On the night of June 27, the New Jersey Assembly – at the urging of Gov. Christie – approved a bill sight unseen to cut the sales tax by 14 percent.

With New Jersey in such dire financial condition that it cannot meet past, current or future obligations, it is simply reckless to forego up to $1.7 billion in sales tax collections as a trade-off for replenishing the Transportation Trust Fund. If enacted, New Jersey’s credit rating – already the second lowest in the nation – would very likely be downgraded, significantly driving up borrowing costs.

The sales tax is the largest funding source for the general budget so a cut of this magnitude would blow a lethal hole in an already sinking ship.

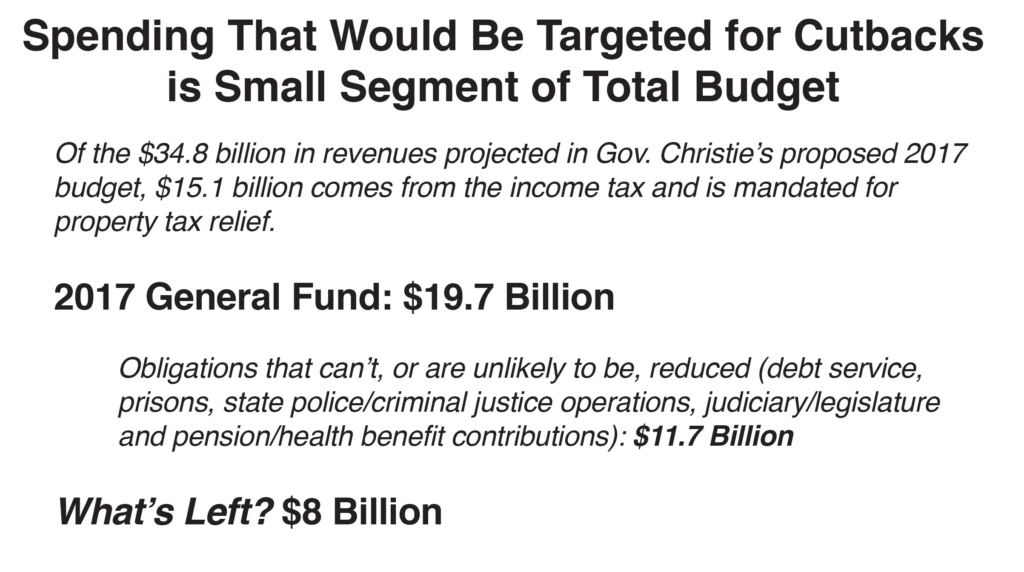

The numbers are straightforward and the consequences are frightening:

About 46 percent of general fund expenditures rely on the $9 billion in sales tax collections. However, there are certain obligations that cannot be reduced, eliminated or put off to future years. For example, New Jersey cannot become the first state since the Great Depression to not pay the interest and principal due on its $43 billion in debt, and it is also legally required to pay the employer share of employees health benefits and pension payments to public employees. There are other areas – like public safety and the legislature – that are likely off limits for significant spending reductions.

This leaves a target list of just $8 billion in spending that would be vulnerable to the $1.7 billion sales tax cut. In other words, we’re looking at a potential 21 percent cut.

So which remaining budget items would be expected to make do with less? The same ones that have endured flat funding, relentless cuts or budget raids to make up for insufficient revenue over the years. Here’s a sampling:

- Public colleges and universities (which have seen a 23 percent cut in inflation-adjusted state support since 2008)

- Safety net programs like WorkFirst New Jersey (where the level of cash assistance hasn’t been increased since 1987, thereby losing half of its value to New Jersey’s poorest families with kids)

- Pre-K expansion (which needs $550 million in funding a year to fully implement the 2008 expansion)

- Charity care payments to hospitals (which were reduced by $200 million from 2016 to 2017)

- Clean energy programs (which have been raided by more than $1.3 billion this decade)

- Women’s health funding (which has been shortchanged by nearly $50 million since 2011)

New Jersey can only honor its obligation to families who are struggling to get by in high-cost New Jersey if these programs are properly funded. Without long-term public investments in these building blocks of a strong state economy New Jersey has little chance to restore prosperity. In fact, its economy would only worsen.