Removing All Undocumented New Jerseyans Would Harm the State’s Economy

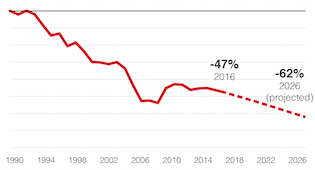

To read a PDF version of this report, click here. New Jersey’s economy would suffer a substantial blow if all of the United States’ 11.3 million undocumented immigrants – more than 7 million of whom are working – were removed from the country. In fact, the loss to [...]