To read a PDF version of this report, click here.

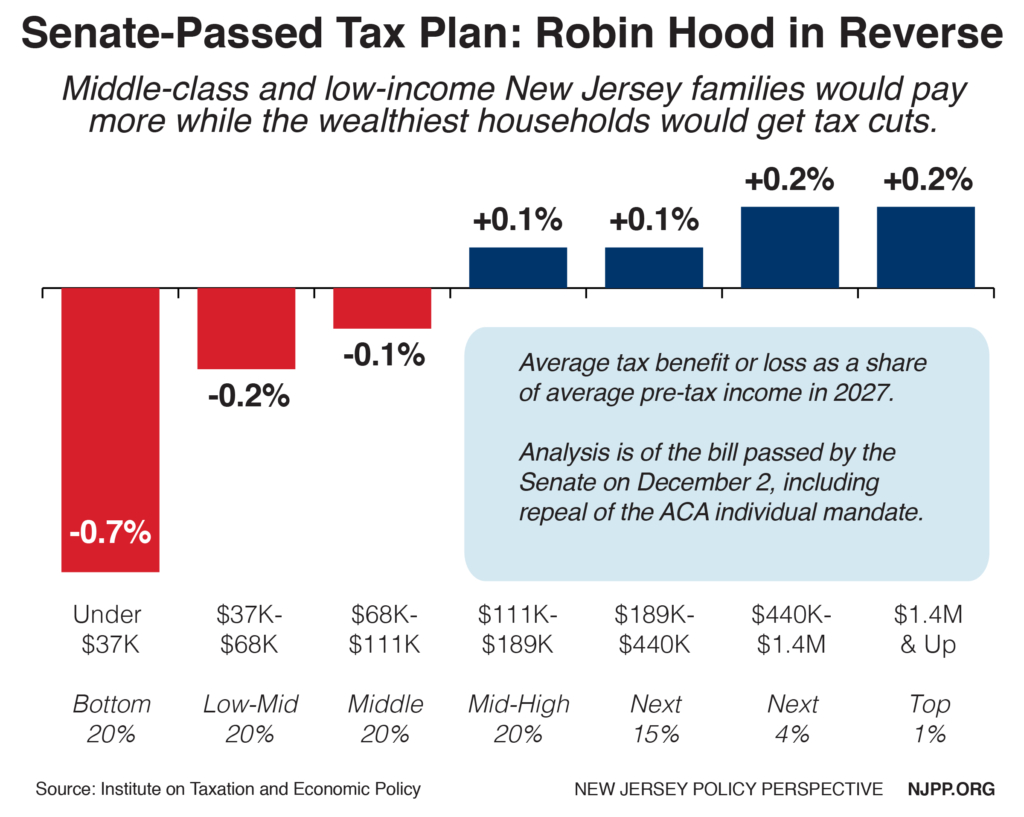

The federal tax proposal passed by the U.S. Senate on December 2 would raise taxes for the average middle-class and low-income New Jersey family while cutting taxes for wealthier families and for large corporations. At the same time, it would increase the number of New Jerseyans without health insurance by 340,000 by 2027 thanks to the repeal of the Affordable Care Act’s individual mandate.[1] (Unless otherwise noted, all data in this Fast Facts is on the impact in the year 2027, once the plan is fully phased in.)

