To read a PDF version of this policy brief, click here.

The public health crisis created by the COVID-19 pandemic has caused an unprecedented demand in unemployment insurance (UI), a program that compensates eligible workers who have been recently laid off due to no fault of their own. Since the beginning of March 2020 through April 25, 2020, New Jersey saw over 930,000 UI claims.[1] This is about a 1,500 percent increase in claims, when comparing April to February.[2] While federal action will be integral to support vulnerable workers and those who are now unemployed, New Jersey must also act fast to ensure that no workers are left behind in the state’s recovery.

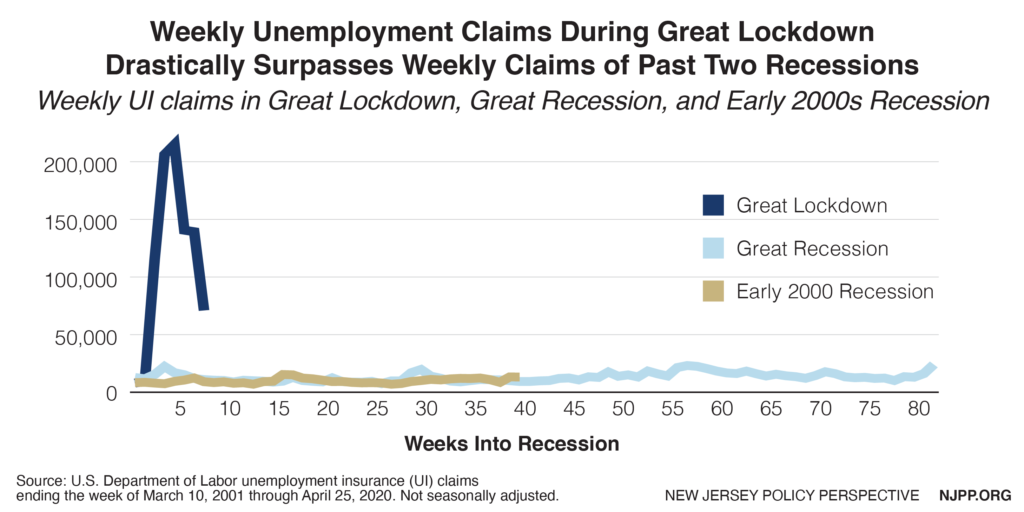

To better understand the magnitude of this record-breaking increase, NJPP compares UI claims seen in the current recession, which we refer to as “The Great Lockdown,”[3] to the past two recessions: the Great Recession, which lasted from December 2007 through June 2009, and the Early 2000s Recession that ran from March 2001 through November 2001.[4]

Unemployment claims made in the first weeks of the COVID-19 pandemic drastically surpass any week of the previous recessions. In fact, the total number of claims made in the current recession is over three quarters of claims seen during the entirety of the Great Recession and almost twice the amount seen during the entire early 2000s recession.[5] We expect that the total claims made by the end of May will surpass all the jobless claims made during the Great Recession.

