Governor Phil Murphy delivered his sixth annual State of the State address last week, marking the start of a new legislative session in New Jersey. The address focused on ways to make New Jersey the best place to raise a family, from protecting reproductive rights and freedoms to new policies to make the state more affordable. However, the speech lacked any reference to how the state would pay for these investments, particularly in the aftermath of lawmakers’ decision not to renew the Corporate Business Tax surcharge by year’s end.

Without the corporate surcharge’s $1 billion in annual revenue generation, lawmakers will be hard-pressed to fund the many programs and services the Governor outlined in his speech. To make matters worse, the state’s financial outlook is not as strong as it was a year ago, with tax collections coming in lower than expected and federal pandemic aid running out.

Below are the rapid reactions from NJPP’s team of analysts on what was in the speech, what was notably absent, and what state lawmakers should focus on in the new legislative session.

Peter Chen

Senior Policy Analyst (Tax and Budget)

Governor Murphy spoke at length about how his administration wasn’t afraid to address the “fiscal elephant in the room,” cleaning up the state’s finances with full pension payments and increased school funding. But other “fiscal elephants” went unmentioned, namely the looming deficits for NJ Transit and the child care sector. These services desperately need funding, as do all other services trumpeted in the Governor’s address. There was no mention of additional revenue to replace the $1 billion lost from the corporate surcharge, and we all know that this revenue will have to be made up somewhere else in the budget.

Additionally, for a speech focused on making New Jersey the best place to raise a family, there were few new policies focused directly on family affordability. Certainly, a proposal to expand affordable housing is welcome news, but there was no mention of direct cash programs to help raise families out of poverty. For example, the Governor did not propose any expansion of tax credits for working families, and there was nothing in the speech about infant and toddler child care.

To address the “fiscal elephants” in the room and make New Jersey affordable for families with the lowest incomes, state lawmakers should:

- Bring back the Corporation Business Tax surcharge. To pay for New Jersey’s long-term investments and ambitious programs, the state must ensure the biggest and most profitable corporations pay their fair share. Bringing back the 2.5 percent surcharge would be a good start.

- Expand family and child tax credits. Expanding the Child Tax Credit to older children, increasing the benefit amount, and removing barriers to the Earned Income Tax Credit could substantially reduce poverty and make life affordable for low- and middle-income families.

Brittany Holom-Trundy

Senior Policy Analyst (Health and Safety Net)

The Governor used his speech to acknowledge the significant medical challenges residents face across the state, and he outlined some new initiatives to promote affordability in health care. Between medical debt relief through the Louisa Carman Medical Debt Relief Act — named in honor of a young policy analyst who tragically lost her life on New Year’s Day — and the elimination of financial barriers to abortion through the Reproductive Equity Act, the Governor’s proposals would make New Jersey a healthier and more equitable state.

It’s important to note that addressing medical debt on the back end is one piece of a broader puzzle regarding health care affordability. Lawmakers should advance this proposal with initiatives that expand access to affordable health coverage options for all residents. This would ensure New Jersey has the leading health system in the country.

