To read a PDF version of this report, click here.

Immigrants who are undocumented pay a share of sales, property, payroll, and income taxes that help support public services for all New Jersey residents. Nevertheless, undocumented workers and their families have been systematically excluded from many of the state and federal programs that they help fund, including unemployment insurance benefits.[1] In the midst of a global pandemic, this exclusionary practice will only push immigrants who are undocumented further behind. Undocumented immigrants are not only disproportionately at risk of health impacts due to the coronavirus,[2] but they are also overrepresented in the service sector industries at risk of the most job loss.[3] In order for all New Jerseyans to recover from the current crisis, it is critical that lawmakers address barriers to relief and assistance for immigrants. Anything short of that will only deepen existing structural inequities and slow the state’s recovery.

New Jersey is facing unprecedented job loss as a result of COVID-19,[4] with 1.2 million claims for unemployment benefits since the onset of the pandemic.[5] Unemployment insurance, which provides financial support to people who lose their jobs through no fault of their own, has been essential to helping New Jersey residents meet their financial obligations during this challenging time.[6] Unemployment insurance systems, which are funded by unemployment insurance trust funds, are financed by a payroll tax that employers pay to state and federal governments on behalf of all workers.[7] While considerable contributions to unemployment insurance funds are made based on the work of undocumented immigrants, these workers are ineligible[8] to collect unemployment benefits.[9]

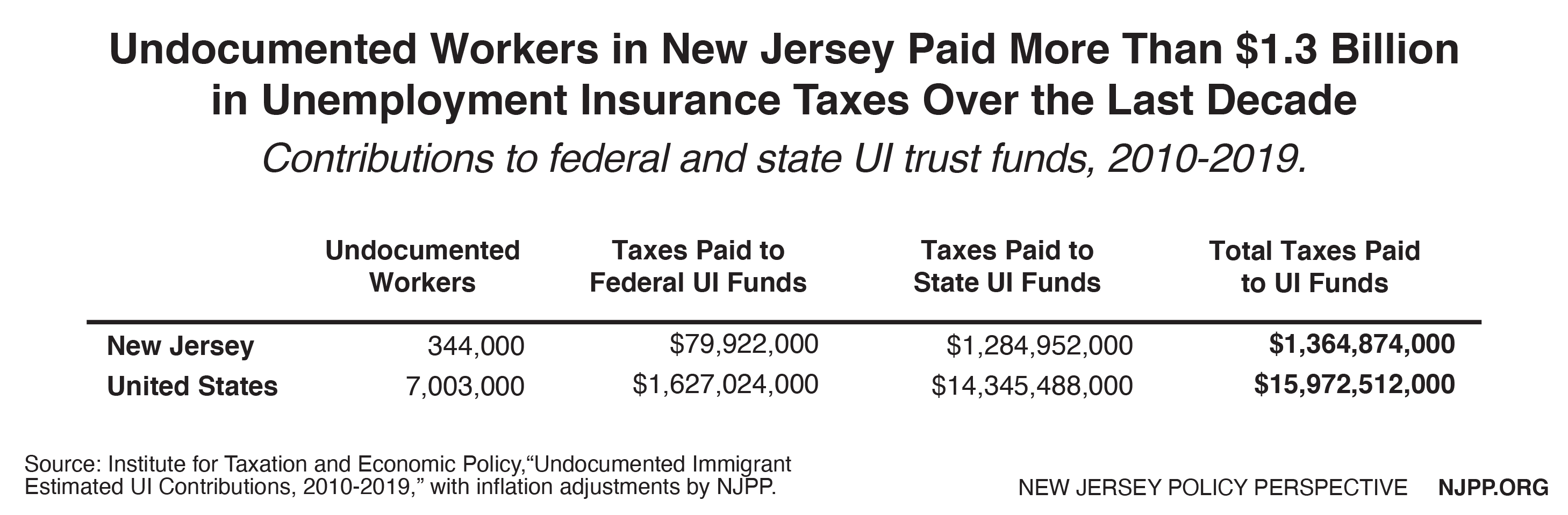

Over the past ten years, unemployment insurance taxes paid based on undocumented immigrants’ work in New Jersey added more than $1.36 billion to state and federal unemployment insurance trust funds, according to a recent analysis[10] conducted by the Institute on Taxation and Economic Policy and the Fiscal Policy Institute.[11]In addition to contributions to unemployment insurance taxes, undocumented immigrants pay sales taxes, income taxes, and other taxes. Overall, New Jersey residents who are undocumented contribute approximately $587 million in state and local taxes each year.[12]