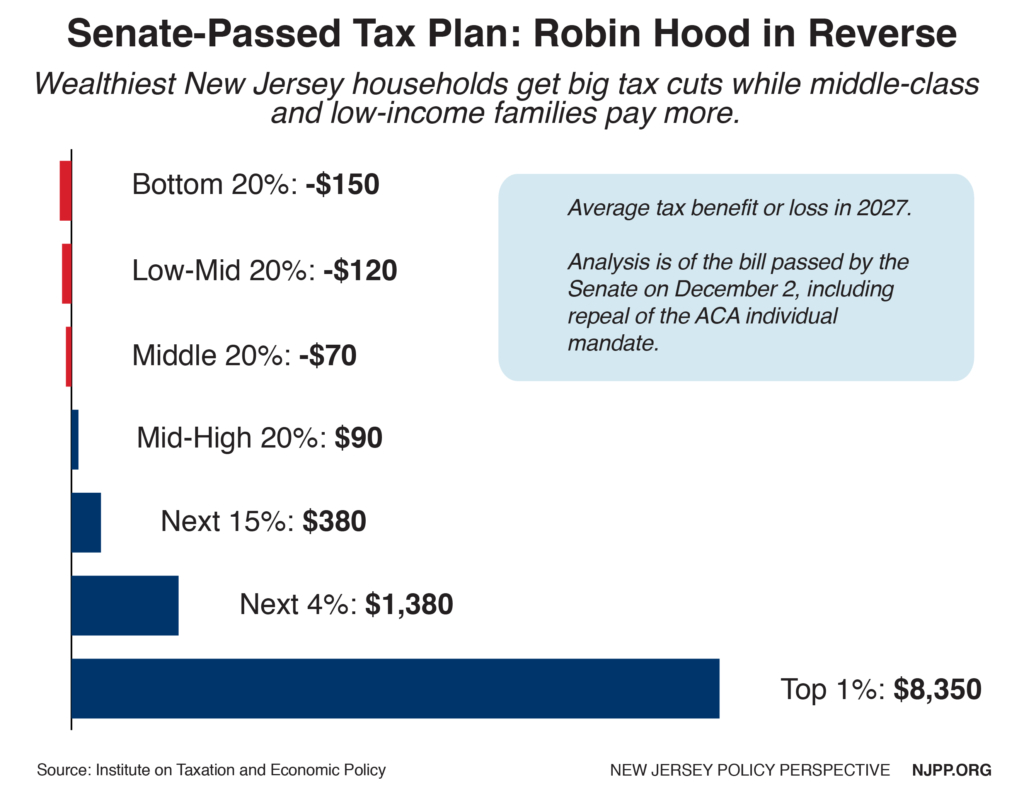

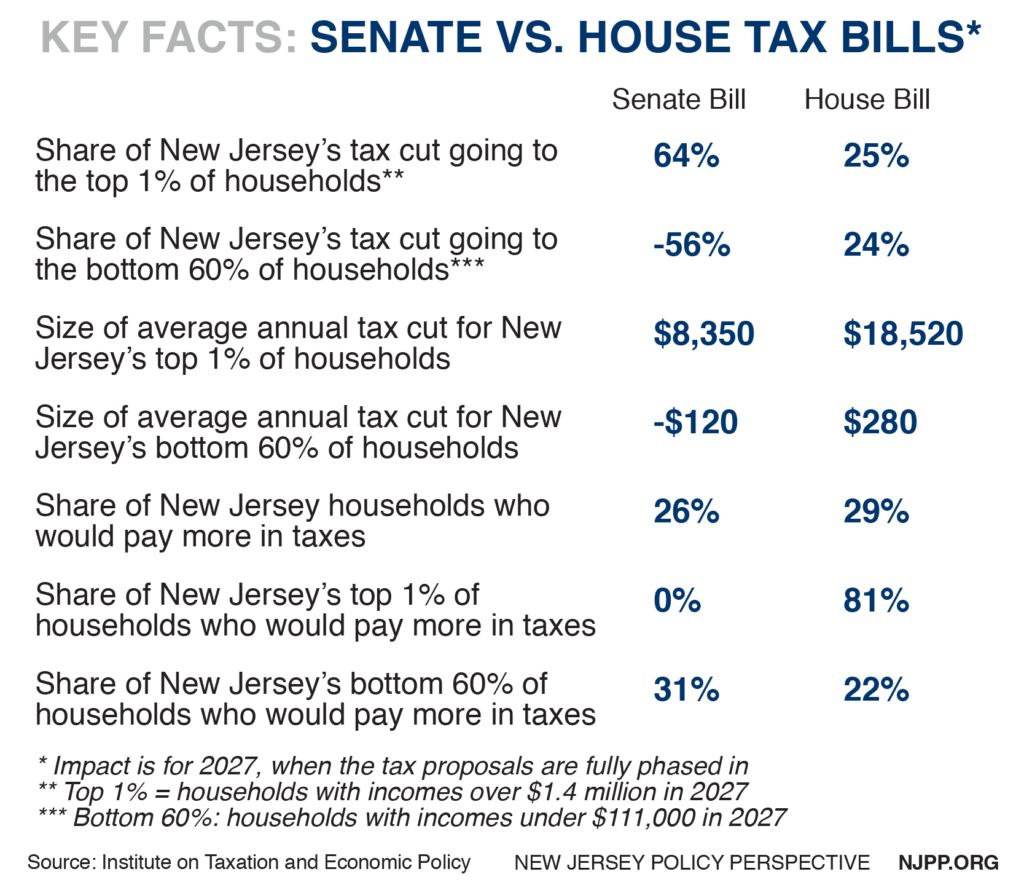

New Jersey households with incomes over $1.4 million (the top 1 percent) would receive an average $8,350 tax cut while the bulk of Garden State families (the bottom 60 percent, or those with incomes under $111,000) would see a tax hike averaging $120.[2] Taken all together, those families in the top 1 percent would receive 64 percent of the state’s share of the tax cut – $378.8 million in total – while the bottom 60 percent would, together, receive less than 0 percent of the tax cut, since they’d pay a total of $333.7 million more in taxes under the plan. In all, about 1 in 4 New Jersey taxpayers (26 percent) would see a tax hike under the Senate-passed bill.[3]

The plan is a clear example of Robin Hood in Reverse, as it gives the largest average tax hikes to New Jersey’s poorest families while showering the state’s very wealthiest families with the biggest tax cuts. While just 1.6 percent of the state’s wealthiest 5 percent of families would see a tax hike, 3 in 5 families in the bottom 60 percent would.

