Welcome to NJPP’s Budget Address FY 2021: Rapid Reaction, your source for commentary and data analysis on Governor Murphy’s address. The transcript below was taken from NJPP’s conference room, over a delicious Sicilian pizza, and has been lightly edited.

Lou (Louis Di Paolo, Communications Director): Budget season is back! Earlier today, Governor Murphy delivered his budget address for fiscal year (FY) 2021, where he detailed new investments in education, transportation, tax credits for working families, and so much more. The budget proposes the largest pension payment in state history, limits one-shot revenues and (some) raids of dedicated funds, and makes another big investment in the state’s Rainy Day Fund.

For New Jersey Policy Perspective (NJPP), this year’s budget season started a week early with the launch of For The Many NJ. This new coalition, made up of faith-based organizations, labor unions, and nonprofits advocating for education, the environment, transportation, affordable housing, and more, stood on the State House steps to call for a new approach to budgeting that puts the needs of ordinary people over those of corporate special interests.

Joining me in reflecting on what we heard today are Nicole Rodriguez and Sheila Reynertson! Sheila, can you give a brief overview of the coalition and its priorities this budget season?

Sheila (Sheila Reynertson, Senior Policy Analyst): Happy to do that, Lou. We are over 30 organizations working together to advance smart, responsible budgets that are sustainably funded. We are also prioritizing racial and economic equity as a critical component in realizing a New Jersey that works for the many instead of the few. We want to see New Jersey reverse ill-advised tax cuts like the tiny decrease of the state sales tax, close remaining corporate tax loopholes that allow profits to be parked overseas, and ensure the ultra-wealthy pay their fair share on inherited wealth.

Nicole (Nicole Rodriguez, Research Director): The coalition recognizes that budgets are about more than numbers. That’s because each line item represents real people – our neighbors, our families, our coworkers, as well as students and seniors in every corner of the state. Budgets have direct implications on all our livelihoods and we need to keep that in mind when discussing and advocating for sound budget practices and investments that will help all residents thrive.

Lou: Beautifully said, Nicole. Budgets really are moral documents and represent the state’s priorities. Keeping that in mind, let’s jump into the governor’s address. First, what did we like?

Nicole: The governor proposed a boost to working families across the state by way of the Earned Income Tax Credit (EITC), a refundable tax break for lower-income workers. The EITC is an important anti-poverty program that helps families struggling on low wages to make ends meet and provide basic necessities for their children. Think of it like a refund for low-paid workers.

Specifically, the FY 2021 budget proposal increases the state tax credit to 40 percent of the federal benefit and proposes lowering the age threshold for workers without children to 21, making about 60,000 more workers eligible.

Sheila: I was really impressed with another round of solid investments in education across the board. Students and teachers should be very excited about this budget.

Pre-Kindergarten expansion continues to be an important priority with $83 million in additional funding. That will help 30 more districts introduce early education. That’s on top of the expansion to 60 districts over the past two years. Direct formula aid for K-12 public schools is slated to receive an additional $336 million. In total, the Murphy administration has increased this funding by 11 percent. It was great to see continued support for the community college grants program, which started in 2019, and it was a pleasant surprise to learn this budget will bring this model to 4-year public college and universities.

Lou: I’d like to point out the $1.6 billion surplus and $300 million deposit into the Rainy Day Fund (RDF). These aren’t sexy investments, but they help rebuild the state’s fiscal foundation and prepare New Jersey for the next recession or superstorm. The governor remarked that this is the first time the state is making back-to-back deposits into the RDF in over 20 years. That really surprised me given that this is such a basic budgeting best practice.

Sheila: Yes, baby steps! The state’s Rainy Day Fund was emptied during the height of the Great Recession and then was allowed to grow cobwebs for years. While this is a relatively small investment, it is an important step in rebuilding an emergency savings account that will give New Jersey the ability to weather tough times without having to resort to making drastic and dangerous cuts to programs that, might I add, low-income communities depend upon the most.

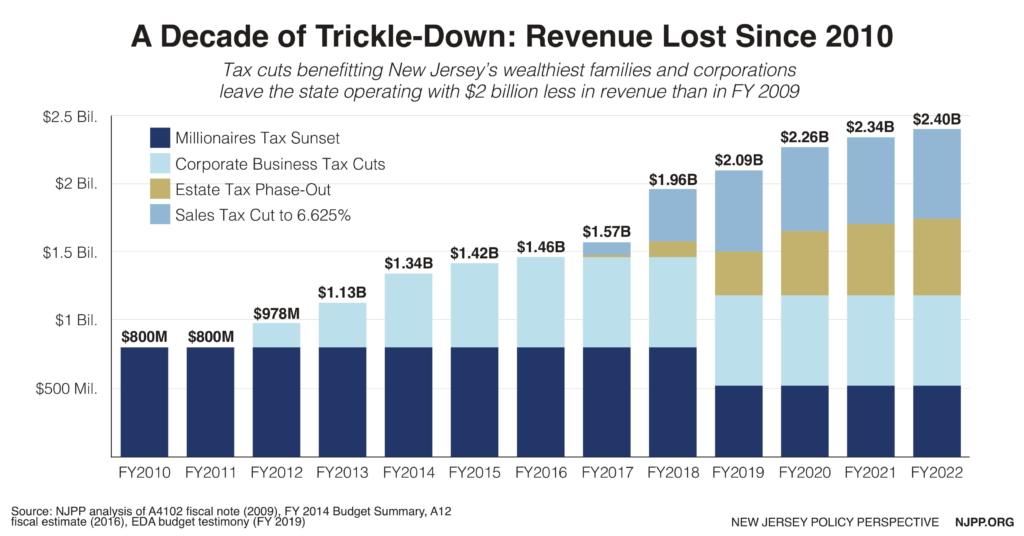

Lou: You know what else was emptied during the last decade? Billions and billions of dollars in revenue. New Jersey enacted $15 billion in cumulative tax cuts that primarily benefited the state’s wealthiest families and biggest corporations.

