To read a PDF version of this report, click here.

SALT ‘fixes’ would mostly help the state’s most well-off; plans to make state income tax fairer should move forward

The GOP tax plan is now law, and states are grappling with how the enormous federal tax cuts will play out for their residents. The plan delivers lopsided cuts to the wealthiest Americans and large corporations while teeing up deep and devastating budget cuts that would harm working families across New Jersey. But despite the grave threat to progress and opportunity this tax law presents, New Jersey lawmakers seem most concerned about a relatively narrow provision of the plan: the new federal limit on the deductibility of state and local taxes (SALT). Households that itemize deductions are now only allowed to deduct up to $10,000 in combined SALT when calculating their taxable income for federal taxes.

While “workarounds” are under discussion to evade the cap – including shifting the state income tax to a payroll tax[1] or attempting to treat property tax payments as charitable donations[2] – lawmakers have also voiced concern about advancing long-held plans to make the state’s income tax fairer while raising hundreds of millions of dollars for schools and property tax relief.[3]

There’s no reason not to try to design workarounds that restructure the state tax code to help New Jersey taxpayers avoid the federal cap on SALT deductions, but these workarounds should not be the primary focus of lawmakers concerned about the well-being of the state’s middle-class and working families. That’s because these workarounds would disproportionately benefit the wealthiest households in New Jersey, to make no mention of the fact that the Trump administration is unlikely to allow them to stand.

