To read a PDF version of this report, click here.

There are many compelling reasons for New Jersey policymakers to advance a bold agenda for tax reform in 2018. They’d be making the state’s tax code fairer while raising new revenues for the state to pay for public services, help those in need and invest in the shared building blocks of a strong economy. They’d be reversing years of tax-cutting that has mostly benefited the state’s wealthiest families and made the tax code even more upside down. And last but not least, they’d be boosting the state economy and creating jobs.

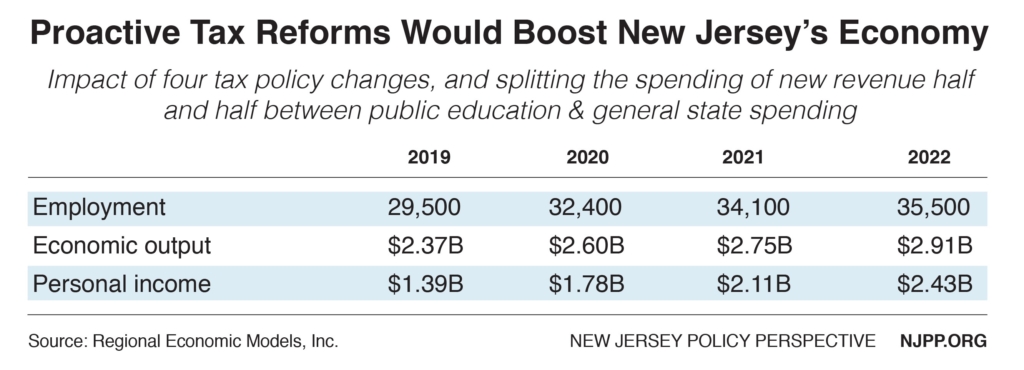

In fact, enacting a bold tax reform agenda and using that new money to reinvest in New Jersey would boost the economy by $2.9 billion by 2022, increasing personal income by $2.4 billion and creating over 35,000 new jobs. (For details on the methodology, see Appendix.)

These economic boosts are based on the following policy changes and assume that all are enacted in 2018.

Revenue raisers:

- Increasing the income tax on the wealthiest 5 percent of New Jersey households. By adding four brackets to the state’s income tax and increasing rates on these well-off households, lawmakers would raise more than $1 billion in new revenue each year.[1]

- Restoring the sales tax to 7 percent. By reversing 2016’s third-of-a-penny cut to the state sales tax – a cut that most New Jersey families say hasn’t helped them at all[2] – lawmakers would raise about $600 million in new revenue each year.[3]

- Closing corporate tax loopholes by enacting “combined reporting.” By following the lead of the majority of states with corporate taxation and ending the ability of multistate corporations to artificially shift profits out of New Jersey to lower- or no-tax states[4], lawmakers would level the playing field for small, local businesses and raise up to $290 million in new revenue each year.[5]

- Restoring the estate tax for heirs inheriting estates worth more than $1 million. By returning sensible taxation of inherited wealth to New Jersey, lawmakers would raise approximately $500 million in new revenue a year and restore an essential safeguard against rapidly increasing wealth inequality.[6]

Spending:

- The new revenues from the policy changes above would be split 50/50 between general state services (spent in the same proportion as current state spending) and public education (at both the elementary and secondary level, spent in the same proportion as current spending on public education).

Appendix: Economic Model

The employment and economic effects of tax policy changes described in this report were derived from the PI+ Version 2.1 of Regional Economic Models, Inc. (REMI), which generates realistic year-by-year estimates of the total regional effects of any specific policy initiative.

A wide range of policy variables allows the user to represent the policy to be evaluated, while the explicit structure in the model helps the user to interpret the predicted economic and demographic effects.

For more details on the PI+ Version 2.1 model, visit http://www.remi.com/model/pi/

Endnotes

[1] New Jersey Policy Perspective, Reforming New Jersey’s Income Tax Would Help Build Shared Prosperity, September 2017. https://www.njpp.org/budget/reforming-new-jerseys-income-tax-would-help-build-shared-prosperity

[2] New Jersey Policy Perspective, Poll: Most New Jerseyans Want Bold Solutions on State Taxes, November 2017. https://www.njpp.org/budget/poll-most-new-jerseyans-want-bold-solutions-on-taxes-public-investments

[3] New Jersey Office of Legislative Services, Legislative Fiscal Estimate on A-12, October 2016. http://www.njleg.state.nj.us/2016/Bills/A0500/12_E3.PDF

[4] New Jersey Policy Perspective, Nearly All of New Jersey’s Largest Employers Already Subject to ‘Combined Reporting’ in Other States, January 2016. https://www.njpp.org/budget/nearly-all-of-new-jerseys-largest-employers-already-subject-to-combined-reporting-in-other-states

[5] New Jersey Office of Legislative Services, Legislative Fiscal Estimate on S-982, March 2016. http://www.njleg.state.nj.us/2016/Bills/S1000/982_E1.HTM

[6] New Jersey Policy Perspective, Fairly and Adequately Taxing Inherited Wealth Will Fight Inequality & Provide Essential Resources for All New Jerseyans, June 2017. https://www.njpp.org/budget/fairly-and-adequately-taxing-inherited-wealth-will-fight-inequality-provide-essential-resources-for-all-new-jerseyans