To read a PDF version of the full report, click here.

As the Great Recession gripped the country over a decade ago, states like New Jersey had to make tough choices to balance their budgets. They relied on a mix of tax increases, budget cuts, and tapping into savings to close budget gaps and ride out significant reductions in tax revenue collections. Nationally, state tax revenue has recovered overall, but each state’s recovery varies widely and many states still lag behind.

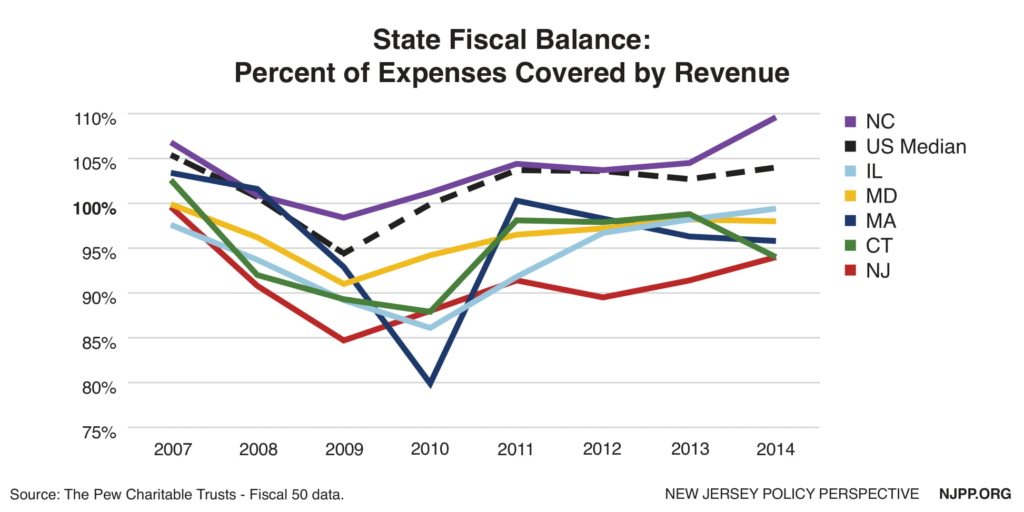

Nearly one-fifth of states still collect less revenue than before the economic downturn, more than one-third have smaller rainy day funds, and almost half spend less from their general fund budgets than a decade earlier. Unfortunately, New Jersey checks all of these boxes, putting the state’s precarious financial health at greater risk should another recession hit. To put it another way, the Garden State has yet to fully recover, making New Jersey one of the least prepared states to weather a future economic downturn.

To better understand why New Jersey continues to struggle while states with similar economic profiles have fully recovered and then some, New Jersey Policy Perspective (NJPP) commissioned graduate students at the Edward J. Bloustein School of Planning and Public Policy to examine the matter. This report assesses the policy choices made before and in response to the Great Recession by New Jersey and five comparable states: Connecticut, Illinois, Maryland, Massachusetts, and North Carolina.

Using a set of performance indicators, the practicum group tracked how each state prepared for, and recovered from, the Great Recession using information collected through document and database analysis and interviews with state and national budget and policy experts. Because each state had its own unique experience in the past decade, no one policy decision could be identified as making or breaking a state’s recovery. Nonetheless, the report finds a number of important trends, such as:

- States with policies in place to rationalize debt usage before and during the recession were less likely to borrow for operational expenses and pension funding

- Reliance on non-recurring revenues and borrowing during and before the recession often exacerbated budgeting challenges in future years

- States with a well-funded Rainy Day Fund were able to get through the recession with less borrowing, fund transfers, and spending cuts

- States with already low bond ratings were more likely to use debt financing during the Great Recession

- Pension/OPEB liabilities and structural deficits greatly limited states’ flexibility and posed challenges to maintaining services and investments

- States that raised taxes during the recession and sunsetted them before their economies fully recovered generally had to deal with budgetary shortfalls in future years.

This report was prepared for New Jersey Policy Perspective (NJPP) by a practicum of graduate students from the Rutgers University Edward J. Bloustein School of Planning and Public Policy under the advisement of Dr. Cliff Zukin: Alex Barree, Vineeta Kapahi, Rafay Kazmi, Benjamin Levy, Jeehye Min, and Emilia Piziak.