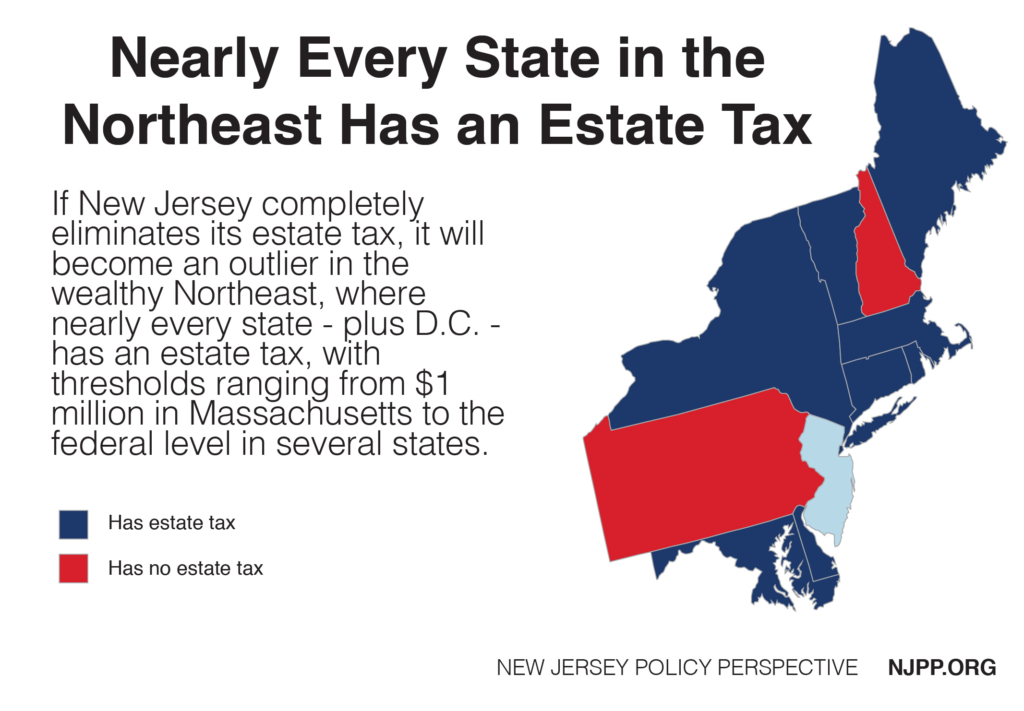

As legislators from both sides of the aisle have charged ahead with an extreme plan to completely eliminate the estate tax, much has been made of how New Jersey – with the nation’s lowest threshold – is an “outlier” state.

By repealing the 82-year-old tax, New Jersey lawmakers wouldn’t only be providing a spectacular tax break for heirs of multimillion dollar estates while depriving the state of $550 million dollars every year at a time when the state’s already can’t meet its obligations. They’d also be putting New Jersey out of step with nearby wealthy states, which understand the value of levying a tax on fortunes that the vast majority of Americans can only dream of.

Yet the governor, some legislative leaders and business lobbyists are adamant that the estate tax has to go, asserting that wealthy residents leave New Jersey to avoid the tax and middle-class heirs are unfairly burdened by its low threshold.

Putting aside whether these stories are accurate and representative, (they’re not), the rush to completely wipe the estate tax clean off the books at a time when New Jersey relies on its revenue more than ever is hardly a sensible trade-off. Instead of raising the threshold to help relieve “smaller estates,” lawmakers seem determined to give away the farm – making New Jersey an outlier in the most damaging way.