New Jersey likes to tout its reputation for having a high-quality education system that produces some of the strongest students and workers in the country. While it’s certainly true that colleges and universities here consistently rank well nationally, the same can’t be said for our state government’s level of investment in public institutions of higher education.

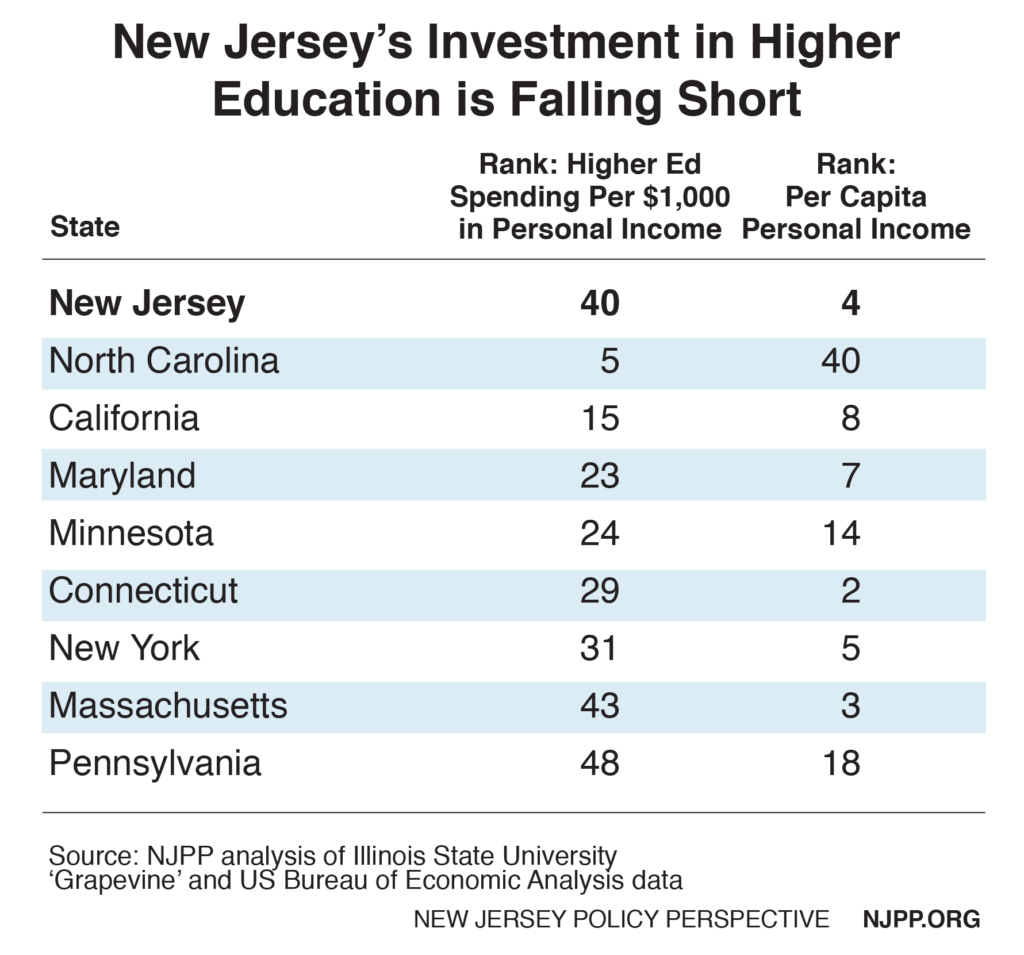

When taking into account New Jersey’s wealth, our support for higher ed is in the bottom rung of all states. The Garden State ranks 40th nationally (including Washington, D.C.) on the level of tax appropriations per $1,000 in personal income. In other words, despite the high number of wealthy residents and high-income households in New Jersey, the state doesn’t appropriate its tax revenue to support higher education at the level most would expect – especially when compared to our neighbors like New York and Connecticut.

