable New Jersey requires shifting resources from punitive systems to meaningful community investment. By fostering transparency and accountability in law enforcement and ending abusive policing practices, communities can develop systems that center anti-racist decision-making, reduce over-policing, and ensure true equity for low-income, immigrant, and vulnerable communities. The following proposals are essential for moving New Jersey forward.

Create Civilian Oversight Boards

Civilian oversight boards, or civilian complaint review boards (CCRBs), review the policies, practices, and actions of local police departments and officers, shifting power from law enforcement to the communities most affected by abusive policing. To operate effectively, these boards must have broad investigatory authority, adequate funding, and the power to suspend or remove officers. To build community trust and buy-in, they should include diverse community members, advocates, and those with experience in the carceral system. By establishing CCRBs statewide and fully empowering them to do their important work, New Jersey can hold police accountable, increase transparency, and rebuild trust between citizens and law enforcement. Newark has already led the way, and it’s time for the rest of New Jersey to follow.

Further reading: American Civil Liberties Union - New Jersey, Strong Civilian Complaint Review Boards. (2024).

Increase Transparency For Police Misconduct Records

New Jersey is one of 23 states that keeps police misconduct records confidential, limiting access even to defendants in cases involving the officers. This secrecy hides disciplinary actions, preventing juries and the public from assessing officers' credibility, and fostering mistrust in law enforcement. While New Jersey now requires police to be licensed, publicizing misconduct records would further ensure transparency and accountability, helping prevent dangerous officers from continuing to serve. Public access would also build trust between communities and law enforcement by reducing secrecy around officer misconduct.

Further reading: NJ Spotlight News. Concerns Remain Over OPRA Bill’s Effect On Police Accountability. (2024).WNYC, Is Police Misconduct a Secret in Your State? (accessed 2024).; Rules Governing the State Courts of New Jersey (accessed 2024).

Replace Civil Forfeiture with Criminal Forfeiture

Civil forfeiture allows police to seize cash or property from individuals suspected of crimes, even without charges. In New Jersey, police can keep, and later sell, 100 percent of the confiscated assets, with low thresholds: anything over $1,000 in cash or $10,000 in property can be kept, even without a conviction. Assets below this require costly claims to recover. These policies incentivize abuse of power and disproportionately affect people of color. By replacing civil forfeiture with criminal forfeiture, New Jersey would shift the burden of proof from the individual to the state, requiring a conviction in all cases and reducing conflicts of interest. To further curb potential abuses, New Jersey should follow the lead of 13 states and the District of Columbia, and redirect forfeiture funds to the general state budget rather than leaving them in the control of local police departments.

Further reading: Institute for Justice, Policing for Profit: The Abuse of Civil Asset Forfeiture. (2020).; Forbes, New Jersey is Now the 16th State to Require Convictions for Civil Forfeiture. (2020). Institute for Justice, Civil Forfeiture on the State Level. (accessed 2024).

Eliminate Excessive Criminal Legal System Fines and Fees

Excessive fines and fees in New Jersey's criminal legal system burden individuals and families with low incomes, trapping them in cycles of debt and incarceration. These costs include steep court fees, many of which are mandatory and unrelated to the crime a person is charged with, municipal counsel fees, and high prison telecommunication rates. These punitive practices disproportionately affect communities with low incomes and people of color, making it harder for families to stay connected and for people to rebuild their lives after incarceration. Ending these punitive financial penalties would promote fairness, reduce recidivism, and allow those caught up in the justice system to focus on rehabilitation.

Further reading: National Center for Access to Justice, Fines and Fees Index: New Jersey. (2022).

End Criminalization of Children

Incarcerating children is harmful, separating them from critical support and causing lifelong trauma. New Jersey operates three juvenile “secure facilities” that function like adult prisons, using solitary confinement ("room restriction") for up to 24 hours a day. While New Jersey has reduced youth incarceration and implemented alternatives, it must close youth prisons, end the practice of trying juveniles as adults, and adopt a restorative justice model. This approach should provide community services and support, helping young people thrive outside the criminal legal system.

Further reading: Ashanti Jones (New Jersey Institute for Social Justice). Shut Down N.J.’s Juvenile Detention Centers And Stop Traumatizing Our Children. (2023).; State of New Jersey Juvenile Justice Commission, Room Restriction Statistical Report. (2022).

Decriminalize Drugs

New Jersey’s drug laws criminalize addiction, disproportionately affecting residents earning low incomes and communities of color, and populating prisons with people who committed nonviolent offenses. Between 2017 and 2022, the most common offenses charged were drug-related. Decriminalizing drugs would treat substance use as a public health issue rather than a criminal one, focusing on rehabilitation and harm reduction. This approach reduces overdose deaths, cuts down on mass incarceration, and provides individuals with the support they need to recover. By decriminalizing drugs, New Jersey can create a more compassionate and effective system that prioritizes treatment over punishment.

Further reading: New Jersey Policy Perspective, A War On Us: How Much New Jersey Spends Enforcing the War on Drugs. (2021).; NJ Monitor, New Public Database Sheds Light on Who Gets Arrested in New Jersey, and Why. (2023).

Protect the Privacy of Immigrant Families

Parents should trust that their children can use public services like schools and healthcare without fear of family separation. However, recent reports reveal that ICE is exploiting loopholes to access sensitive data from schools, libraries, and doctors' offices, leading to family separation. This is especially harmful in New Jersey, where nearly half a million children live with at least one non-citizen parent. New Jersey should close the loopholes in the Immigrant Trust Directive, limit data sharing with federal immigration authorities, and protect families’ privacy, ensuring equal access to services without fear of deportation, discrimination, or surveillance.

Further reading: New Jersey Policy Perspective, Combating Surveillance and Protecting Privacy. (2023).