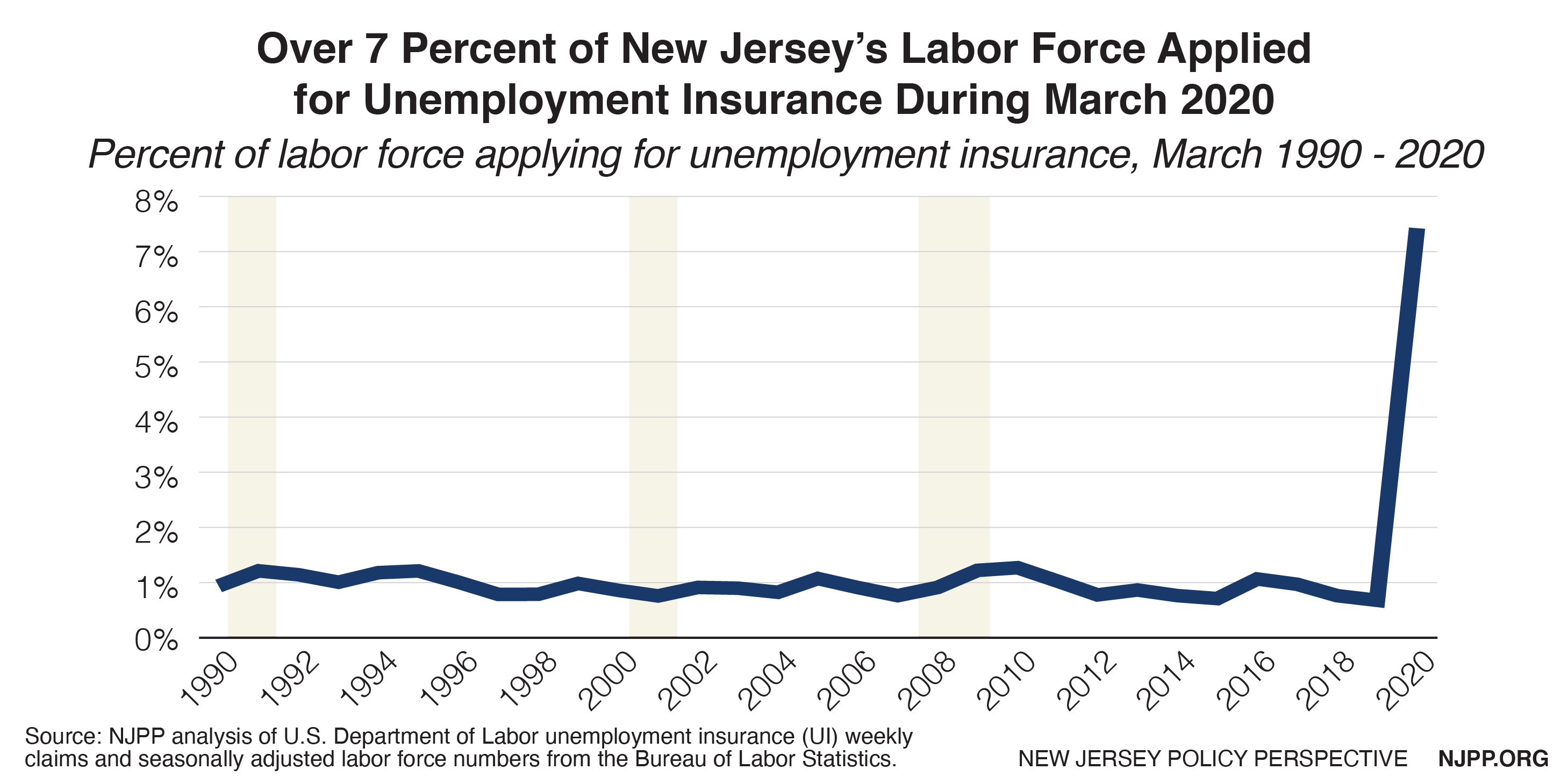

Another way to understand the magnitude of job loss resulting from COVID-19 is to determine how much of the labor force has filed jobless claims. As seen below, so far, a record-breaking 7.4 percent of the labor force has applied for job loss claims in March, and this is expected to rise in April, when new labor force data is available.

The overwhelming number of UI claims has placed an enormous strain on the state’s Department of Labor and Workforce Development, the agency tasked with administering these benefits. New Jersey’s UI system is collapsing under the weight of so many applications, due in part to dated technology and a department staff that is 25 percent lower than it was over a decade ago.[6] Job loss also strains other agencies, such as the Departments of Health, Human Services, and Community Affairs, as many workers have also lost their employer-provided health insurance and need additional assistance to pay for essentials like food and rent.

