On September 5, the Trump administration announced that it would end DACA (Deferred Action for Childhood Arrivals), the program for immigrants who were brought to the United States as children. DACA grants immigrant youth temporary relief from deportation and gives them authorization to work lawfully in this country. The president then “challenged” Congress to provide a fix to the problem he created—presumably with something like the Dream Act, a pathway to citizenship for immigrants who were brought to the United States as children.

So far, Congress has not moved a solution forward, and the lives of many young immigrants hang in the balance. Failure to act will harm these individuals and their families, of course, as well as the state’s economy, as NJPP’s earlier work has shown. The lack of action also has negative consequences for the state budget.

There are 53,000 young immigrants who were potentially eligible for DACA that call New Jersey home. They have attended our public schools, graduated high school and many have enrolled in our public colleges. And many are our coworkers, our neighbors and loved ones. They currently pay a total of $57 million to state and local taxes each year – an amount that’s sure to shrink if Congress fails to act.

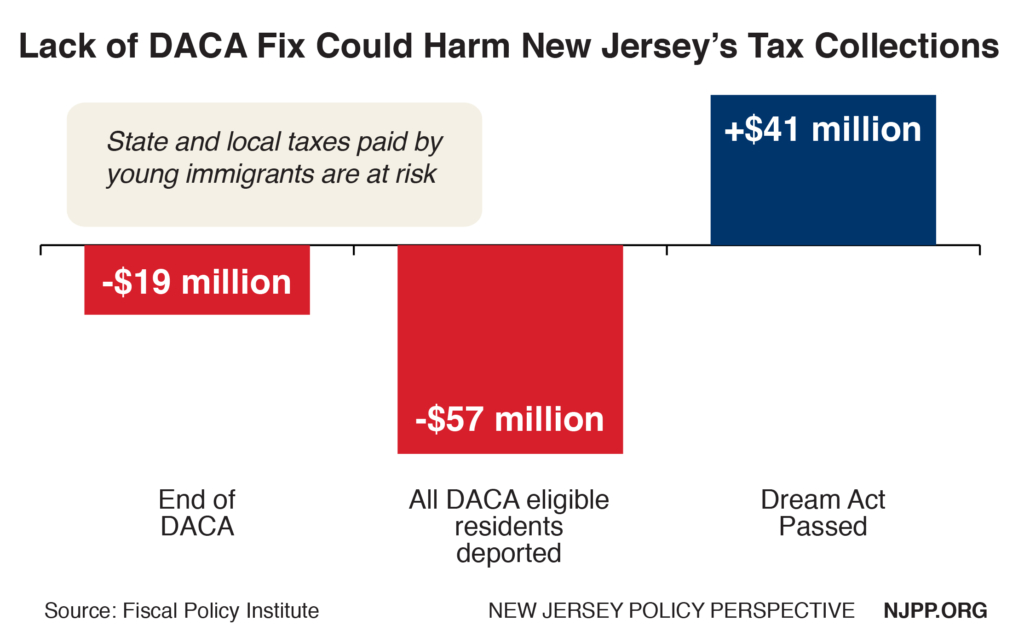

Without the Dream Act, New Jersey can expect to lose at least $19 million in annual tax revenue. That’s the projected loss if DACA recipients stay in the state after losing work authorization, earning lower wages and becoming less likely to file income tax returns.

Of course, New Jersey would lose even more if all DACA-eligible residents were deported. In that case, the state would lose the entire $57 million that’s currently paid each year, and there would be many additional costs to businesses and communities of such a draconian measure.

On the other hand, if Congress passes a Dream Act, these young immigrants would retain or be granted work authorization and a pathway to citizenship – and New Jersey would see a boost of at least $41 million a year in state and local taxes paid. If allowed a pathway to citizenship, immigrant youth would be more likely to advance in a real career, buy a home, or start a business. At stake is $98 million in annual tax revenues, the difference between a $57 million loss and a $41 million gain.