By just about every measure, the Senate-passed bill is worse for New Jersey’s working-class and middle-class families than the House bill, which was quite damaging for these families already.

The pain for New Jersey’s working families does not end with the direct impact of this tax bill, unfortunately. In fact, the tax bill is step one of Congressional Republicans’ two-step tax and budget agenda[4]: enact costly tax cuts now that are heavily skewed toward wealthy households and profitable corporations, then use the cost of those tax cuts and their negative impact on the federal deficit as a rationale to cut public services, programs and investments on which all Americans – particularly low- and moderate-income residents – rely.[5]

State and Local Tax Deductions Remain On the Chopping Block

The Senate-passed bill – like the House-passed bill – eliminates taxpayers’ ability to deduct state/local income or sales taxes paid while capping the amount of property taxes one could deduct at $10,000. A total of 41 percent of Garden State households currently file using these deductions – the third highest share of all states, after Maryland and Connecticut. Slightly more New Jerseyans claim the income or sales tax deduction (1.8 million) than claim the property tax deduction (1.6 million). Garden State households deduct a total of $32.2 billion in state and local taxes each year, the third highest dollar amount after California and New York.[6]

While the property tax provision has been pitched as a “compromise” to win over reluctant lawmakers from New Jersey and other similar states, an estimated 54 percent of Garden State taxpayers who currently claim the property tax deduction would no longer do so under the Senate-passed bill. And those most likely to lose the deduction are middle-class families – in fact, 60 percent of current middle-income claimants of the property tax deduction would lose it, while just 1 percent of current high-income claimants would.[7]

That’s because even though they’d still technically be able to take the property tax deduction, many would choose not to because the combination of itemized deductions (which would no longer include state income and sales taxes) would be smaller than the standard deduction. This would be a bad deal for many taxpayers because even as the Senate-passed bill increases the standard deduction, it eliminates personal exemptions would be eliminated. Even if the standard deduction were tripled (and it’s not even doubled under the Senate-passed bill), a significant portion of families that now itemize their deductions would still end up with tax increases.[8]

In all, New Jerseyans would likely deduct nearly $27 billion less in state and local taxes under the Senate-passed bill than they do now.[9]

Endnotes

[1] NJPP analysis based on Congressional Budget Office estimates using weighted average for employer-based, marketplace, and Medicaid expansion coverage.

[2] Institute on Taxation and Economic Policy Microsimulation Tax Model, December 2017. Model includes all major components of the tax bill, including personal income tax changes, changes to deductions, corporate tax changes and estate tax changes. Full dataset and methodology available at https://itep.org/housesenatetaxplans-dec17/

[3] This report’s key findings on the distribution of the tax plan focus on average and total tax hikes or cuts by income group. This explains why, for example, the bottom 60 percent would, on average, and, in total, pay more in taxes, even while there are individual taxpayers inside that income group who would pay less – the tax cuts they receive are just overwhelmed by the tax hikes that others in the same income group would see.

[4] Center on Budget and Policy Priorities, Budget Briefs: The Republican Two-Step Fiscal Agenda, November 2017. https://www.cbpp.org/budget-briefs-the-republican-two-step-fiscal-agenda

[5] The Washington Post, GOP eyes post-tax-cut changes to welfare, Medicare and Social Security, December 2017. https://www.washingtonpost.com/news/wonk/wp/2017/12/01/gop-eyes-post-tax-cut-changes-to-welfare-medicare-and-social-security/?utm_term=.7f251e2e56bf

[6] New Jersey Policy Perspective, Fast Facts: Millions of New Jerseyans Deduct Billions in State & Local Taxes Each Year, November 2017. https://www.njpp.org/budget/fast-facts-millions-of-new-jerseyans-deduct-billions-in-state-local-taxes-each-year

[7] Ibid 2

[8] Government Finance Officers Association, Impact of Eliminating the State and Local Tax Deduction (Updated with 2015 IRS Data), 2017. http://www.gfoa.org/sites/default/files/RCC%20Report%20on%20SALT%20Deduction-092017_Final.pdf

[9] NJPP analysis using data and estimates from Ibid 2 and actual dollar amounts currently deducted by New Jersey households from Ibid 6