To meet this increased demand for safety net programs, relief packages from the federal government — such as the Coronavirus Aid, Relief, and Economic Security (CARES) Act — are critical. The CARES Act made necessary expansions to state UI programs to help relieve some of the economic decline caused by the COVID-19 pandemic.[7] It includes Pandemic Unemployment Assistance, which expands benefit eligibility for those not eligible for their state UI program, such as self-employed workers, independent contractors, and part-time workers. It also contains Pandemic Unemployment Compensation, which increases the maximum unemployment benefit above one’s base unemployment compensation benefit through July 2020 by $600 per week. Finally, it includes Pandemic Emergency Unemployment Compensation, which extends unemployment benefits for an additional 13 weeks.

The CARES Act relief package will not be enough, however. New Jersey cannot meet all these immediate and approaching needs on its own, especially since the state does not have a sufficient Rainy Day Fund or any major progressive tax strategies to raise sufficient revenue. In fact, the state may likely borrow federal funds to cover unemployment claims, in addition to cover revenue shortfalls.[8] From the beginning of March through April 25, the state has distributed about $1.4 billion in unemployment related claims.[9]

These record-breaking UI numbers also severely undercount the extent of job loss in New Jersey, as not all workers are eligible for unemployment assistance and are thus not filing claims. For instance, undocumented workers, who make up over 15 percent of the workforce in industries most affected by COVID-19, are excluded from much of the relief provided by the federal government. What’s more, other immigrant workers must have valid work authorizations during the base period,[10] at the time they apply for benefits, and throughout the period that they are receiving benefits,[11] making it more difficult to qualify. If New Jersey fails to step in and prioritize these workers throughout its recovery, the economic fallout will be much worse. (For more see, NJPP’s Undocumented Workers in Service Sector Most Likely to be Harmed by COVID-19.

Job loss claims are just one indicator to understanding the extent of this health pandemic and the repercussions that will be felt throughout the economy. Currently, they understate the impact of the virus. These claims are expected to rise beyond what most of us have seen in our lifetimes. To respond to this unprecedented surge in job loss, it is imperative that the state step in and ensure that no worker or family is left behind.

End Notes

[1] U.S. Department of Labor, Unemployment Insurance Weekly Claims Data for New Jersey. Accessed 4/30/2020 https://oui.doleta.gov/unemploy/claims.asp

[2] U.S. Department of Labor, Unemployment Insurance Weekly Claims Data for New Jersey. Accessed 4/30/2020 https://oui.doleta.gov/unemploy/claims.asp

[3] NJPP analyzes UI claims starting the first week of March 2020 to determine the start of the Great Lockdown for NJ.

[4] The National Bureau of Economic Research, US Business Cycle Expansions and Contractions. 2010. https://www.nber.org/cycles.html

[5] Total UI claims for Early 2000s Recession is about 399700 and for the Great Recession is about 1,088,000. U.S. Department of Labor, Unemployment Insurance Weekly Claims Data for New Jersey. Accessed 4/24/2020 https://oui.doleta.gov/unemploy/claims.asp

[6] New Jersey Policy Perspective, Years of Disinvestment Hamper New Jersey’s Pandemic Response. April 2020. https://www.njpp.org/budget/years-of-disinvestment-hamper-new-jerseys-pandemic-response

[7] U.S. Department of Labor, Unemployment Insurance Relief During COVID-19 Outbreak. 2020. https://www.dol.gov/coronavirus/unemployment-insurance

[8] POLITICO New Jersey, Murphy: New Jersey likely to borrow federal funds to cover unemployment. April 25, 2020. https://subscriber.politicopro.com/states/new-jersey/whiteboard/2020/04/25/murphy-new-jersey-likely-to-borrow-federal-funds-to-cover-unemployment-9422713

[9] New Jersey Department of Labor, Unemployment Payments Surpass 500K; $1B in Benefits Distributed Since Pandemic Began. April 30, 2020. https://www.nj.gov/labor/lwdhome/press/2020/20200423_weeklypayments500k.shtml

[10] Base period is the recent work history timeframe used to determine if one qualifies for UI benefits and to calculate the benefit amount.

[11] National Employment Law Project (NELP), Immigrant Workers’ Eligibility for Unemployment Insurance, April 2020. https://www.nelp.org/publication/immigrant-workers-eligibility-unemployment-insurance/