Increasing New Jersey’s Earned Income Tax Credit (EITC) will provide over half a million New Jersey working families with a much-needed bump in their take-home pay while giving the state’s economy a boost, according to a new report we released today.

As part of last year’s gas tax increase deal, the New Jersey EITC was increased to 35 percent of the federal credit, up from 30 percent of the federal credit. The change will help hundreds of thousands of New Jersey families this year during tax time, as the change applies to tax year 2016.

Working families across New Jersey will benefit from the governor and legislature’s decision to increase this important tax credit. Now Congress should take the next step in improving the EITC by expanding it for workers not raising children.

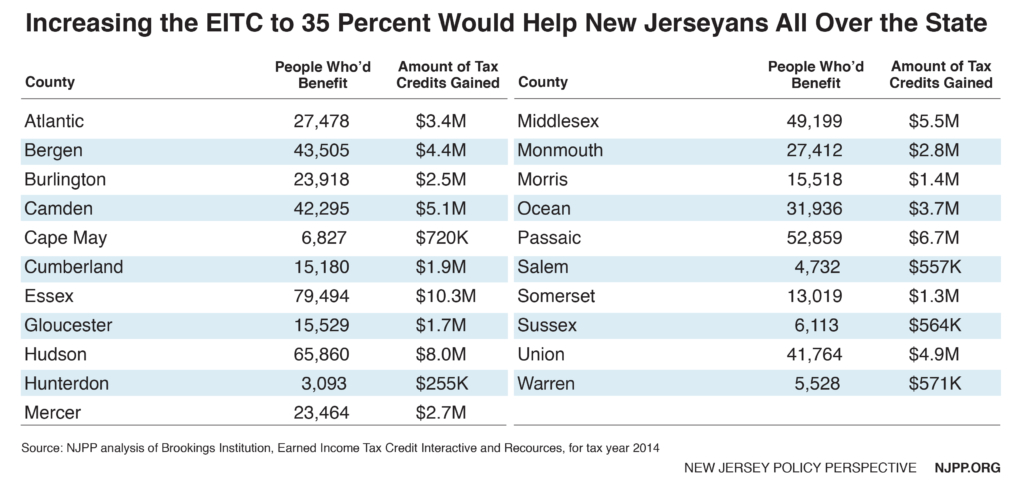

The report includes a county-by-county breakdown of the number of working families affected, and the increase in the EITC to those families, as well as other key information about this vital boost to this important tax credit.

Key findings:

Increasing the EITC to 35 percent will help nearly 600,000 New Jersey families whose members are working but not earning enough to get by in this high-cost state. These workers’ annual take-home pay will increase by an average of $116 (and by as much as $314), bringing the average total of state EITC dollars received to $811 a year

Boosting the EITC will help working people all over New Jersey. All but five of the state’s 21 counties have more than 10,000 households receiving the EITC, and more than half of them (12) have over 20,000 EITC households.

Increasing the EITC will help very poor families the most. Nine out of every ten New Jersey households that receive the EITC earn less than $30,000 a year. About three-quarters earn less than $20,000 and more than half – 61 percent – make less than $15,000.

Increasing the EITC will boost the economy. Increasing the state EITC to 35 percent will generate $69 million in new tax credits each year that will help boost local economies around the state, bringing millions of dollars of spending to almost every county.