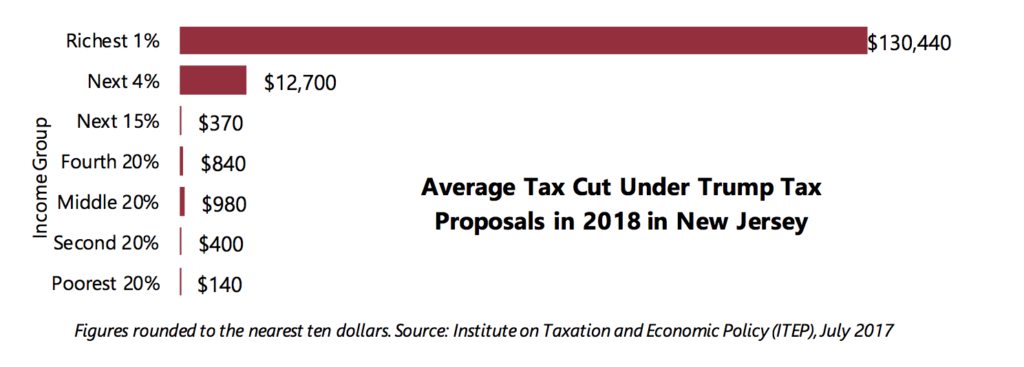

More than half of the tax cut dollars would go to top 1% of taxpayers, who’d get an average break of $130,000

A federal tax package based on President Trump’s April outline would fail to deliver on its promise of mostly helping the middle class, instead showering most of its help to the richest 1 percent, according to a new 50-state analysis from the Institute on Taxation and Economic Policy released today.

In New Jersey (click here for the state Fact Sheet):

- The top 1 percent of the state’s taxpayers – with average incomes of $3.1 million a year – would receive an average tax cut of $130,440, which is more than 250 times larger than the average $510 tax cut the bottom 60 percent of New Jersey taxpayers – with average incomes of $77,800 – would receive.

- The top 1 percent would receive 55 percent of the tax cut dollars, while the bottom 60 percent would receive just 21 percent.

- The average tax cut received by the top 1 percent would equal approximately 4.2 percent of their average annual income while cut received by the bottom 60 percent would equal 1.3 percent of their average annual income.

Even worse, these tax cuts for those who need the least help would be incredibly expensive, costing the federal government $4.8 trillion in revenue over the next decade. To pay for these huge tax cuts for the wealthy, Republican leaders in Congress and the President propose deep and devastating cuts to major programs like Medicare, Medicaid, food assistance and others to offset the costs. As a result, low- and middle-income families would likely lose far more as a result than they gain from the small tax cuts President Trump’s plan would provide them.

These tax cuts would benefit New Jersey’s multi-millionaires while inevitably stripping health care, food assistance and more from low- and moderate-income residents and decimating investments in science, technology and job training that are proven to grow the economy.

Let’s get real: that is not ‘tax reform,’ and it’s surely not a blueprint for true economic opportunity and shared prosperity. It’s Robin Hood in reverse, and in New Jersey it would lead to more hardship, wider income and wealth gaps and lackluster economic growth.