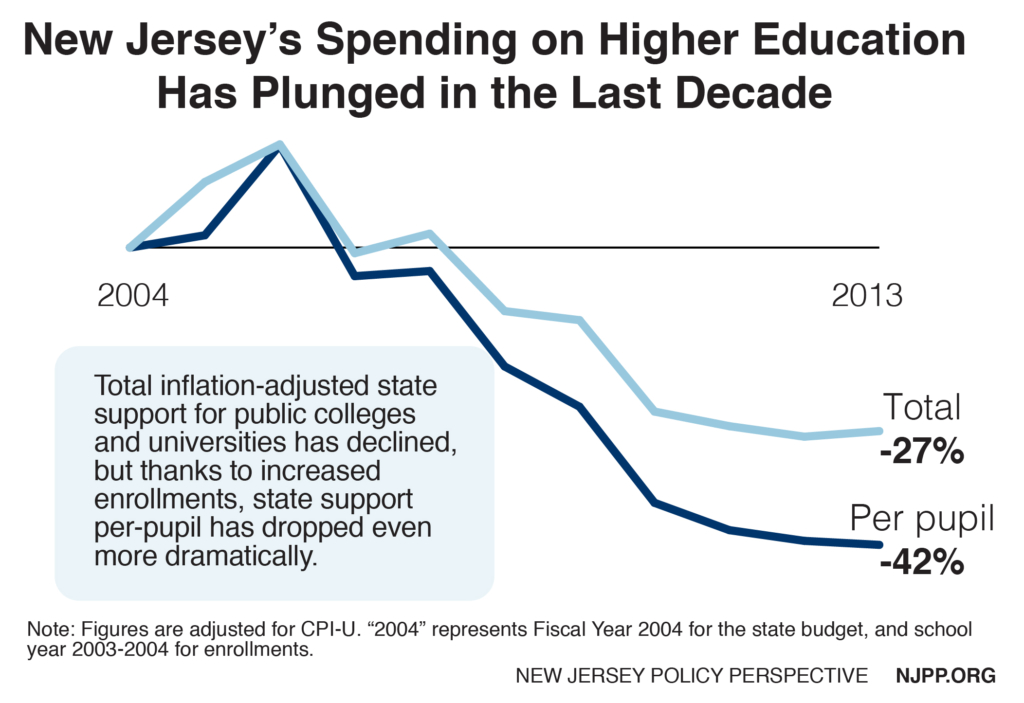

As NJPP showed last year, New Jersey has seen one of the biggest drops in higher education funding per pupil over the past decade. State support dropped from $1.16 billion inflation-adjusted dollars in 2006 to just $725 million in 2015. Looking at state investment per full-time student, funding has dropped from $11,382 inflation-adjusted dollars for the 2005-2006 school year to just $5,744 in the 2013-2014 school year. As a result, tuition levels have increased dramatically in a short amount of time, shifting the financial responsibility for a college education away from the state and onto the backs of working-class families who already have a difficult time making ends meet.

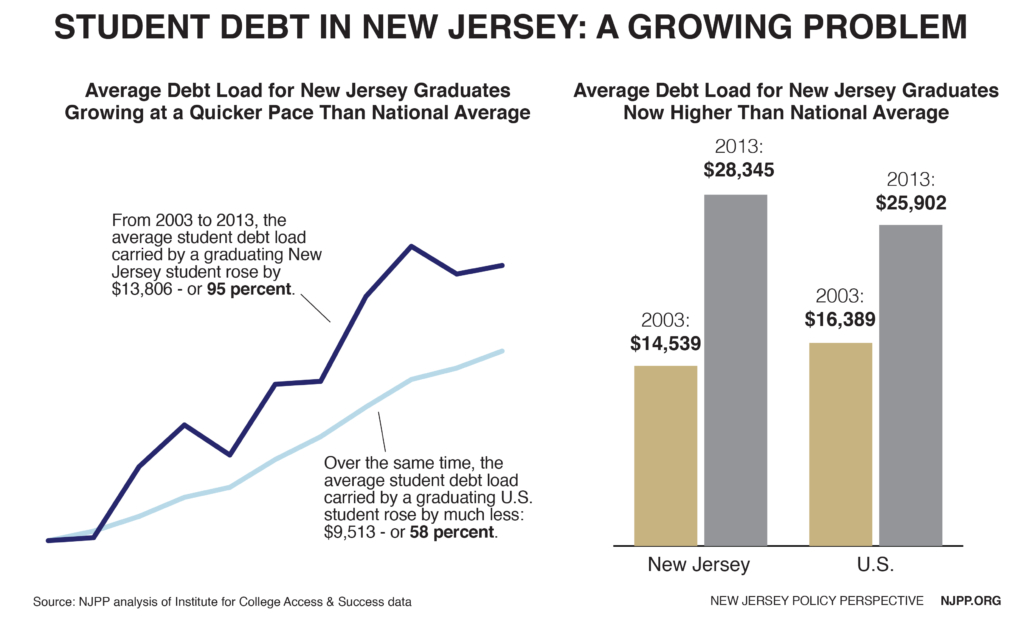

The consequences of high tuition rates have been more students graduating with arrestingly high levels of debt, impeding their ability to move out on their own and start lives independent of their parents. In the 2003-2004 school year, fifty-seven percent of graduates from public 4-year institutions in New Jersey held debt, and the average debt load was $14,539. Just a decade later, in the 2013-2014 school year, those numbers were sixty-nine percent and $28,345, respectively.

In fact, New Jersey is tops in the country for the share of millennials – nearly half – who live in their parents’ home. It goes without saying that having the younger generation saddled with high levels of debt so early in life endangers the future of the state. New Jersey’s system of higher education requires the vast majority of students to borrow so much money that they are far less likely to contribute to the economy because they lack the economic security to start a business, buy a home or a car, and start a family.

With the average of combined in-state tuition and fees among four-year public institutions in New Jersey ranking 4th highest nationally, this is a pressing issue that requires the immediate and sustained attention of lawmakers. Advocates and business leaders all agree that making college more affordable is essential to ensuring that New Jersey retains an educated and innovative workforce – failing to do so will have grave complications for our economy and our future.