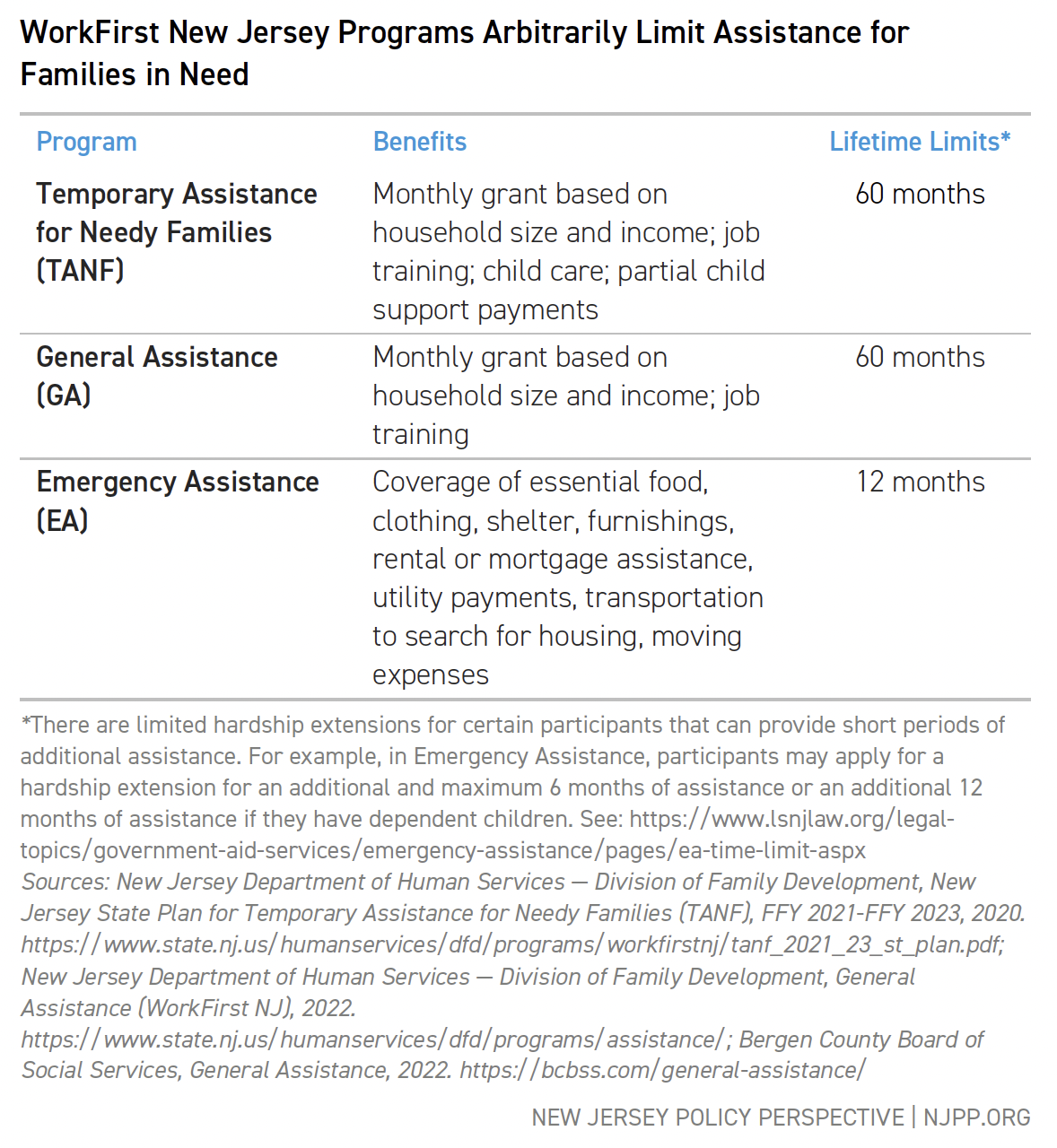

Finally, the word “poverty” was not in the Governor’s remarks, as it had been in years past. Despite a theme of making the state more affordable for families, decision-makers continue to leave direct cash assistance programs — namely WorkFirst NJ — to languish. As a result, federal dollars and state resources continue to fall short of their full potential in supporting families with the lowest incomes.

To make health care more affordable for families with low incomes, lawmakers should consider initiatives that:

- Expand affordable coverage options for all residents, regardless of immigration status, age, race, or gender. This includes removing barriers to NJ FamilyCare and GetCovered NJ to ensure that additional age groups are eligible, building on the success of the Cover All Kids program.

- Revamp the WorkFirst NJ program, so families with low incomes have the support they need. This includes increasing monthly grant amounts, smoothing exit ramps, and ensuring the program’s requirements meet the needs of residents looking to build a sustainable future.

