Today New Jersey will consider – and likely approve – $111 million in new tax breaks for corporations as the state’s surge in these subsidies continues.

If all of these tax breaks are approved, New Jersey will have OK’ed over $6.8 billion in subsidies since January 2010 – $4.2 billion of which has been approved since December 2013 alone under the misleadingly-named “Economic Opportunity Act.”

This flamboyant over-reliance on tax breaks to try to boost the state’s economy has done little to move the economic needle or grow good jobs. New Jersey, with among the most lucrative corporate subsidy offerings in the country, is one of just 10 states that hasn’t yet recovered all the jobs it has lost since the Great Recession’s official start in December 2007. This surge in subsidies is creating a long-term and growing economic drag that policymakers will have to grapple with for at least the next 15 years as the backlog of tax credits is paid out.

The regular monthly meeting of the state Economic Development Authority (EDA) comes after EDA officials appeared earlier this week in front of the legislative budget committees and released new estimates showing the damaging revenue consequences of already-approved subsidies.

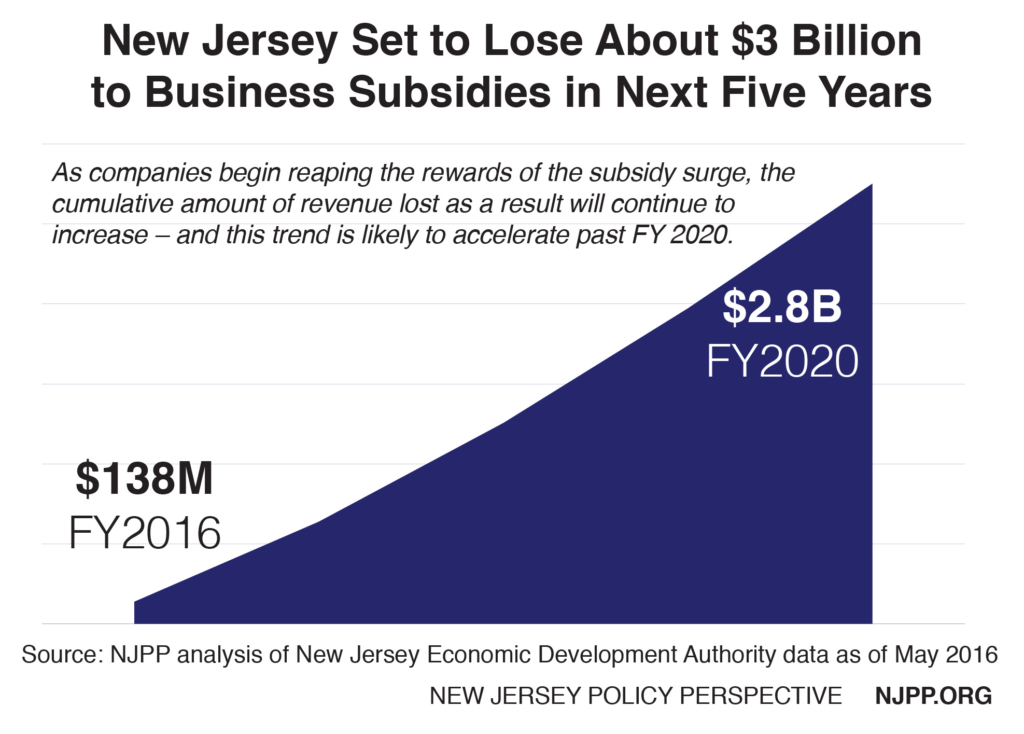

These tax breaks will cost New Jersey an estimated $2.8 billion in fiscal years 2016 through 2020 alone, or an average of $550 million a year.

That’s a substantial amount of revenue that could be put to much better use by investing in the assets that, unlike tax breaks, are proven to grow New Jersey’s economy, like higher education or transportation, or providing a stronger safety net for the growing numbers of working New Jersey families and children who are living in poverty.

And the negative impact on New Jersey’s finances is only going to grow after 2020, as more of the corporations who’ve been approved for tax breaks in recent years cash in. Of the $4.1 billion in tax credits approved between December 2013 and April 2016, for example, only $12.9 million – or 0.3% – has been redeemed to date, according to the EDA.

The approval of more than $100 million in new tax subsidies in a month has become so commonplace in New Jersey, it’s easy to dismiss it as routine business. But what we’re in the midst of is far from routine, and comes with crippling consequences for the Garden State.

New Jersey is already in an enormous financial hole, unable to meet its obligations, provide essential services for all who need them and maintain adequate investment in its key economic assets. And every month that our leaders continue down this path of unbridled corporate largesse, the deeper and wider the hole gets. It’s time for lawmakers to observe the cardinal rule of holes: when you’re in one, stop digging.

UP TO DATE DATA ON NEW JERSEY & CORPORATE TAX SUBSIDIES

(as of May 12 – today’s approvals or modifications will change these totals)

The 2010s Have Seen a Subsidy Surge

• $6.7 billion: The dollar amount of total business tax breaks approved by New Jersey since January 2010. This is up from $1.2 billion the entire previous decade.

• $88 million: The monthly rate of business tax breaks awarded since January 2010. This is up from $10.1 million in the 2000s.

• $59,700: The cost per job of these subsidies since January 2010. This is up from $16,400 in the 2000s.

2013 Legislative Overhaul Opened the Floodgates Even Wider

• $4.1 billion: The dollar amount of total business tax breaks approved by New Jersey since December 2013, when the 2013 legislative changes went into effect.

• $140.9 million: The monthly rate of business tax breaks awarded since December 2013.

• $83,000: The cost per job of these subsidies since December 2013.