All children in a state as wealthy as New Jersey deserve to grow up without fear of homelessness or hunger. Yet many families with children struggle with affordability due to the state’s high cost of living, especially for housing and transportation. More than 1 in 4 New Jersey children live in a low-income household — less than $62,000 for a family of four. To make the state the best place to raise a child, New Jersey’s state budget must prioritize programs that help working families meet the cost of raising children.

New Jersey already has two programs that help families meet those rising costs:

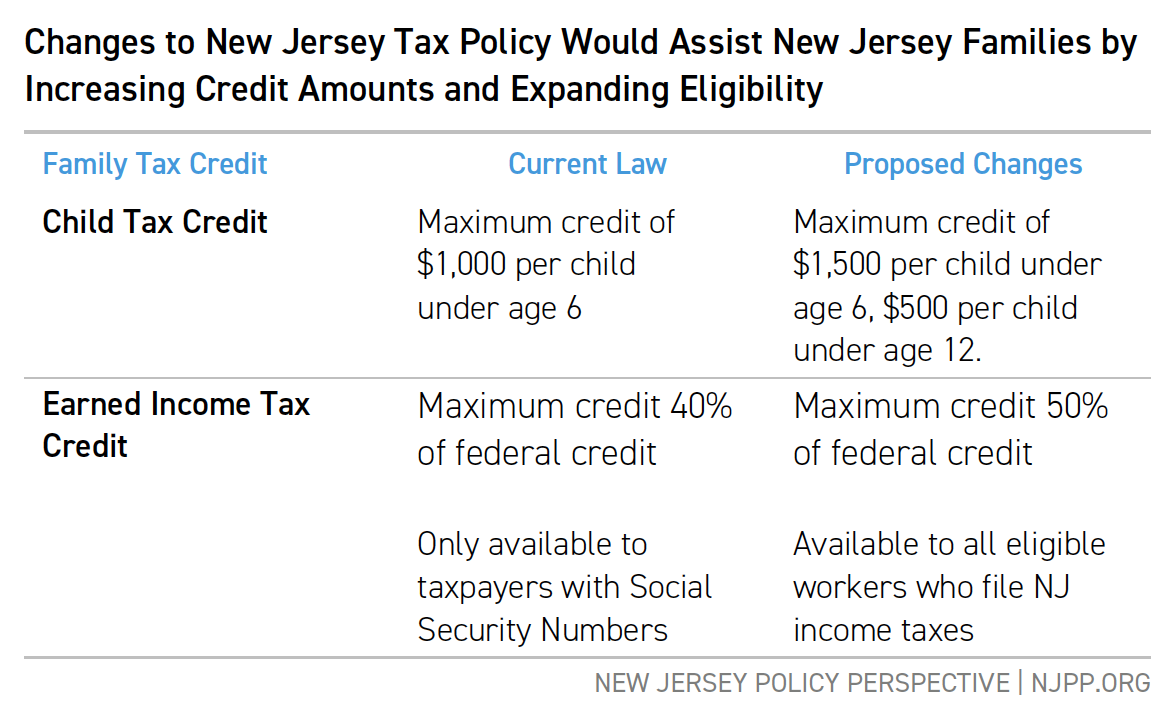

- The Child Tax Credit, which provides families up to $1,000 per eligible child back on their taxes each year, and

- The Earned Income Tax Credit, which offers up to $3,100 for families with children.

However, these tax credits do not reach all families with children who need assistance, due to the children’s age, the tax filer’s citizenship, or other eligibility requirements. Also, the credit amounts should increase to keep up with the rising child-related costs like food and child care.

As a recent NJPP report lays out, New Jersey should expand its Child Tax Credit to children beyond age 5 through 11 and increase the maximum benefit from $1,000 to $1,500 for children under age 6. In addition, expanding the Earned Income Tax Credit by another 25 percent and increasing eligibility for all workers who file taxes.

These changes would put hundreds of dollars back into families’ pockets, helping make New Jersey the best place to raise a family by providing an estimated $432 million to low- and moderate-income households. By amplifying the antipoverty effects of these critical lifelines, the state can help more households meet basic needs and raise the standard of living for working families.

These tax credits can help address the affordability crisis for families in the most straightforward way – by giving them cash to help pay critical costs. Working family tax credits have a long track record of reducing poverty and helping families meet basic needs. New Jersey’s budget for fiscal year 2026 should include expanded funding for working family tax credits to put money back in families’ pockets and make good on the state’s promise to its children.