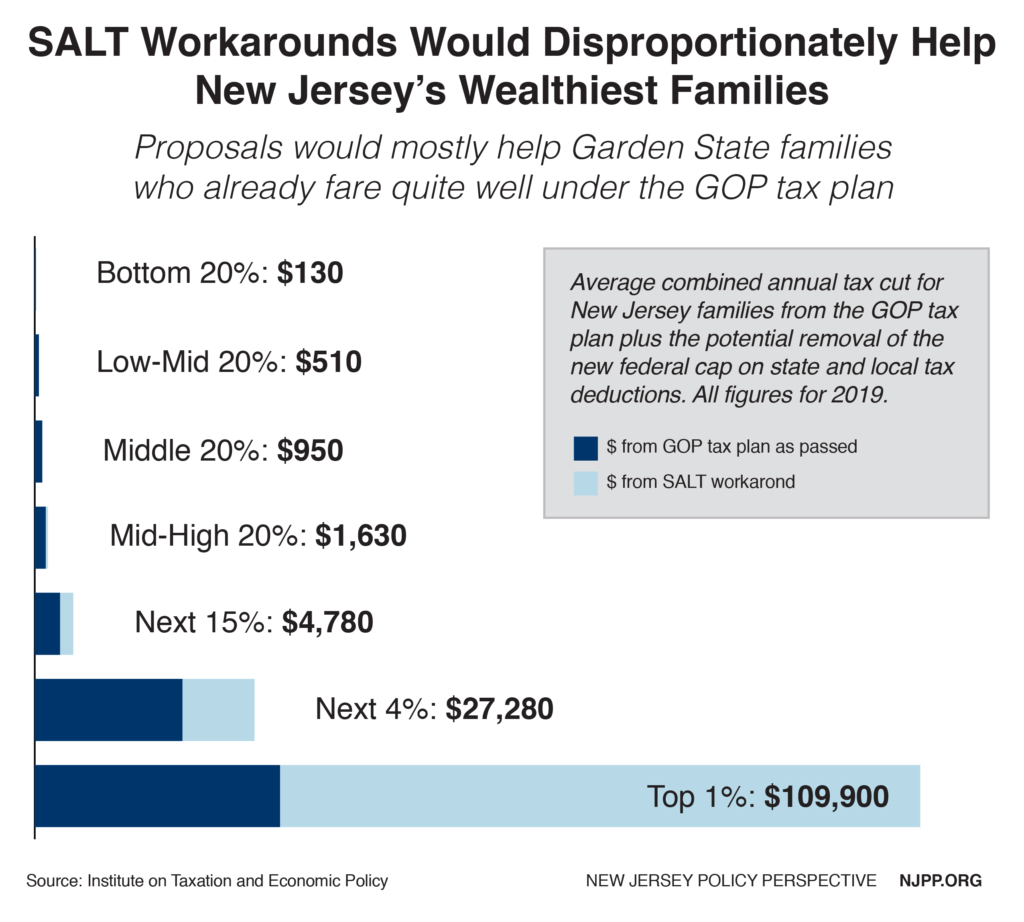

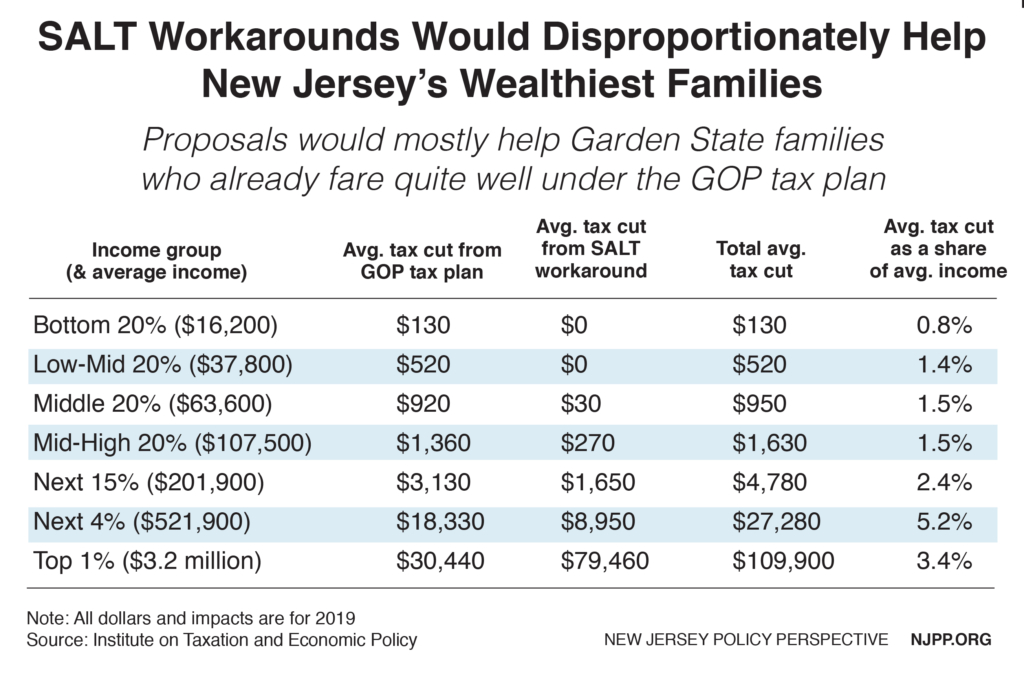

- The wealthiest 1 percent of families (those with annual incomes over $1.1 million) would receive 54 percent of the benefit from a SALT workaround. Nearly every family in the top 1 percent – 99.9 percent of them, in fact – would benefit, with an average tax cut of $79,460 a year, or 2.5 percent of their average incomes.

- The bottom 80 percent of families (those with annual incomes under $142,000) would receive less than 1 percent of the benefit from such a policy. Just 10 percent of these families would benefit at all, and their average tax cut would be $75 a year, or less than 0.1 percent of their average incomes.

To the extent that lawmakers ought to be considering these SALT workarounds, they should be doing so only as part of a comprehensive package responding to the federal tax plan – one that includes proposals to raise revenue from the corporations and wealthy interests who will most benefit from the federal plan. At the very least, shying away from bold tax policy – as suggested by some legislative leaders – should not be part of the equation.

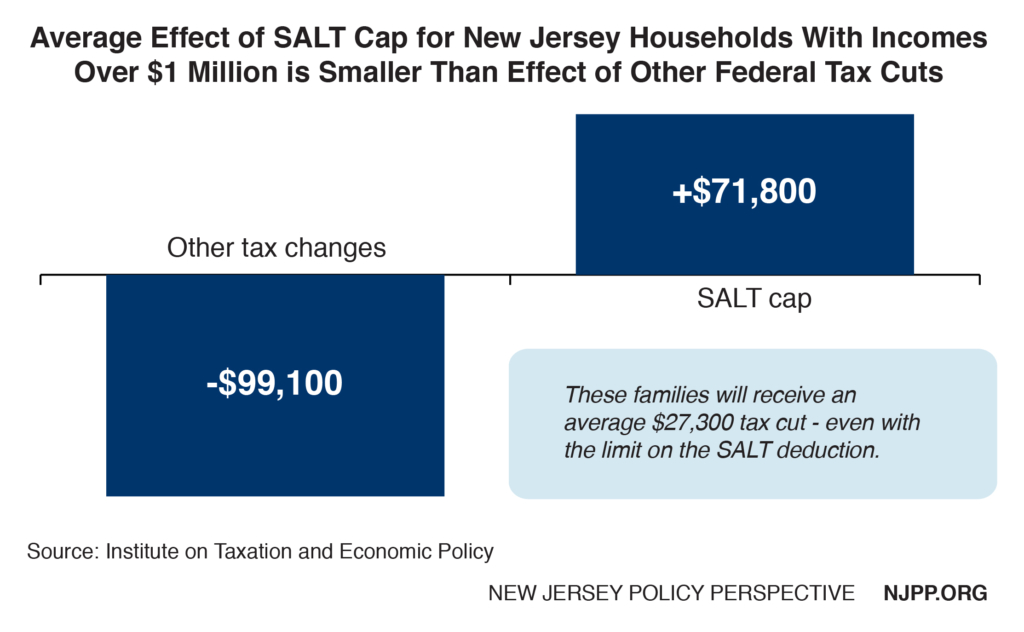

The truth is New Jersey’s highest-income households – those with annual incomes over $1 million – get a windfall from the new tax plan, even with the new limit on SALT deductibility. That’s because for New Jersey’s wealthiest families, the average federal tax cuts from other changes in the law are notably larger than the average size of the impact from the loss of SALT deductibility.

