State investments in public higher education have been declining for decades, forcing universities to deal with increasing numbers of students with less public funding. The result has been students and families taking on larger and larger amounts of student loan debt to pursue a college degree.

New Jersey is no exception.

In fact, the Garden State has seen one of the largest decreases in funding per pupil when compared to other states in the Northeast and the national average. Students attending New Jersey colleges are likely to incur noticeably more debt than the national average.

As a consequence, some students find it more difficult to complete their degrees, are forced to do so part time, or are prevented from attending at all. For those who attend and graduate, their delayed earnings potential and more immediate repayment requirements translate into higher rates of delinquency and default, and concurrent declines in participation in the economy — they are less likely to buy cars and homes or start families.

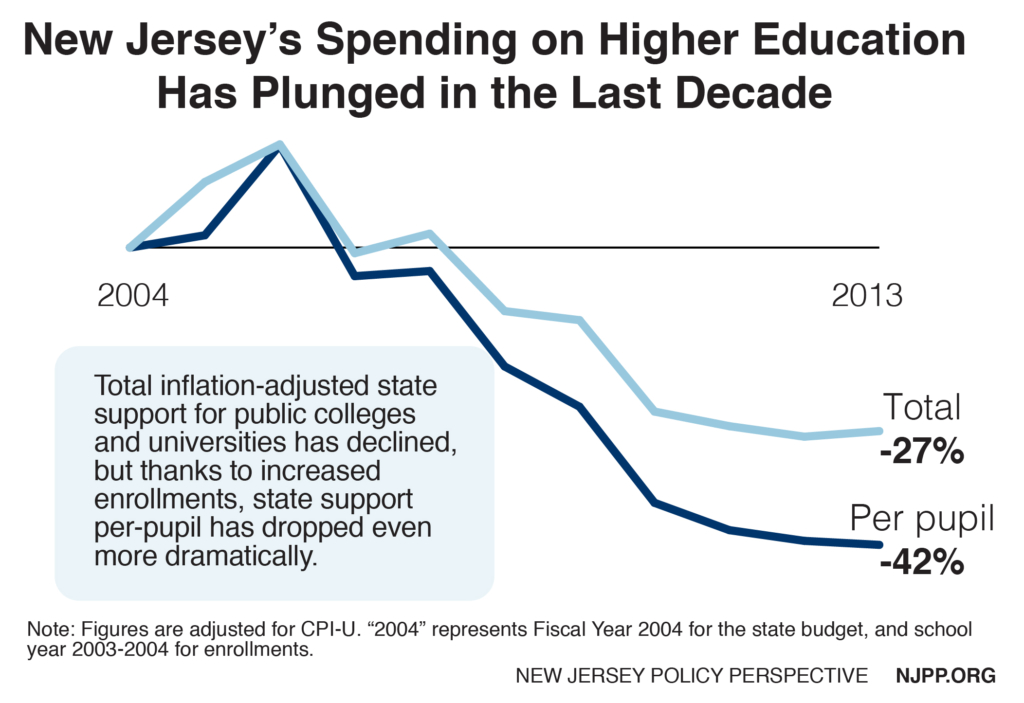

New Jersey’s declining investment in higher education accelerated during the recent recession, when annual state support declined by 29 percent from 2008 to 2015. These cuts, however, are worse when combined with the increase in attendance that accompanies a recession as families choose more affordable in-state tuition rates. When these two trends are combined, colleges and universities are foced to do more with less, and the amount of funding per pupil drastically decreases – in New Jersey, it declined by 30 percent from 2008 to 2014.

As state funding for public colleges and universities has declined, tuition rates have increased. In just a little over ten years, the average tuition in New Jersey has increased by nearly $4,000 when adjusting for inflation. Without adjusting for inflation, the average sticker price for a college education in the Garden State has increased by $6,000 during the same period. This shows that the price of a college degree out-paced the rise in inflation over the same period; the extra burden is made doubly worse by simultaneous and significant decreases in state funding for public universities and colleges. This is a drastic shift in the responsibility of paying for a college education from the state to students and families, and is particularly troubling at a time of stagnant or declining incomes for most New Jerseyans. Average tuition and fees at the state’s public colleges and universities are now about 12 percent of the median income for a New Jersey family of four – nearly double the 6.6 percent share in 1995.

These problems, however, are not without solutions. New Jersey has an important role in reversing – or at least slowing down – increasingly unaffordable college prices and rising student debt.

To slow it down, New Jersey could return to pre-recession levels of funding for higher education, reversing recent cuts. To do so, New Jersey would need to increase state support by 40 percent (in CPI-U adjusted dollars), from the $735 million invested in 2015 to $1.03 billion. While this would help ease the pain, it would not cure the patients by meaningfully improving the affordability of public college.

Of greater impact would be a return to public funding levels that would place tuition and fees to the more affordable 6.6 percent of family income seen in 1995. To get there, New Jersey would need to increase state support by 63 percent, from the $735 million in 2015 to $1.2 billion. This would bring today’s funding in line with the average funding in the 1990s and serve as a true reversal, supporting not only the current middle class, but also providing for its expansion.