How’s the governor’s proposal stack up in terms of recouping this lost revenue and ensuring the ultra-wealthy pay their fair share? Or, more broadly, how do we feel about the governor’s proposals to raise revenue?

Sheila: It’s baaack! Governor Murphy has proposed the millionaires tax for the third year in a row.

This time the Senate President has signaled his willingness to support it in exchange for a larger pension payment. We shall see how this all plays out in the next few months, but it’s a proposal that is long overdue. Since the Great Recession, there has been a 62 percent increase in the number of New Jersey residents with incomes over $500,000 in annual income. A third of them make over $1 million in annual revenue. These high earners have further enriched themselves and their families through the many new loopholes and tax cuts in the 2017 federal tax law. It’s time for the income tax code to reflect this reality – permanently. It would generate much needed, sustainable revenue for direct property tax relief and address worsened income and wealth inequality in the Garden State.

Lou: I can’t wait for New Jersey to pass the millionaires tax. Then I’ll finally be able to change my twitter name back to normal.

Nicole: Let’s be clear here: The millionaires tax is not the end all be all of tax fairness. New Jersey can and should do more to ensure the ultra-wealthy and corporations pay their fair share. The Senate President made a valid case this weekend for extending the corporate business tax surcharge for companies with over $1 million in annual profits. Many of these corporations pay little-to-no federal taxes and received a huge windfall thanks to the Trump administration’s 2017 tax cuts.

The state can also do a better job of taxing inherited wealth, whether it be through bringing back the estate tax or reforming the inheritance tax for wealthy heirs.

Lou: All great points. New Jersey can definitely do more to advance equity through the tax code. Sheila, were there any new programs or services in the budget that could help reduce disparities?

Sheila: Yes! In his speech today, Governor Murphy highlighted three initiatives that would have a direct impact on racial disparities. He lifted up the Amistad Commission, which will help revitalize African-American history curriculum in public schools, highlighted ongoing efforts to eliminate the racial disparities in New Jersey’s dismal maternal mortality rates, and announced new programs to break the school-to-prison pipeline which disproportionately harms Black and Latino communities.

Lou: I’m curious to hear more about eliminating racial disparities in maternal mortality rates. New Jersey truly is a tale of two states when measuring the experiences of people of color with white people. We have the best public schools in the nation but the worst racial segregation; the best maternal health care but one of the worst maternal health rates for Black mothers; one of the biggest gaps between the wealth of white families compared to Black families. I could go on.

Sheila: We would be here pretty late if you did. This pizza is already getting cold, and I’m sure all of our cats miss us.

Lou: That is very true! Let’s move this thing along: What was missing in the governor’s address?

Nicole: The Governor did not mention immigrants in his address. And what’s more disappointing is that he is proposing to flat fund, which is essentially a funding cut, the programs that provide legal representation to immigrants. Access to counsel is not only a smart budget choice but also necessary in the wake of harmful national policies that increase the need for such representation. It is proven to dramatically affect legal outcomes, reduce the costs of detention, and provide due process to a system that perpetually fails immigrants. In fact, according to a study by Seton Hall University, immigrants with representation were at least 3 times as likely to obtain a successful outcome as those who were not represented. Immigrants are vital to our communities and our economy. Although this state has done a lot to help immigrants feel welcomed, the state must do more to help as they are targeted by federal agencies.

Sheila: I noticed that the NJ Transit investment looks a little shaky compared to the last two years. An additional $132 million has been designated for operating expenses in this budget, but with that comes diversions from the Turnpike Authority to the tune of $154 million and $82 million from the Clean Energy Fund. It reveals how long it is going to take to undo the damage of hollowing out NJ Transit during the last administration. That being said, kudos for keeping a lid on ticket prices for another year.

Nicole: We could definitely use some clarity on the new health insurance assessment. This is another proposal supported by the For The Many NJ coalition as it recaptures a fee on insurers that the federal government no longer collects. It’s unclear where this new revenue will go, though. NJPP supports the assessment in theory, but it must be put towards expanding health coverage for those who need it most, including uninsured children and low-income families who cannot afford the cost of premiums in the marketplace.

Lou: Brandon’s not here so I’ll ask: Did the governor mention poverty once in his address?

Sheila: I’m doing a Ctrl-F search for it in his speech and nothing is coming up. But I did notice that the administration claims it will cut the co-pays parents pay for subsidized child care by 50 percent. Also, in response to the federal gag rule, $20 million is allocated for family planning services to replace lost federal dollars, providing low-income families affordable birth control and, by extension, greater economic stability.

Lou: Anything else missing? Can we go rapid fire so we can wrap this up?

Nicole: It looks like most departments are flat-funded. That’s not good as these agencies were decimated under the previous administration. These are the offices tasked with running state government, and they need adequate resources and support, otherwise they can’t do the job we all need them to.

Sheila: Charity Care is flat funded too, unfortunately. This is a critical resource that foots the bill for hospital care for those who are under- and uninsured.

Lou: Anything else?

Nicole: Oh, good budgeting practices! No mention of consensus revenue forecasting or multi-year projections for revenue and appropriations. These are common-sense reforms that will make the budget process more transparent.

Sheila: And the credit rating agencies love them! Speaking of love, how did no one mention how delicious this pizza is?

Lou: The pizza was very tasty…

Nicole: Like this pizza, I’m walking home!

Lou: Fair enough. Great job, team! Looking forward to doing this again after the budget gets signed.