While many undocumented immigrants experience the same health and employment challenges resulting from COVID-19 as other workers, the vast majority of undocumented immigrants also face barriers to other forms of relief. For example, while federal lawmakers made stimulus payments available to most residents earning under $99,000 through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, taxpayers who filed using an Individual Taxpayer Identification Number (ITIN) were intentionally excluded from this form of relief. As a result, an estimated 686,000 New Jersey residents, including immigrant workers and their family members, many of whom are U.S. citizens, were ineligible for these stimulus payments.[13] Undocumented immigrants are also generally ineligible for safety net programs, such as food assistance under the Supplemental Nutrition Assistance Program (SNAP), cash assistance through Temporary Assistance for Needy Families (TANF), General Assistance, and most forms of public health insurance such as Medicaid.[14]

Philanthropic and grassroots organizations have taken emergency steps to address critical gaps in federal and state government responses by creating or contributing to pandemic relief funds.[15] Although these funds are helpful, these efforts are limited and are far from the scale of resources needed to address the current crisis. Rather than shifting the responsibility of responding to structural inequities onto individuals, lawmakers should take action to address gaps they helped create. One example of such action is proposed state legislation, S2480, which would provide a one-time payment to certain New Jersey residents who pay taxes using an ITIN.[16] While this is an important step and would benefit up to 35,000 residents — or one quarter of ITIN holders — this bill alone will not meet the needs of New Jersey’s immigrant families, many of whom are now in their third month without relief.[17] In addition, the maximum amount that would be provided per taxpayer in this proposal is still less than the amount afforded to most New Jersey residents through other forms of relief, including the stimulus payments and unemployment insurance.[18]

While the federal government has intentionally excluded immigrants who are undocumented from many forms of relief, New Jersey lawmakers have the opportunity to take responsibility for the health and safety of all of the state’s residents, regardless of immigration status. One concrete way to address gaps in response to the pandemic is to create a program for undocumented immigrants excluded from unemployment insurance, by way of providing weekly benefits similar to those afforded to other unemployed New Jerseyans. The cost of a program parallel to unemployment insurance would depend on the unemployment and participation rates. While the unemployment rate in New Jersey is 15.3 percent[19], many unemployed immigrants who are undocumented may be hesitant to access this type of program due to the chilling effect of anti-immigrant policies.[20] If, for example, 10 percent of the state’s 344,000 undocumented workers in the labor force in New Jersey[21] accessed a benefit comparable to what other unemployed New Jerseyans receive on average each week — the average weekly unemployment benefit in New Jersey in 2019 was $461.53[22] — the cost would be approximately $69 million per month.

New Jersey could further address gaps in the federal government’s pandemic response by establishing a state program that mirrors the Federal Pandemic Unemployment Compensation (FPUC), but is available to all workers, regardless of their documentation status. Under the CARES Act, FPUC, which went into effect in April and is set to expire at the end of July, provides an additional $600 weekly benefit to workers who are collecting unemployment insurance.[23] If 10 percent of undocumented immigrants in the workforce accessed the program weekly, the cost would be $89 million per month, and $358 million for a four month period.

While low-wage workers face disproportionate health and economic consequences from the coronavirus pandemic without benefiting from the systems they help fund, many of the wealthiest corporations and individuals are profiting from the current crisis.[24] Not only have the fortunes of many of the wealthiest increased during the pandemic, but those who are the most well-off also pay a disproportionately small amount in taxes.[25] Rather than compounding wealth inequality by giving state resources to those who do not need them, New Jersey has the opportunity to create programs and policies that reflect the state’s values.

Investing in the health and well-being of New Jersey’s families and workers — who have been paying into and yet are excluded from systems that provide relief and support — would not only promote the safety and well-being of these workers and their families, but also strengthen the state’s recovery from the current pandemic. By addressing gaps and inequities in responses to the current crisis, lawmakers can better protect the health and wellbeing of all New Jerseyans.

End Notes

[1] Make the Road New Jersey. Essential and Excluded: A Survey of Immigrants in New Jersey under COVID-19”. (2020). Accessed May 26, 2020. https://www.maketheroadnj.org/report_essential_and_excluded

[2] Gelatt, Julia. Immigrant Workers: Vital to the U.S. COVID-19 Response, Disproportionately Vulnerable. March 2020. Accessed May 26, 2020. https://www.migrationpolicy.org/research/immigrant-workers-us-covid-19-response;

[3] McKoy, Brandon, J. Fine, and T. Vachon. 2020. Undocumented Workers in Service Sector Most Likely to be Harmed by COVID-19. Accessed May 26, 2020. https://www.njpp.org/wp-content/uploads/2020/05/NJPP-Policy-Brief-Service-Sector-Industries-Most-Likely-to-be-Harmed-by-COVID-19.pdf

[4] Rodriguez, Nicole. COVID-19 Unemployment Claims Will Soon Surpass Total Claims from the Great Recession. (May 2020). New Jersey Policy Perspective. Accessed May 27, 2020. https://www.njpp.org/economic-opportunity-2/covid-19-unemployment-claims-will-soon-surpass-total-claims-from-the-great-recession#_edn4 on May 27, 2020.

