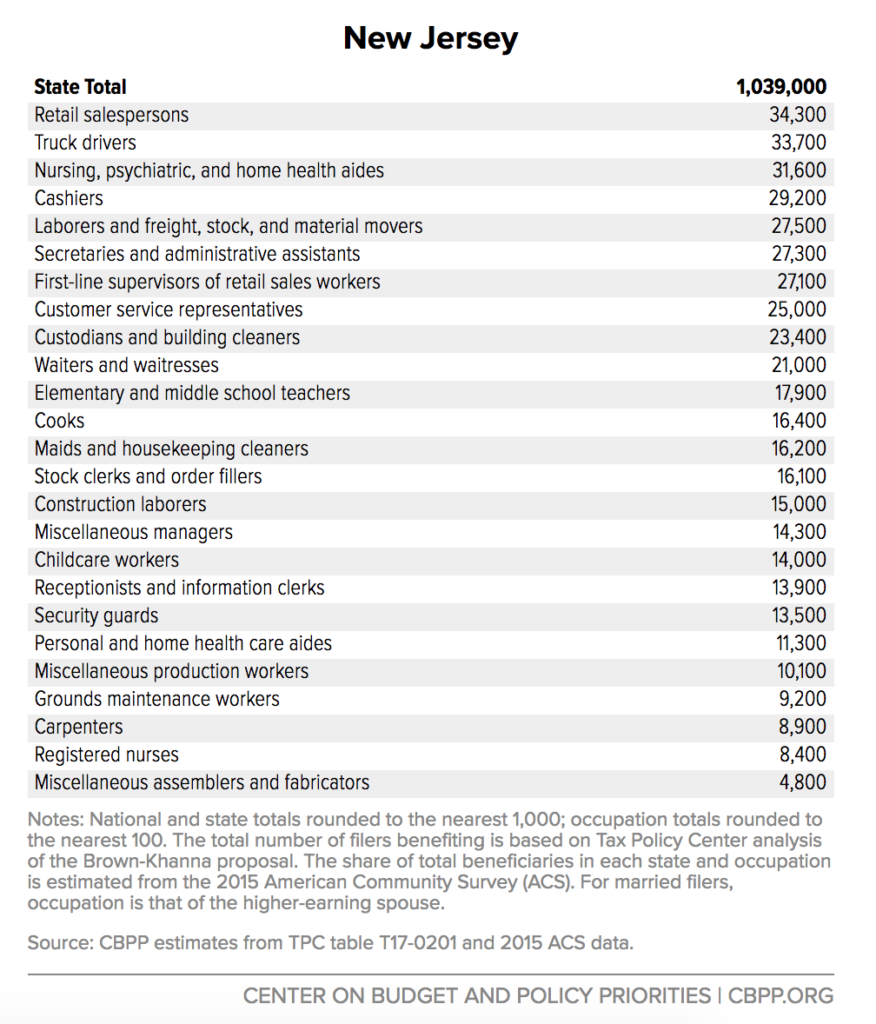

Earlier this fall, U.S. Senator Sherrod Brown and Representative Ro Khanna, joined by 52 House cosponsors, introduced legislation that would expand the earned income tax credit (EITC) and help raise the incomes of 47 million working families and individuals across the country, including over 1 million right here in New Jersey.

Expanding the EITC – a federal tax credit with a long track record of success in helping lift families out of poverty – is the kind of real tax “reform” that could actually boost working-class Americans, unlike the Trump-GOP proposal that delivers the overwhelming majority of its benefits to the top 1 percent. New Jersey’s own Representatives Bonnie Watson Coleman, Donald Norcross, Frank Pallone Jr., and Albio Sires should be applauded for co-sponsoring this proposal, and we urge their colleagues to join them.

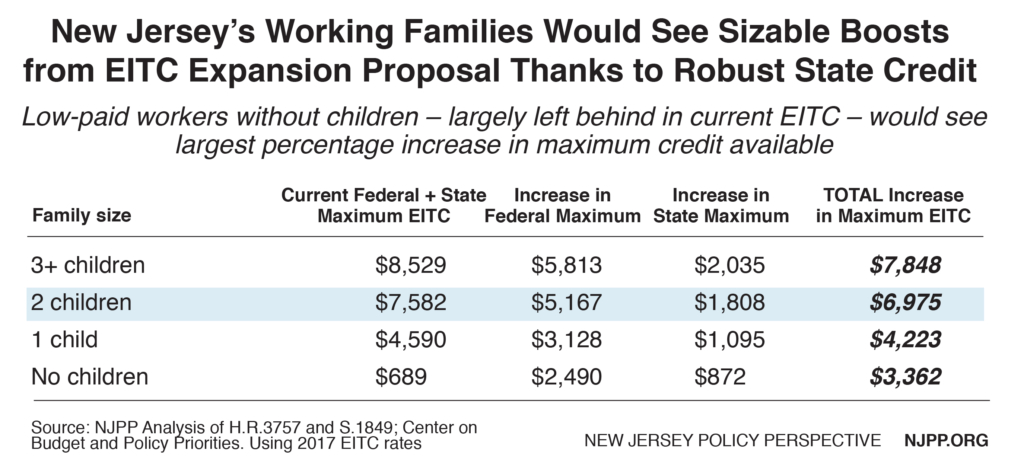

The Brown-Khanna proposal would expand the EITC by lowering the qualifying age for workers without children to 21 from 25 and increasing income eligibility levels for all EITC recipients. For families with children, the average federal credit would be more than $5,600, and the maximum federal credit would nearly double from $3,400 to $6,528; the income ceiling to qualify would increase from about $45,000 to about $65,000. For families without children, the average federal credit would be more than $1,800, and the maximum federal credit would increase nearly six-fold from $510 to $3,000; the income ceiling to qualify would increase from about $15,000 to about $37,000.

Expanding the EITC would also significantly reduce the number of working families and individuals in poverty – effectively doubling the poverty-reducing impact of the federal credit. In 2015, the federal EITC lifted 6.5 million people out of poverty, including about 3.3 million children. The Brown-Khana proposal would lift an additional 8.3 million people out of poverty, including 2.9 million children. Additionally, 16.9 million people would be made less poor, including 5.3 million children. With income inequality at alarming levels across the nation, this would be an important step to reversing course and helping low-income families have a better shot at success.

The working families who receive the EITC in New Jersey would be especially helped by this proposal, since the state has its own version of the credit, which is refundable at 35 percent of the federal credit.

The over 1 million New Jersey workers who would be helped by the proposal are a diverse group, including everyone from retail workers to truck drivers to home health aides and teachers.