Specifically, the long-term benefit of slashing the corporate rate nearly in half will overwhelmingly go to wealthy stockholders rather than the average worker.[4] Eighty percent of the value of the total stock market is concentrated at the top while fewer than half of all Americans own any stock. Further, the big tax cuts for corporations are permanent, while nearly all the smaller tax cuts and changes for individuals and families are temporary – making the overall impact of the GOP tax plan even more favorable to New Jersey’s wealthiest families than this fact sheet illustrates (since it uses 2019 impact data).

Households with incomes over $1 million – with a projected average income of $2.6 million in 2019 – will receive a combined $1.4 billion tax cut with an average tax cut of $27,300 per household, even with the SALT deduction limits factored in.

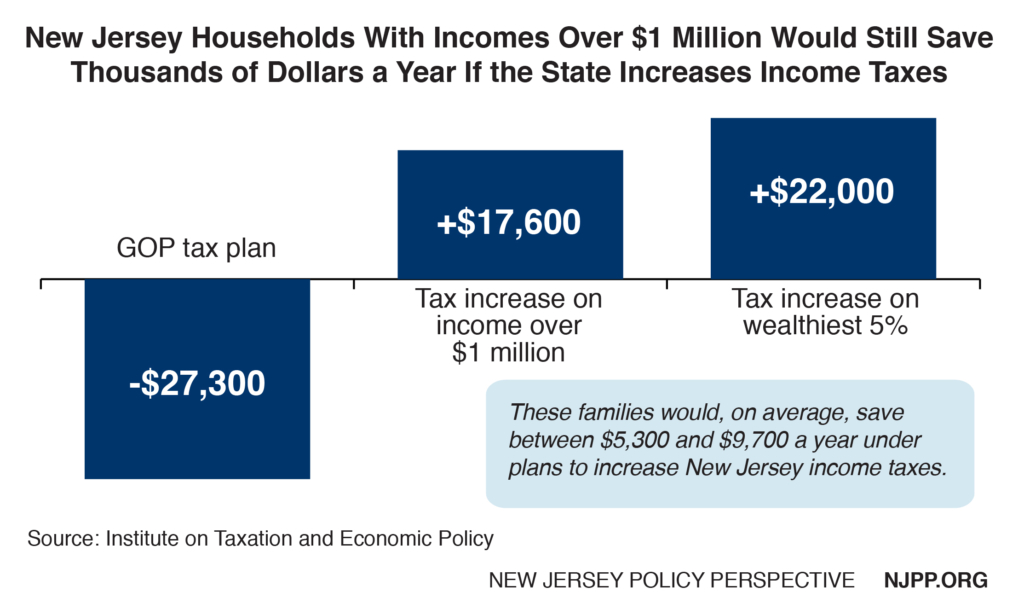

Given this windfall for the state’s wealthiest families and the state’s precarious fiscal condition there is no reason for legislative leaders to back off of long-held plans to make New Jersey’s income tax fairer and raise much-needed new revenue to invest in schools and property tax relief.

In fact, under a proposed overhaul of New Jersey’s income tax that would, in all, raise over $1 billion in new revenue while increasing taxes on only the 5 percent of highest-income families,[5] households with $1 million or more in taxable income would be paying an average of $22,000, more a year in New Jersey taxes. And under the decidedly less bold plan to raise the top tax rate to 10.75 percent on incomes over $1 million, households with $1 million or more in taxable income would be paying an average of $17,600 more a year in New Jersey taxes. Either way, these millionaire households would still come out well ahead from the combined effect of the federal tax plan and a state income tax increase.[6]

What’s more, these families at the top of New Jersey’s income brackets are already paying the lowest share of their annual average income to state and local taxes in the state (7.1 percent versus 9.1 percent for middle-income families and 10.7 percent for the lowest income quintile).[7] And they have also enjoyed over $4 billion in cumulative tax cuts since 2010, at a time when these households have reaped the overwhelming majority of any economic gains in the state.

Endnotes

[1] New York State Department of Taxation and Finance, Preliminary Report on the Federal Tax Cuts and Jobs Act, January 2018.

[2] Congressman Josh Gottheimer, Gottheimer, Murphy Offer Tax Cut Plan, January 2018.

[3] See, for example, New York Times, Democrats in High-Tax States Plot to Blunt Impact of New Tax Law, December 2017.

[4] Joint Committee on Taxation (JCT), Modeling the Distribution of Taxes on Business Income, JCX-14-13, October 2013.

[5] New Jersey Policy Perspective, Reforming New Jersey’s Income Tax Would Help Build Shared Prosperity, September 2017.

[6] Federal tax plan changes affecting individuals are modeled using ITEP’s microsimulation tax model, which generates tax estimates for a sample of representative taxpayer records in each state. For more information about the model, visit https://itep.org/itep-tax-model-simple/

[7] Institute on Taxation and Economic Policy, Who Pays: A Distributional Analysis of the Tax Systems in All Fifty States (2015 edition).