[5] New Jersey Department of Labor and Workforce Development. “NJ Unemployment Claims, Payments Hit New Historic Highs”. (June 11, 2020) Accessed on June 16, 2020. https://www.nj.gov/labor/lwdhome/press/2020/20200611_paymentsupdate.shtml

[6] New Jersey Department of Labor and Workforce Development, Division of Unemployment Insurance. “What is Unemployment Insurance?”. Accessed on May 28, 2020. https://myunemployment.nj.gov/labor/myunemployment/before/about/

[7] Tax Policy Center. “Key Elements of the US Tax System: What is the unemployment insurance trust fund, and how is it financed?” Accessed on June 1, 2020. https://www.taxpolicycenter.org/briefing-book/what-unemployment-insurance-trust-fund-and-how-it-financed

[8] To qualify for unemployment insurance, workers generally must have been authorized to work during the base period (the period during which the worker performed the work), at the time that they apply for benefits, and throughout the period during which they are receiving benefits.

[9] National Employment Law Project. “Immigrant Workers’ Eligibility for Unemployment Insurance”. Accessed on March 31, 2020. https://www.nelp.org/publication/immigrant-workers-eligibility-unemployment-insurance/

[10] Institute on Taxation and Economic Policy. (May 2020) “Undocumented Immigrant Estimated UI Contributions 2010-2019.”

[11] This estimate, which was generated by the Institute on Taxation and Economic Policy and the Fiscal Policy Institutes, assumes that half of undocumented immigrants employed in New Jersey are paid on the book, following the approach of the National Academy of Sciences study on fiscal impacts of immigrants. Further details on this methodology are available in the Fiscal Policy Institute’s brief: Unemployment Insurance Taxes Paid for Undocumented Workers in NYS, available here http://fiscalpolicy.org/wp-content/uploads/2020/05/UI-taxes-and-undocumented-workers.pdf

[12] Nava, Erika. “Undocumented Immigrants Pay Taxes: County Breakdown of Taxes Paid.” New Jersey Policy Perspective. Accessed June 11, 2020. https://www.njpp.org/blog/undocumented-immigrants-pay-taxes-county-breakdown-on-taxes-paid-in-2017

[13] Migration Policy Institute. 2020. “Mixed-Status Families Ineligible for CARES Act Federal Pandemic Stimulus Checks.” Accessed May 29, 2020. https://www.migrationpolicy.org/content/mixed-status-families-ineligible-pandemic-stimulus-checks.

[14] Protecting Immigrant Families. “Immigrant Eligibility for Public Programs During COVID-19.” Accessed June 5, 2020. https://protectingimmigrantfamilies.org/immigrant-eligibility-for-public-programs-during-covid-19/.

[15] Council of New Jersey Grantmakers. 2020. “NJ Focused Response Funds.” Accessed May 28, 2020. https://www.cnjg.org/nj-focused-response-funds

[16] State of New Jersey 219th Legislature. Senate, No. 2480. Retrieved from https://www.njleg.state.nj.us/2020/Bills/S2500/2480_I1.PDF.

[17] Ibid.

[18] Ibid.

[19] New Jersey Department of Labor and Workforce Development. 2020. “Pandemic Leads to Historic Job Losses in April Unemployment Rate Surges to 15.3 Percent.” http://state.nj.us/labor/lpa/pub/emppress/pressrelease/prelease.pdf

[20] Bernstein, Hamutal, D. Gonzalez, M. Karpman, and S. Zuckerman. “Immigrant Families Continued Avoiding Public Benefits in 2019.” Washington, DC: Urban Institute. Accessed on June 15, 2020. https://www.urban.org/research/publication/amid-confusion-over-public-charge-rule-immigrant-families-continued-avoiding-public-benefits-2019

[21] Institute on Taxation and Economic Policy. (May 2020) “Undocumented Immigrant Estimated UI Contributions 2010-2019.”

[22] United States Department of Labor. Monthly Program and Financial Data. Accessed June 4, 2020. https://oui.doleta.gov/unemploy/claimssum.asp

[23] U.S. Department of Labor. “Unemployment Insurance Relief During COVID-19 Outbreak.” Accessed June 8, 2020. https://www.dol.gov/coronavirus/unemployment-insurance.

[24] Chris Collins, Omar Ocampo, and Sophia Paslaski. “Billionaire Bonanza 2020: Wealth Windfalls, Tumbling Taxes, and Pandemic Profiteers.” (2020). Institute for Policy Studies. Accessed on May 29, 2020. https://ips-dc.org/billionaire-bonanza-2020/

[25] Ibid.