Alex Ambrose

Policy Analyst (Transportation and Climate)

Governor Murphy recommitted to New Jersey’s 100 percent clean energy goal by 2035, which is crucial for moving away from harmful fossil fuels. However, he stopped short of action by not taking the opportunity to urge the Legislature to pass bills to ensure these efforts become reality. In the last session, lawmakers failed to codify the goal into law, and this year’s bills remain in the balance due to misinformed opposition. The longer the state waits, the more time these fossil fuel-funded misinformation campaigns have to stop offshore wind projects, holding back the state’s transition to a clean energy future. Typically, these campaigns weaponize “energy privilege” when wealthy white communities oppose wind projects, slowing clean energy goals in the majority of Black and brown communities who bear the brunt of the climate crisis.

Also, a notable omission from the speech is NJ Transit and its impending fiscal cliff, which will face a budget shortfall of $120 million in the upcoming fiscal year. That shortfall will quickly balloon to nearly $1 billion (yes, with a ‘b’) by the next fiscal year, threatening a vital service that millions of New Jersey residents rely on. While the Governor has yet to propose a solution, Senate President Nick Scutari recommended using the corporate surcharge to fully fund NJ Transit in his speech during the swearing-in ceremony for new legislators.

During the new legislative session, lawmakers can make progress on clean energy and public transit if they:

- Establish clean energy standards that center environmental justice. New Jersey needs comprehensive clean energy legislation that prioritizes Black and brown communities that are disproportionately harmed by pollution and the climate crisis.

- Fully fund NJ Transit. Lawmakers can fund NJ Transit by bringing back the corporate surcharge. Fully funding the agency is the only way to avoid drastic service cuts and fare hikes.

Marleina Ubel,

Senior Policy Analyst (Criminal Legal Systems and Immigrants’ Rights)

The Governor spent a minor part of his speech restating his commitment to criminal justice reform, where he acknowledged the failures of the drug war and the state’s glaring racial disparities in incarceration. As he spoke about helping those “unjustly thrown behind bars” get back on track, the Governor mentioned the rollout of a new clemency initiative we’re looking forward to learning more about.

While it’s important that the Governor stated these facts, it’s hard to look past how these words stand in stark contrast to last year’s actions when legislators passed, and the Governor signed various tough-on-crime bills and rollbacks to bail reform. This tough-on-crime approach fuels racial disparities in jails and prisons and is proven to be an ineffective response to public safety, running counter to the Governor’s promise to create a more fair and humane system.

On immigrants’ rights, it was refreshing to hear the Governor recognize immigrants as the backbone of New Jersey, especially now with xenophobia and anti-immigrant rhetoric on the rise. However, the context used in his speech was narrow, focusing solely on immigrant business owners. Given the challenges migrants are facing, we would have liked to see the Governor stand up and support all immigrants, from those who have built their lives here to the newcomers dreaming of doing the same.

Looking forward, here are some ways lawmakers can further reform the criminal legal system and make New Jersey a more inclusive state for all:

- Drop the tough-on-crime rhetoric and policies. We know this approach is ineffective and harmful and that these policies disproportionately harm Black and brown residents. Instead, invest in community-led initiatives and programs that get residents the support they need.

- Promote accountability in policing. A proposal to create civilian complaint review boards died last legislative session–this year, lawmakers must ensure this bill passes.

- Codify the Immigrant Trust Directive. The New Jersey Attorney General’s directive currently prevents state agencies from collaborating and sharing private information with ICE. Codifying this directive will build trust between immigrant families and help make New Jersey a truly fair and welcoming state.

