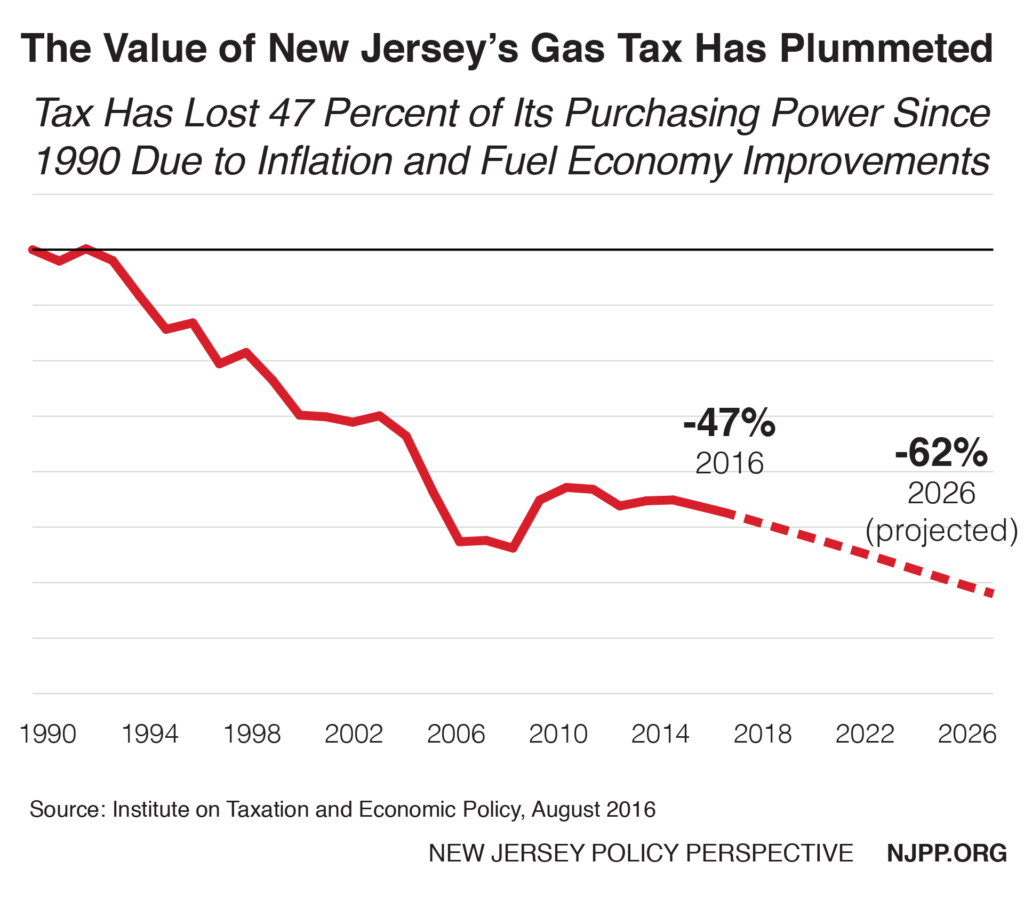

Having the second lowest gasoline tax rate in the country may be great on drivers’ pocketbooks but it’s been devastating for the fund that keeps New Jersey’s roads, bridges and mass transit in shape. In fact, the purchasing power of New Jersey’s gas tax has dropped by 47 percent since the last time it was increased in 1990, costing the state over $10 billion in lost revenue over the past 26 years, according to a new analysis by the Institute on Taxation and Economic Policy.

And the need to replenish the Transportation Trust Fund will only grow in the years ahead if New Jersey fails to raise the gas tax. By 2026, the gas tax will have lost 62 percent of its value.

Enacting an increase in the gasoline tax rate could reverse this decline. But as the governor and lawmakers remain unwilling to raise the gas tax without some sort of tax break trade-off, the gas tax as it stands now will continue to raise insufficient level of revenue over time for two reasons.

The escalating cost of maintaining and building roads, bridges and mass transit has reduced the amount of work that can be done with each dollar raised by the gas tax and the gas tax collections per mile driven has decreased due to more fuel-efficient cars on the road.

Simply reversing this decline would require increasing the state’s gasoline/diesel tax rates by 13.8/16.7 cents, respectively, in 2017. If lawmakers want to increase the purchasing power of the gas tax beyond its 1990 levels, the tax rate increases would need to be even larger.

But in the face of inevitable improvements in vehicle fuel efficiency and continued growth in the cost of construction and maintenance, further rate increases will be needed in the years ahead. A tax rate indexing law similar to the one recently enacted in Georgia would be a good way to implement such future increases.

Those who love to boast about New Jersey’s cheap gas and the fact that about a third of it is bought by out-of-state travelers may find it harder to do so as they face more treacherous road conditions and longer commuter times, and as state government agencies that serve New Jerseyans face budget raids to help bail out the broken Trust Fund. It’s beyond time to put forward a sustainable plan that adequately funds one of New Jersey’s greatest assets – its infrastructure – for decades to come.