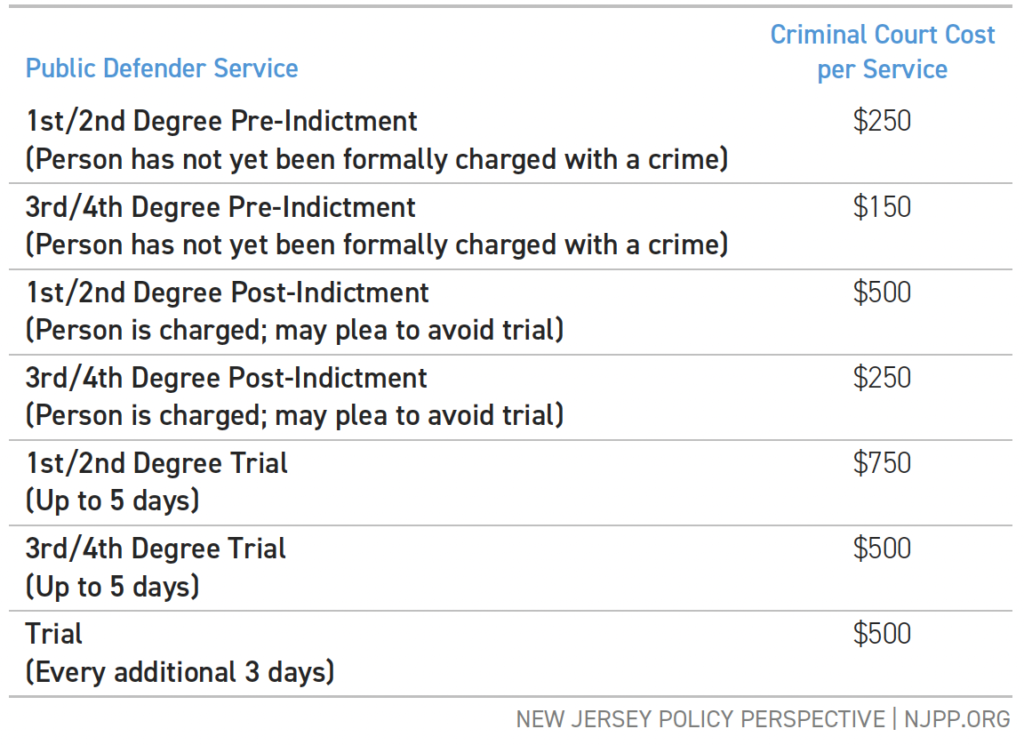

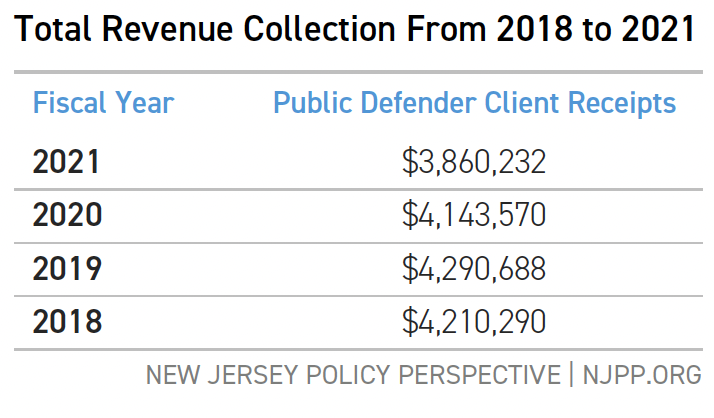

While the costs for indigent New Jerseyans can be insurmountable, the cash returns for the state are small. Anticipated revenue for Fiscal Year 2022 from clients of the Office of the Public Defender (OPD) is about $4 million,

While the costs for indigent New Jerseyans can be insurmountable, the cash returns for the state are small. Anticipated revenue for Fiscal Year 2022 from clients of the Office of the Public Defender (OPD) is about $4 million, The state Legislature, Judiciary, and Attorney General have taken some steps to reduce the negative impact of fines and fees, such as halting arrest warrants for debt from unpaid fines and fees.

The state Legislature, Judiciary, and Attorney General have taken some steps to reduce the negative impact of fines and fees, such as halting arrest warrants for debt from unpaid fines and fees.